2024-11-07 04:30:00

Donald Trump’s victory in US presidential election yields Given the importance of the North American market, there is uncertainty about the future of regional fruit growing and the likely economic conditions of a new republican government.

President-elect Donald Trump said: “Besides love and religion, tariffs are the most beautiful words in existence.” campaign period That brought him back to the White House. The new president’s protectionist mission is not new. During his first government term from 2016 to 2020, he introduced a series of measures to protect production and internal work.

nature, Trump’s protectionist policies have focused on China, and he maintained a relationship with the Asian giant that at times became personal during his first term as president.. However, products assembled in Mexico are another favorite target. In fact, throughout the campaign, the president-elect mentioned the possibility of imposing 60% tariffs on Chinese products and 200% tariffs on Mexican-assembled cars.

Relations with the EU are another big issue. The annual transaction volume reaches US$1.1 trillion, and the core of global trade is located here. estimate If the new Trump administration imposes 10% tariffs on EU products, the continent’s exports to the United States will fall by a third.

“After love and religion, tariff is the most beautiful word in existence”

President-elect Donald Trump is running for president in 2024.

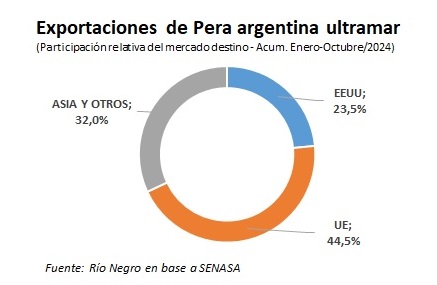

With this framework in place, the main question for the region is what will happen to fruit exports, given the relative weight of the North American market. The situation of pears is particularly delicate. One ton of every four tons shipped overseas goes to the United States..

The importance of the North American market

Strictly speaking, The U.S. market is not the most important for pears and apples from the upper valleys For flights from Rio Negro and Neuquén, the main destinations are the European Union and Asia. This is reflected in Senasa’s official export-related data for 2024.

In the first 10 months of this year, Argentina exported a total of 67,850 tons of apples, of which only 1,360 tons were shipped to the United States. It only accounts for 2% of the total. From January to October, 318,800 tons of pears were exported abroad, including 44,850 tons from the United States, accounting for 14% of the total..

However, the view changes if the type of fruit exported is taken into account, as currently most sales from the upper valleys outside the country are shipped overland to Brazil. The final destination of 42% of the apples and 40% of the pears exported by our region is the country of Rio de Janeiro.

So the equation for the U.S. is very different if only overseas export data is considered. Of total seaborne apple exports, 3.4% were destined for the United States. But when it comes to pears, the relative weight of the North American market is particularly sensitive. Of the pears exported overseas, 23.5% were destined for the United States.

It’s at this point that Trump’s protectionist image could become key to upper valley fruit production. North American production is mainly concentrated in California, Oregon and Washington, with annual fluctuations of around 580,000 tons.However, this year, the trading volume was significantly affected by spring temperatures.

If President Trump maintains his policy of strengthening domestic production in North America through tax exemptions and domestic subsidies, and If he also follows through on his promise to impose tariffs on imports that compete with U.S. production, that could represent a difficult hurdle to overcome. For the pears of our region.

Danger: Euro depreciation

The certainty of Donald Trump’s victory, the protectionist experience of the first Republican administration and a potential trade war with China in the early hours of Wednesday The dollar strengthened against other major world currencies such as the euro or the yen.

Uncertain scenario. Fruit of the Upper Valley and the world Donald Trump brings.

Uncertain scenario. Fruit of the Upper Valley and the world Donald Trump brings.

If an appreciation of the U.S. dollar is observed across the Atlantic, the immediate impact is: Everything the EU buys from the rest of the world will become more expensive, so this could lead to a fall in demand, which would have an impact on international prices.Consider Europe’s share of global trade. For products, this order is especially important.

For apples and pears, this is basic news given the dynamics of overseas exports. If the euro depreciation trend intensifies, This could dampen demand for fruits from the upper valleys. In this sense, the relative weight Continental Europe accounts for 28% of overseas exports of apples and 44% of overseas exports of pears.

But given that the depreciation of the euro may lead to lower demand in Europe, the indirect impact of Trump’s victory Could mean lower international prices Apples and pears. It is worth mentioning that according to official data, The average price per ton of pears in 2024 is 4.9% higher than the 2023 averagebut 19% lower than the price recorded before 2018.

If coupled with the obvious delay in Argentina’s official exchange rate, Argentina’s official exchange rate rose by only 18% in the first 10 months of this year, while the domestic inflation rate during the same period was 100%. This prospect could lead to a very uncertain outlook for the season starting in January 2025..

1730958894

#Uncertain #Situation #Donald #Trump #Problem #Upper #Valley #Apples #Pears

Effects of Trump’s tariffs

Thus, if tariffs are imposed and the dollar strengthens, there could be significant repercussions for the EU’s export markets. As highlighted earlier, if the Trump administration implements a 10% tariff on EU products, it is estimated that exports from the continent to the U.S. could decline by a third. This would particularly affect agricultural exports, especially fruits, given the relatively high dependency of certain regions on the North American market.

For instance, even though the U.S. market is not the dominant one for apples from Argentina, the pear exports have sizable contributions from the U.S. market, accounting for 23.5% of total overseas exports. The potential for reduced exports due to tariffs could disadvantage producers, especially in the face of competition from domestic U.S. fruit producers who might be supported through protectionist policies.

Add to that the impact of currency fluctuations, where an appreciating dollar makes European products more expensive for U.S. consumers, this could reduce the competitiveness of EU exports not only in the U.S. but potentially in other international markets as well due to overall global price adjustments.

if U.S. producers see favorable conditions domestically due to reduced foreign competition from tariff imposition and the currency landscape, it could lead to a consolidation of market share in the domestic fruit market, making it extremely challenging for EU and Latin American producers to sustain their exports and maintain pricing strategies. Therefore, this presents an uncertain and potentially precarious scenario for fruit exporters from regions like Argentina and the EU in a post-Trump trade landscape.