Join Fox News today to enjoy exclusive access to a wealth of engaging content and insights.

Additionally, your account provides special privileges, granting you complimentary access to select articles and premium content that you won’t find elsewhere.

By entering your email and pressing continue, you consent to abide by Fox News’ Terms of Use and Privacy Policy, which encompasses our Notice of Financial Incentive.

Please ensure you enter a valid email address to proceed.

Experiencing issues? Click here for assistance.

FIRST ON FOX: A damning new report from the House of Representatives alleges that the Biden administration has neglected to recover approximately $200 billion tied to fraudulent COVID-19 relief loans.

The House Small Business Committee, under the leadership of Republican Chairman Roger Williams from Texas, has led an extensive investigation over the years into the operations of the Small Business Administration (SBA) regarding emergency financial aid programs initiated as state governments implemented lockdowns during the pandemic.

According to the report released by the committee, “In creating the COVID Lending Programs, Congress understood that the relief funds needed to be issued quickly to help businesses cope with the economic strain of the pandemic.” The rush to provide pandemic relief funding led to significant shortcuts, undermining the integrity of the disbursement process.

The report further criticized the SBA for taking “numerous decisions that decreased the likelihood” of recovering funds disbursed to ineligible recipients, compounding the financial loss to taxpayers. “In total, it is likely that $200 billion from the COVID Lending Programs were disbursed to fraudulent recipients,” added the report.

Out of the roughly $5.5 trillion allocated by Congress for pandemic relief, approximately $1.2 trillion was administered by the SBA, largely distributed through the CARES Act, which was signed into law by former President Trump, and the American Rescue Plan, enacted by President Biden.

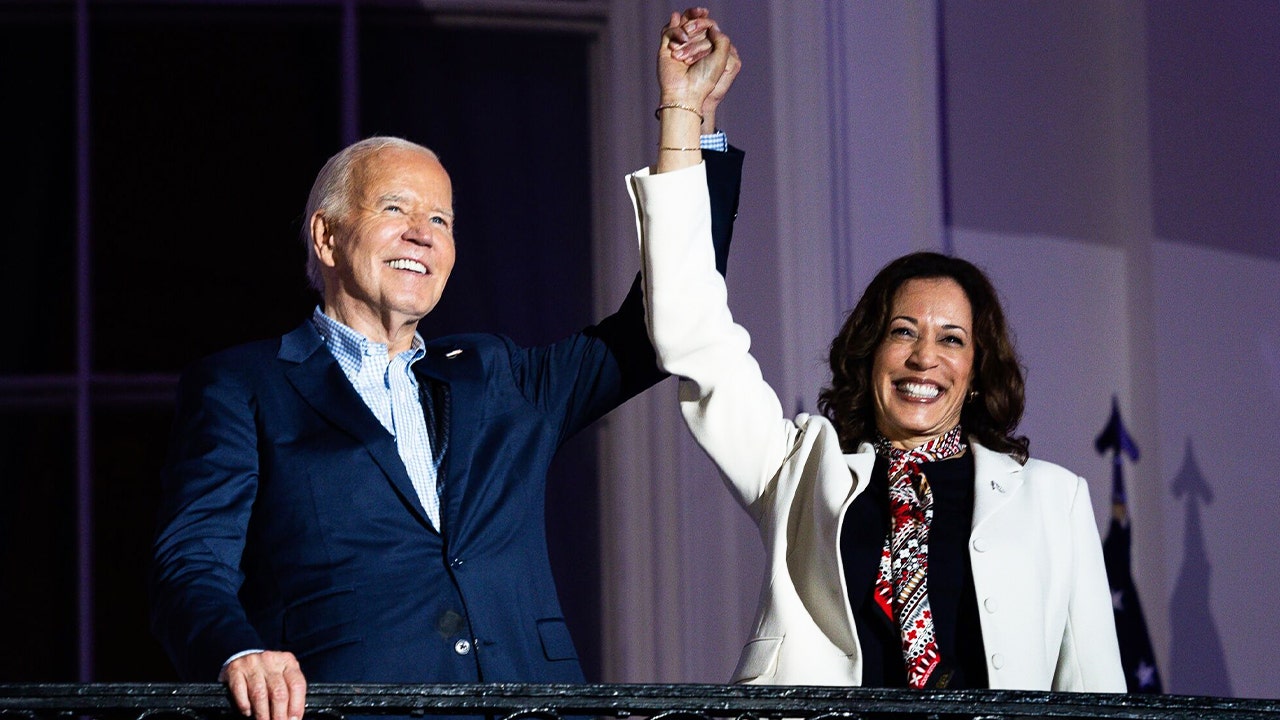

President Biden and Vice President Kamala Harris (Tierney L. Cross)

