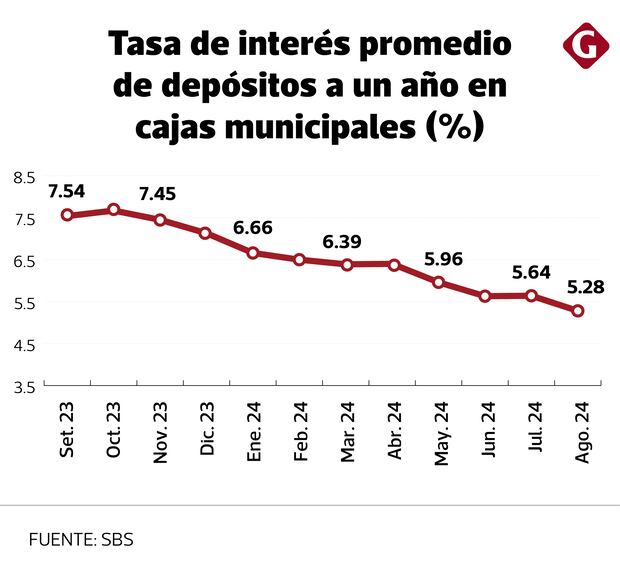

As of 2024, the average interest rate for 180-day deposits in banks decreased from 5.88% to 4.29%, while a year ago, it fell from 4.97% to 3.94%, according to the Superintendency of Banking, Insurance and AFP (SBS). The average yields in municipal savings banks reflect a similar trend, declining from 7.64% to 5.07%, and from 7.13% to 5.28%, respectively.

In this context, interest rates on these accounts are dropping as central banks lower their benchmark rates. Their objective is to encourage the public to prioritize spending and investment over saving, thereby stimulating the economy while ensuring price stability within the target range.

READ ALSO Wealthy families increase real estate investment in the face of rate cuts

Movements

This change became more evident when the Central Reserve Bank of Peru (BCRP) reduced its reference rate a year ago (from 7.75% to the current 5.25%). Furthermore, even though the US Federal Reserve just lowered its rate last Wednesday, this decision had already been anticipated by the markets and was reflected in the rates of various financial products.

However, the extent of the Fed’s rate cut (50 basis points, or half a percentage point, rather than the 25 basis points expected) caught most analysts and economists by surprise.

This significant reduction suggests that there will be more drastic movements in interest rates, especially affecting term deposits.

Javier Gamboa, financial insurance and pension manager at Rimac Seguros, stated that the Fed’s actions will lead to a steepening of the yield curve. This implies that the interest rates on short-term government bonds in both the US and Peru will decrease more substantially than those on long-term bonds.

“We will not observe a similar reduction in the long-term rate of 10 years or more on bonds (in fact, they have risen since the Fed’s announcement), but we will see a significant decrease in the short end of the curve,” he explained. He added that this reconfiguration will influence deposit rates, resulting in more noticeable declines for shorter-term products.

Less appetizing

“People will need to adjust to the fact that bank deposit rates, which were unusually high at over 7.5%, will likely normalize and average closer to 4%,” he emphasized.

Additionally, Paul Rebolledo, CEO of Tandem Finance, stated that bonds have appreciated over the past two months, anticipating further interest rate reductions by central banks. Consequently, bond rates, particularly shorter-term ones, have decreased, according to the expert.

This trend is expected to continue, as the Fed’s rate reduction would provide the BCRP with more flexibility to lower its own rates, which will then be reflected in the financial system.

“Progressively, bank deposits and municipal savings banks will be less attractive,” Rebolledo remarked, advising the public to consider longer-term deposits—which offer higher rates over extended periods—rather than short-term options that carry reinvestment risk due to ongoing rate declines.

“The recommendation is to opt for long-term deposits because interest rates are likely to continue falling due to actions from the BCRP and the Fed; at times, banks mislead clients by promoting short-term accounts,” he added.

In this context, Tandem’s CEO estimated that interest rates would decrease more rapidly for deposits of less than one year compared to those for accounts of 360 days or more.

On average, deposit rates could drop by an additional 50 to 100 basis points over the next year, he projected.

READ ALSO After aggressive Fed rate cuts, “the one who will sell the least dollars”

Referent

While financial institutions are governed by the BCR’s monetary policy and strive to align savings and credit rates with key rate movements, the Fed serves as a benchmark for making these adjustments, according to Giancarlo Zevallos, head of Caja Arequipa’s passive products division.

He noted that the yields on time accounts will continue to decrease in line with anticipated interest rate cuts from the Central Bank, a trend that is expected to persist until the first half of 2025.

“We are closely monitoring changes in reference rates (both global and local), and expect further reductions in the coming months; however, the rates on term deposits should stabilize at a certain level in the second half of next year,” he stated.

Should the Fed implement more significant reductions in its reference rate, the BCR could follow suit, leading to more noticeable decreases in term deposit profitability, he added.

Furthermore, Edmundo Lizarzaburu, a professor at ESAN University, indicated that the unexpected 50 basis point cut by the Fed provides the local monetary authority with room for more substantial cuts.

The overall inflation rate is currently under control, underlying inflation is also within the target range, and the exchange rate is favorable with the dollar below the soles rate, which provides the BCR with greater latitude for monetary policy decisions, he pointed out.

According to the professor, if the price index remains stable, a more pronounced effect on term account rates is expected in October, particularly as returns are already showing a downward trend.

However, should inflation rise, the BCRP may delay further cuts to the reference rate, resulting in a more significant adjustment in deposit yields in November, he projected.

This downward trajectory in deposit rates is expected to continue into next year, as the monetary authority aims to maintain alignment with that of the EU, he mentioned. However, if the US economy slips into recession, the Fed’s cuts could accelerate and lead to quicker adjustments in the same direction, he added.

