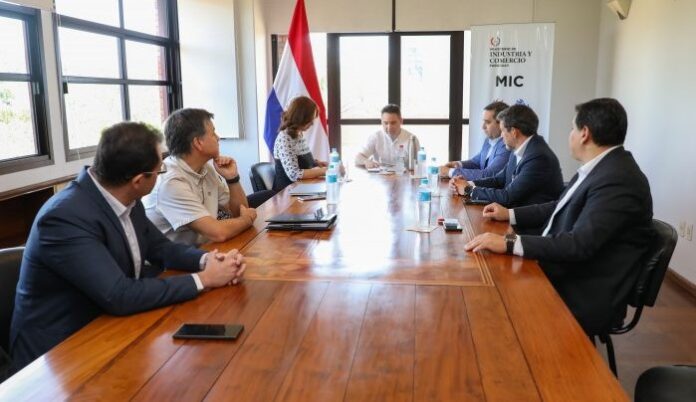

Asunción, IP Agency.- The Ministry of Industry and Commerce reports that the “National Plan for Digital Transformation and Financing for MSMEs”, for micro, small and medium-sized businesses, which was launched in September, was analyzed during a working meeting between the Vice Ministry of MSMEs and the Financial Development Agency (AFD).

The meeting was led by Vice Minister Gustavo Giménez and the president of the AFD, Stella Guillén, as well as members of the cabinet from both departments of the State.

“Currently, some 4,200 MSMEs benefited, accessing loans with funds from the AFD and almost 5,000 microenterprises with guarantees from Fogapy. The goal is to exceed 10,000 beneficiaries between AFD and Fogapy.

This represents a growth of approximately 30% compared to last year, stressed the member of the AFD Board of Directors, Isaac Godoy.

He highlighted that the government of Paraguay promotes, through the Vice Ministry, specific projects for the world of microenterprises and in that sense, the AFD has its role of providing funds to finance the sector, through banks and financial companies, he specified when referring to the issue. of the meeting.

He pointed out that the AFD credit lines and Fogapy guarantees are already available, however, they established, together with the Vice Ministry of MSMEs, the approach with the implementation of this new program, the platform and the implementation of strategic alliances with the cooperative sector, with the Agricultural Habilitation Credit (CAH), with the National Development Bank (BNF) and with private banks and financial institutions.

He stated that this is a project that is already underway and what they did is establish the priorities for the next two months to continue moving forward.

#MIC #AFD #align #strategies #strengthen #financing #MSMEs

Interview with Ana Gómez, Deputy Minister of MSMEs

Editor: Thank you for joining us today, Ana. Can you start by telling us about the “National Plan for Digital Transformation and Financing for MSMEs” and what inspired its creation?

Ana Gómez: Thank you for having me. The “National Plan for Digital Transformation and Financing for MSMEs” was created in response to the urgent need for micro, small, and medium-sized enterprises (MSMEs) to adapt to a rapidly changing digital economy. We realized that many of these businesses lack access to modern technology and financing options, which hinder their growth. Our goal is to empower these firms with the tools and resources they need to thrive in a digital landscape.

Editor: That’s an important initiative. What key areas does this plan focus on to support MSMEs?

Ana Gómez: The plan focuses on several key areas: enhancing digital literacy among business owners, providing access to financing options tailored specifically for MSMEs, and promoting the use of digital tools for marketing, sales, and operations. We also aim to create partnerships with tech companies to facilitate training programs and workshops.

Editor: How has the response been from the MSME community since the launch of this initiative in September?

Ana Gómez: The response has been overwhelmingly positive. Many business owners are eager to learn more about digital transformation and see it as a pathway to expanding their market reach and improving efficiency. Our working meetings, including the recent one with various stakeholders, have highlighted their enthusiasm and readiness to embrace these changes.

Editor: What are the next steps for implementation of this plan?

Ana Gómez: The next steps involve rolling out specific training programs and workshops over the coming months. We will also be launching informational campaigns to ensure that MSMEs are aware of the financing options available to them. Continuous feedback from the business community will be crucial as we refine our approach.

Editor: why do you believe digital transformation is critical for the future of MSMEs in Paraguay?

Ana Gómez: Digital transformation is essential for the survival and growth of MSMEs in today’s economy. It allows businesses to improve their operations, reach new customers, and remain competitive. In a world that’s increasingly reliant on technology, those who adapt will undoubtedly thrive, while those who don’t may struggle to keep up. Our plan is about securing a better future for Paraguay’s MSME sector.

Editor: Thank you, Ana, for sharing your insights on this vital initiative. We look forward to seeing how it unfolds.

Ana Gómez: Thank you for having me!

Interview with Ana Gómez, Deputy Minister of MSMEs

Editor: Thank you for joining us today, Ana. Can you start by telling us about the “National Plan for Digital Transformation and Financing for MSMEs” and what inspired its creation?

Ana Gómez: Thank you for having me. The “National Plan for Digital Transformation and Financing for MSMEs” was initiated in response to the urgent need for micro, small, and medium-sized enterprises (MSMEs) to adapt to a rapidly evolving digital economy. We realized that many of these businesses lack access to modern technology and financing options, which hinders their growth. Our goal is to empower these firms by providing the tools and resources they need to thrive in the digital landscape.

Editor: That’s an important initiative. What key areas does this plan focus on to support MSMEs?

Ana Gómez: The plan emphasizes several key areas: enhancing digital literacy among business owners, providing tailored financing options for MSMEs, and promoting the use of digital tools for marketing, sales, and operations. Additionally, we aim to forge partnerships with tech companies to facilitate training programs and workshops, ensuring that businesses can effectively leverage new technologies.

Editor: How has the response been from the MSME community since the launch of this initiative in September?

Ana Gómez: The response has been overwhelmingly positive. Many business owners are eager to learn more about digital transformation. They see it as a pathway to expanding their market reach and improving operational efficiency. Our workshops have attracted significant interest, and we are excited to help them navigate these changes.

Editor: What specific goals do you have for the program in the next few months?

Ana Gómez: Over the next few months, we aim to exceed 10,000 beneficiaries who will receive support through our financing initiatives, including loans and guarantees. We’re also focusing on strategic alliances with cooperatives and financial institutions to broaden access to resources and ensure that more MSMEs can benefit from our programs.

Editor: And how does this initiative align with broader government efforts to support economic growth in Paraguay?

Ana Gómez: The initiative aligns perfectly with the government’s commitment to economic development, especially in supporting the backbone of our economy—MSMEs. By enhancing their digital capabilities and access to financing, we are fostering a more resilient and competitive business environment that can contribute to job creation and economic prosperity for all Paraguayans.

Editor: Thank you, Ana, for sharing these insights. We look forward to seeing how this initiative unfolds and supports our local businesses.

Ana Gómez: Thank you for the opportunity to discuss this important initiative!