TRUMP CALLS FOR SUPPORTERS TO ‘FORGIVE’ BIDEN IN SHOW OF UNITY AFTER PRESIDENT CALLS SUPPORTERS ‘GARBAGE’

In its analysis, the report recommended comprehensive reforms across the entire COVID loan system, and criticized Democrats for disproportionately focusing on the Paycheck Protection Program (PPP), which has been linked to roughly $64 billion in fraudulent loans. The Economic Injury Disaster Loan (EIDL), on the other hand, was found to have incurred $136 billion in fraud, yet received far less attention.

“In the days after Congress passed the initial COVID relief legislation, SBA employees worked night and day to craft the rules and policies for its new lending programs,” the report detailed.

WHITE HOUSE DENIES THAT BIDEN REFERRED TO TRUMP SUPPORTERS AS ‘GARBAGE’

It went on to commend SBA staff for their dedication, noting they “did a remarkable job” in setting up the programs. However, the report stated that these employees operated without adequate resources or sufficient time to create programs with robust fraud protection, ultimately leaving taxpayers vulnerable to significant losses.

The findings indicated that the Biden administration failed to implement necessary anti-fraud measures and did not adequately recover misappropriated funds after assuming office in January 2021. Furthermore, it criticized the focus on the PPP due to its partnership with private sector entities, which may have distracted attention from the significant fraud associated with other programs.

CLICK HERE TO GET THE FOX NEWS APP

The report concludes, “It is likely that this misplaced focus by Congressional Democrats, and their surrogates in the media, obscured the realities of fraud in these programs, at least to some degree.” It called for investigations to ensure private companies adhere to regulations, while urging Congress and their staff to prioritize oversight that serves the interests of American citizens, rather than merely pushing a political agenda.

In light of these findings, Republicans have emphasized the need for “substantial changes” to the PPP to enhance its efficacy and reduce susceptibility to fraud.

Fox News Digital reached out for comments from the SBA and the House Small Business Committee’s Democratic minority.

**Interview with Roger Williams, Chairman of the House Small Business Committee**

**Editor:** Good morning, Chairman Williams. Thank you for joining us to discuss your recent findings regarding the COVID-19 relief loan programs.

**Chairman Williams:** Good morning! Thank you for having me. This is an important topic that has significant implications for taxpayers and small businesses alike.

**Editor:** Your committee’s report alleges that the Biden administration has neglected to recover about $200 billion in fraudulent loans. Can you explain how this situation arose?

**Chairman Williams:** Certainly. When Congress initiated the COVID Lending Programs, the urgency to provide relief led to the implementation of these funds with minimal oversight. The goal was to get money out quickly to help businesses survive the pandemic, but that rush resulted in significant shortcuts in the disbursement process. Unfortunately, this allowed many ineligible recipients to access these funds.

**Editor:** In your report, you criticize the SBA for making decisions that decreased the likelihood of recovering funds. What specific decisions did you find most concerning?

**Chairman Williams:** One concerning decision was the lack of rigorous eligibility checks. The haste to distribute funds came at the cost of verifying applicants properly. This directly contributed to the rise in fraudulent claims, particularly through the Economic Injury Disaster Loan program, which accounted for a staggering $136 billion in fraud, compared to the more widely scrutinized Paycheck Protection Program.

**Editor:** It’s clear there are large sums involved. What reforms do you propose to prevent future occurrences of this nature?

**Chairman Williams:** We are recommending comprehensive reforms that enhance oversight and accountability in the COVID loan system. This includes stricter verification methods for applicants, improved tracking of funds, and a focus on fraud prevention mechanisms. We need a balanced approach that ensures quick relief without sacrificing accountability.

**Editor:** With approximately $5.5 trillion allocated for pandemic relief, how will your findings impact current discussions around economic recovery and future relief packages?

**Chairman Williams:** Our findings should prompt a thorough review of how relief packages are structured and implemented. We must ensure that while we provide support during crises, we do not inadvertently facilitate fraud that undermines taxpayer trust and financial stability. This is a crucial moment for reevaluating our strategies to support small businesses.

**Editor:** Thank you, Chairman Williams, for your insights today. It certainly sounds like there’s a lot of work ahead in ensuring aid programs serve their intended purpose effectively.

**Chairman Williams:** Thank you for having me. It’s vital that we hold the systems in place accountable, not just for today, but for future emergencies as well.