The benchmark Korea Composite Stock Price Index (KOSPI) experienced a modest yet noteworthy increase, climbing 2.88 points, or 0.12 percent, to settle at 2,471.95, reflecting investor sentiment in the current economic landscape.

This uptick followed a robust performance on Monday, where the main index soared by an impressive 2.16 percent, marking the most significant gain since September 26, and instilling optimism among market participants.

Trade activity was characterized by a moderate volume, with 401.2 million shares changing hands, translating to a total value of 8.9 trillion won (approximately US$6.4 billion). Notably, gainers outstripped losers, with 458 advancing stocks compared to 409 declining ones, illustrating a competitive trading environment.

In contrast, foreign and individual investors were net sellers, offloading a significant 331 billion won and 168.1 billion won, respectively, while institutional investors capitalized on the dips, net purchasing 457.7 billion won. This marks the eighth consecutive session of net selling by foreign investors, raising questions about their outlook.

Overnight on Wall Street, the tech-heavy Nasdaq Composite reflected positive market sentiment, increasing by 0.6 percent as investors keenly anticipated Nvidia’s upcoming third-quarter results, set to be revealed later this week, showcasing the ongoing focus on the tech sector.

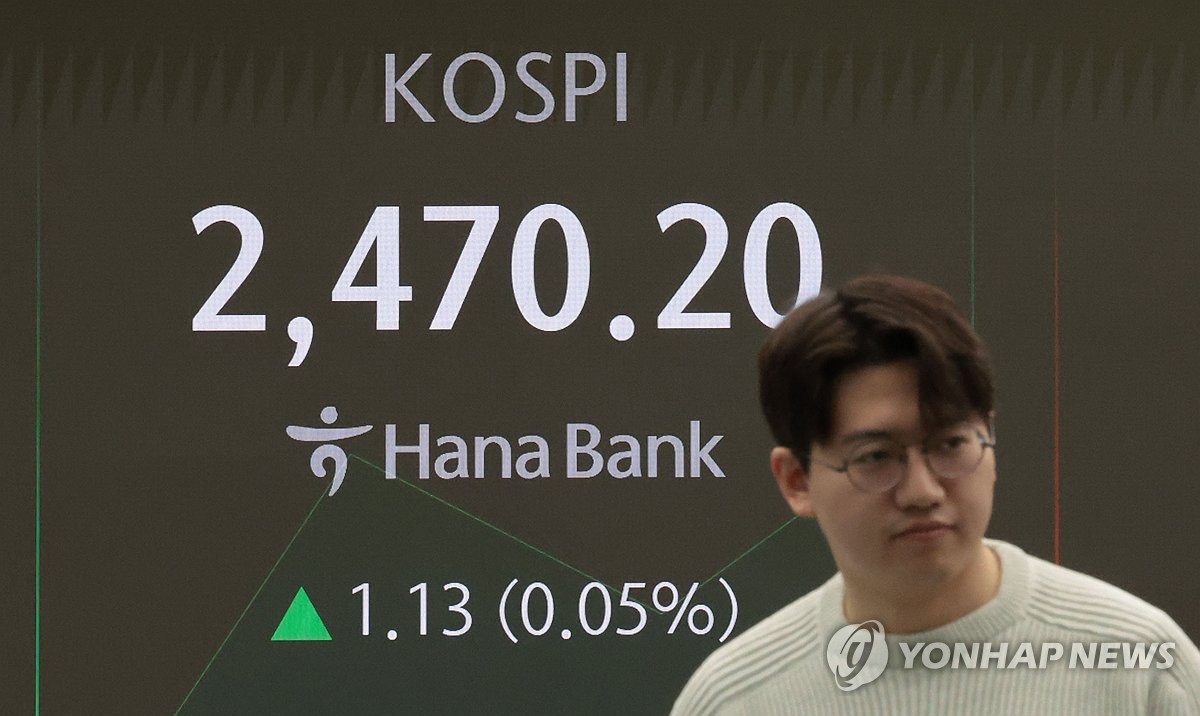

This photo shows a dealing room at Hana Bank in central Seoul on Nov. 19, 2024. (Yonhap)

In Seoul, most shares displayed a mix of performances, with some sectors outperforming others amid the fluctuating market conditions.

