The Metropolitan Bank of Havana has issued a response to a user who raised concerns about the policy of Cuban banks regarding the extraction of foreign currency.

This clarification arose following a publication in the state media Cubadebate, in which key issues related to the Cuban banking system were addressed during a recent Round Table.

The debate began when an Internet user identified as “Obeso” advised against saving money in currency in Cuban banking institutions. “My message is that, under current conditions, do not make that mistake,” the user commented. He added that, after several months of waiting, he was finally summoned to receive his salary in USD, the result of his work in a Joint Company abroad.

Given this concern, Banco Metropolitano responded that the country’s current economic situation has forced it to implement specific mechanisms to manage the withdrawal of cash in foreign currency.

“It is necessary to make a reservation when withdrawing cash in foreign currency. This allows the branch to manage the requested amount, as happens in other countries,” the bank clarified.

The bank also acknowledged that response time may be extended due to low availability of foreign currency cash. However, they assured that requests are attended to in the order in which they are presented. “The operation was carried out on you when the Bank had cash available,” they added.

Four months without being able to collect a salary in foreign currency in Cuba

Another testimony, from user Odalis Fernández, presented a similar experience. She commented that, after receiving her salary in USD from her husband, a Merchant Seaman, she had to wait a month and a half and go to three different banks to withdraw the cash. In addition, she mentioned that her husband has not been able to earn foreign currency for four months.

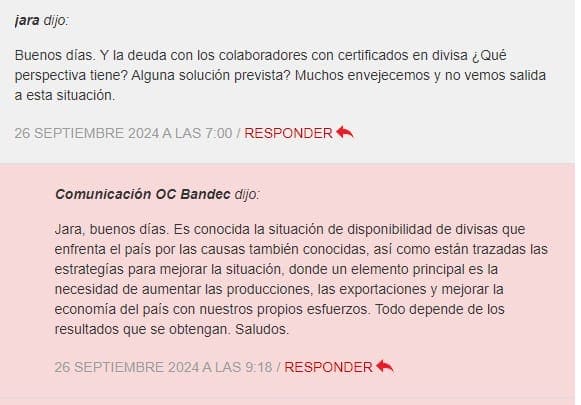

The debate also included Cuban collaborators with currency certificateswho expressed concern about the outstanding debt in USD. One of them, identified as “JARA,” asked if there was any solution planned for this situation.

In response, representatives of the Bank of Credit and Commerce (Bandec) recognized the country’s economic difficulties and pointed out that the strategy to improve the availability of foreign currency depends on increasing exports and domestic production.

#Metropolitan #Bank #Havana #reports #foreign #currency #extraction