2024-09-27 07:59:00

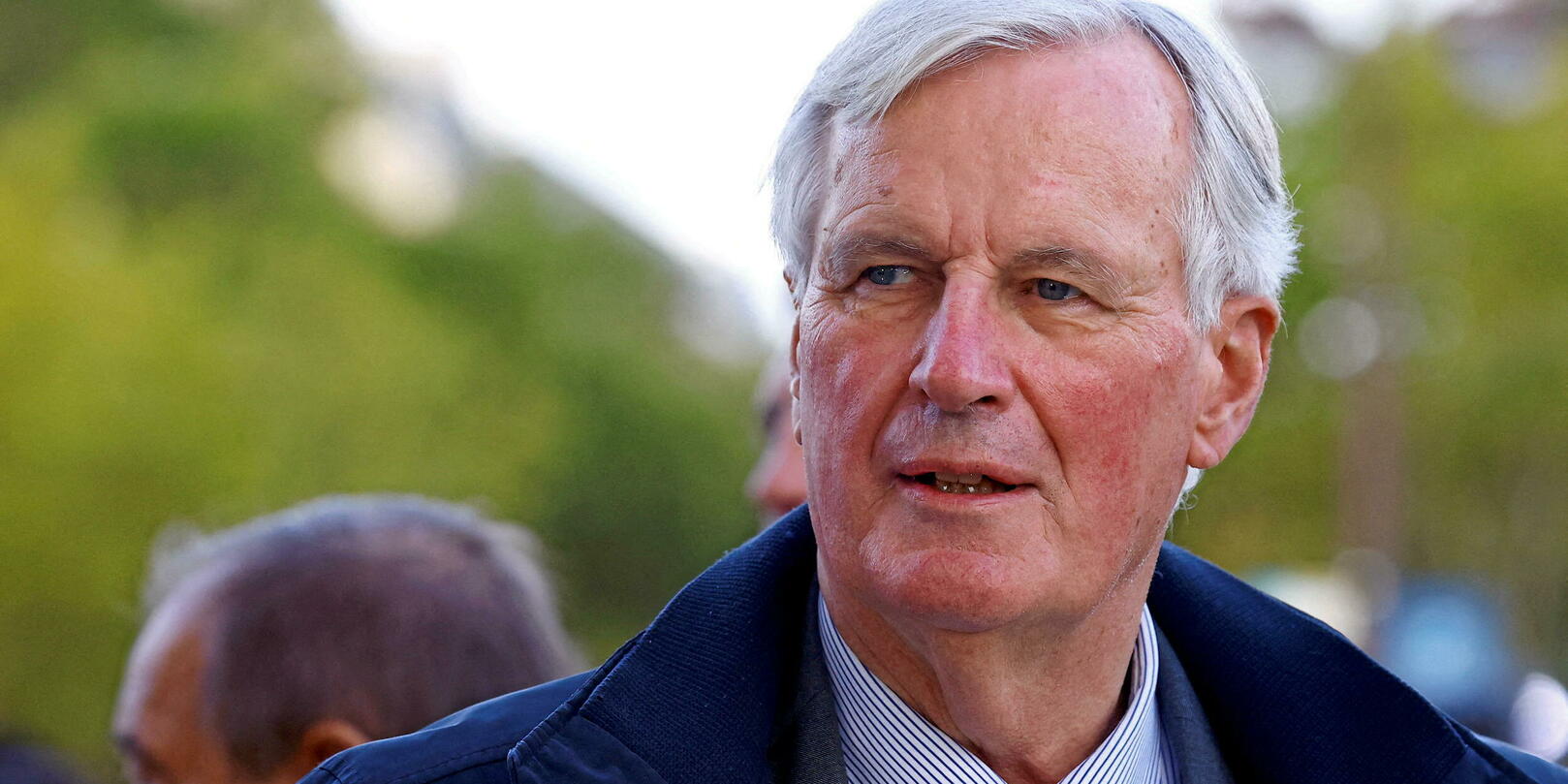

C’is a new worrying sign for the French economy and for the new Prime Minister, Michel Barnier. On Thursday, September 26, the interest rate on five-year French bonds exceeded that of Greece, a country that was almost bankrupt 15 years ago. While Paris now borrows at 2.48%, Athens finances itself at 2.40%.

Certainly, the rate which refers to the European level, namely the 10-year rate, remains higher: 2.97% for Paris, compared to 3.10% for Athens. However, the trend is clearly working against France. For the first time since 2006, its debt costs more than that of Spain. French 10-year bonds are at 2.97%, compared to 2.95% for those of Madrid. The financial markets therefore judge French debt to be more risky than that of Spain. “France’s overshooting of Greece’s 5-year rate is an epiphenomenon, that of Spain’s 10-year rate is even more telling,” observes Christopher Dembik, economist and investment advisor at Pictet AM.

ALSO READ Greek debt: how the “men in black” of the troika tied up Athens “France is clearly at the back of the pack with Greece and Italy at 3.46%, whereas in 2012 it still belonged to the leading group with Germany and the Northern countries, while Spain was among the bad students nicknamed the PIIGS (“pigs”, in English, for Portugal, Italy, Ireland, Greece and Spain)”, notes Alexandre Baradez, chief analyst at IG. However, even Portugal, once in crisis, closed the year 2023 with a budget surplus of 1.2% of GDP. Its 10-year rate is 2.72%. “While France and Portugal were at the same levels, our country declined after the dissolution in June. First there was the political risk of seeing the far left or the far right come to power and impose significant tax expenditures and tax increases. Today, the new government is not enough to reassure, it is the emergency that takes precedence and worries the markets,” continues the expert.

Swords of Damocles

This surge in French rates is also the result of budgetary slippage. Initially forecast at 4.4% of GDP in 2024, the public deficit has been revised upwards several times. It “risks exceeding” 6% of GDP, or twice the figure accepted in the euro zone, warned the new Minister of the Budget, Laurent Saint-Martin, who will present the finance bill for 2025 to parliamentarians this week from October 9.

ALSO READ Debt, from Hollande’s easy money to Macron’s magic moneySeveral swords of Damocles weigh on France in the coming weeks: the European Union’s excessive deficit procedure, France having until October 31 to present its financial trajectory and the revision of France’s debt rating by the rating agencies in the fall. “The spread (gap) between France and Germany has been 80 basis points for several months. This level of danger signals the beginning of panic, the complete panic took place in 2012 at 180-190 basis points,” notes Alexandre Baradez, who thinks that the paroxysm of stress on the bond market has not yet been reached.

According to IG’s chief analyst, the situation nevertheless has economic education benefits for the French. “We know how much retirement pensions and social charges weigh on finances and we realize that the energy checks that we demanded to have lower inflation are being paid for today, just like the support measures during the crisis of Covid which continued after the pandemic,” he insists. Emmanuel Macron’s “whatever it costs” ends up being worth “a crazy amount of money”.

1727431621

#France #finances #expensively #Greece