The fall may be more noticeable until November

Rate reductions in the US and Peru do not differentiate between the maturities of local time deposits, but the anticipated trend for these rates allows institutions to implement differentiated cuts based on client terms, as explained by Giancarlo Zevallos from Caja Arequipa.

“At the end of last year, an increase in the reference rate was anticipated, leading to significant rises in longer-term rates. Currently, the situation has reversed, and we are likely to observe greater reductions in shorter-term rates,” he elaborated.

Moreover, Edmundo Lizarzaburu from ESAN University estimated that interest rates on deposits with maturities of six to nine months will be the most affected.

“There is already a noticeable decline in term deposit rates, which could become more pronounced in October or November, particularly for those with immediate maturities,” he noted.

Lizarzaburu emphasized that the BCR will closely monitor movements not only from the Fed, but also the European Central Bank and adjustments in Japan.

READ ALSO BCRP rate is already lower than that of the US Fed. What could this cause?

Start standing out in the business world by receiving the most exclusive news of the day in your inbox Here. If you don’t have an account yet, Sign up for free and be part of our community.

2024 Interest Rates and Bank Deposits: Trends and Insights

In the early months of 2024, interest rates on bank deposits have undergone significant changes. According to the Superintendency of Banking, Insurance and AFP (SBS), the average rate for 180-day deposits has decreased from 5.88% to 4.29%. Similarly, over the past year, this rate has fallen from 4.97% to 3.94%. Municipal savings banks have reflected these trends as well, with average yields dropping from 7.64% to 5.07%, and from 7.13% to 5.28% respectively.

The Current Landscape of Interest Rates

These decreasing interest rates are primarily a result of targeted actions by central banks to influence economic activity. By lowering benchmark rates, authorities aim to encourage consumer spending and investment rather than hoarding savings. This strategic approach is designed to stimulate economic growth while maintaining price stability.

READ ALSO: Wealthy families increase real estate investment in the face of rate cuts

Central Bank Policies and Their Impact

The downward trend in interest rates became particularly pronounced following the Central Reserve Bank of Peru (BCRP)‘s decision to cut its reference rate from 7.75% to the current 5.25%. This change was anticipated by the market, especially after the U.S. Federal Reserve announced a substantial rate cut. However, the extent of the Fed’s reduction—50 basis points, double the expected 25 points—has left many analysts startled.

Such aggressive adjustments alter the outlook for interest rates substantially, particularly affecting term deposits. Javier Gamboa, a financial insurance manager at Rimac Seguros, indicates that the short-term rates on government bonds will experience more significant declines compared to long-term rates.

Interest Rate Normalization

“Bank deposit rates have spiked unusually high, exceeding 7.5%, but will likely normalize closer to 4%,” explains Gamboa. This perspective is echoed by industry experts like Paul Rebolledo, CEO of Tandem Finance, who observes that the bond market has adjusted in anticipation of further cuts, leading to declining rates, especially on shorter-term bonds.

Strategies for Savers

Choosing the Right Deposit Term

- Favor Long-Term Deposits: With predictions indicating further declines in interest rates, longer-term deposits may offer higher rates compared to their short-term counterparts. Rebolledo recommends this approach to avoid the reinvestment risk associated with short-term accounts.

- Stay Informed: Regularly monitor rate changes to ensure you’re maximizing your savings and not getting locked into unfavorable terms.

- Consult with Financial Advisors: Given current market volatility, seeking advice can help tailor your savings strategy to fit your unique financial goals.

Projected Future Trends

Experts project that bank deposit rates may decline further by an additional 50 to 100 basis points in the upcoming year, as reflected in the BCRP’s recent strategies.

| Deposit Type | Current Average Rate | Projected Rate (Next Year) |

|---|---|---|

| 180-Day Deposit | 4.29% | 3.29% – 3.79% |

| 1-Year Deposit | 3.94% | 2.94% – 3.44% |

| Municipal Savings Bank | 5.07% | 4.07% – 4.57% |

The Role of Inflation and Economic Stabilization

Giancarlo Zevallos, head of passive products at Caja Arequipa, points out that financial institutions adjust their offerings based on both local and international monetary policies. As inflation rates stabilize, it opens a window for potential rate cuts by the BCRP.

Monitoring inflation is crucial. The trends indicate that as inflation remains controlled, we could see further reductions in interest rates until mid-2025. Conversely, in case of an inflation spike, the BCRP might delay cuts, leading to more drastic reductions in deposit yields later in the year.

Key Takeaways for Investors

With shifting policies from the U.S. Federal Reserve causing ripples in global financial markets, it’s essential for investors to adapt. Rates on deposits are fundamentally tied to the decisions made by central banks, and in the coming months, savers may need to recalibrate their strategies to accommodate these changes.

Expert Opinions on the Outlook

Edmundo Lizarzaburu from ESAN University stresses that the unexpected Fed rate reduction allows greater maneuverability for the BCRP, leading to more pronounced effects on short-term deposit accounts.

Final Considerations

- Anticipation of Rate Changes: Financial institutions gear up for rapid rate changes, notably affecting shorter-term deposits.

- Impact of Global Markets: Watch for movements from the European Central Bank and Bank of Japan, as their policies could further influence domestic rates.

- Invest Wisely: Consider diversifying your financial portfolio to include a mix of long-term and short-term investments to cover a spectrum of economic scenarios.

READ ALSO: BCRP rate is already lower than that of the US Fed. What could this cause?

As we move forward in 2024, adapting to decreasing interest rates will be paramount for both savers and investors. Monitoring market trends and adjusting investment strategies accordingly will enable individuals to navigate this evolving financial landscape effectively.