Chip giant SK hynix experienced a setback, retreating 0.64 percent to 170,600 won, indicating potential concerns within the semiconductor industry. Meanwhile, Hanmi Semiconductor, recognized as a key player in chip equipment manufacturing, managed to gain 0.25 percent, closing at 80,800 won, highlighting resilience in certain segments.

Top carmaker Hyundai Motor saw a slight decline of 0.69 percent, closing at 215,500 won, while its auto parts affiliate Hyundai Mobis skidded significantly by 3.09 percent, landing at 250,500 won, reflecting challenges the automotive sector is currently facing.

In contrast, energy stocks experienced a rally, with leading oil refinery SK Innovation surging an impressive 10.3 percent to reach 112,400 won, and the state-run Korea Gas Corp. vaulting 9.26 percent to 46,000 won, signaling a strong performance in the energy market.

Major shipbuilder HD Korea Shipbuilding & Offshore Engineering also saw positive momentum, rising 2.47 percent to 199,200 won, and food giant CJ Cheiljedang soared 5.05 percent to 270,500 won, demonstrating robust growth amid varied market responses.

[email protected]

(END)

What factors are contributing to the recent modest increase in the KOSPI index, according to Dr. Jane Park?

**Interview with Market Analyst, Dr. Jane Park**

**Editor:** Thank you for joining us today, Dr. Park. The KOSPI index has seen a modest increase of 2.88 points recently. What do you believe is influencing this movement in the market?

**Dr. Park:** Thank you for having me. The slight uptick in the KOSPI can be attributed to several factors, including overall investor sentiment following a strong performance earlier in the week. The significant 2.16 percent gain we saw on Monday likely boosted confidence among investors, which may have contributed to today’s positive movement, even if it’s more modest.

**Editor:** That makes sense. The trading volume was quite moderate at 401.2 million shares. What does this indicate about current market activity?

**Dr. Park:** Moderate trading volume often reflects cautious behavior among investors. While there is optimism following recent gains, the overall volume suggests that many are still holding back, likely waiting for clearer economic signals before committing larger investments. The fact that gainers outnumbered losers also highlights a competitive environment, despite some hesitance.

**Editor:** Interesting. We noticed that foreign investors are net sellers for the eighth consecutive session. What implications does this have for the market?

**Dr. Park:** Yes, the continued net selling by foreign investors indicates a growing concern regarding the local market or broader economic conditions. This trend raises questions about their long-term outlook on South Korea’s economy. It’s crucial for local investors to observe these trends, as they can significantly influence market sentiment and volatility.

**Editor:** And meanwhile, institutional investors are seizing opportunities to buy on dips. What does this tell us about the strategy they are adopting in the current environment?

**Dr. Park:** Institutional investors often take a longer-term view, and their net purchasing of 457.7 billion won suggests confidence in the KOSPI’s potential. By buying during periods of decline, they may be positioning themselves to benefit from future increases in stock values. Their activity adds a layer of stability amidst the volatility created by foreign selling.

**Editor:** what should investors keep an eye on moving forward?

**Dr. Park:** Investors should stay tuned to global economic indicators, particularly those affecting South Korean exports, as well as any changes in monetary policy that could influence market dynamics. Additionally, monitoring foreign investment trends will be key in assessing broader market health. Keeping an eye on both institutional and retail investor behaviors will also provide valuable insights into market direction.

**Editor:** Thank you for your valuable insights, Dr. Park. It’s always enlightening to hear your perspective on the market.

**Dr. Park:** Thank you for the opportunity!