OWNING your own home is a dream for many people, especially for millennials and young families. One of the most popular ways to make that dream come true is by taking advantage of the Home Ownership Credit (KPR) program.

However, choosing a mortgage with low interest is a challenge in itself, considering the various options offered by banks.

This article will provide guidance in choosing a low-interest mortgage from various banks in Indonesia and include a simulation of subsidized housing mortgage calculations.

Banks Providing Mortgage with Low Interest

Each bank in Indonesia has different mortgage programs, both in terms of interest rates, requirements, and installment tenors. Here are some banks that offer low-interest mortgages:

1. BTN Bank (State Savings Bank)

As a specialist bank in the KPR program, Bank BTN has long been known as the main choice for people who want to buy a house, especially a subsidized house.

Also read: Pesona Kahuripan Group Works on Construction of 744 Non-Subsidized Houses

BTN offers programs BTN Subsidized Mortgage Loan with very low interest rates, starting from 3%-6% per year.

In addition, there are programs Mortgage Zerowhich provides a fixed interest rate of zero percent for the first few years, and allows for lighter installments at the beginning.

2. Mandiri Bank

Bank Mandiri is one of the large banks that is also active in offering mortgage products.

Also read: Reducing Backlog Through Creative Financing

With fixed interest rates ranging from 4.99% to 7% for the first 3-5 years, KPR Mandiri is an attractive option for those who want installment stability at the beginning of the payment period.

Bank Mandiri also offers several flexible tenor options that can be adjusted to the customer’s financial capabilities, up to 20 years or more.

3. Bank BCA

BCA has a mortgage product that is often chosen by the public because of its stability and excellence in service. BCA’s mortgage product is known for its competitive fixed interest rate, which is around 5%-6.75% for the first 3-5 years.

Also read: The Right Tactics to Reduce Backlog

In addition, BCA offers BCA Fix & Cap Mortgagewhich provides protection against future interest rate increases.

In this scheme, customers will get a fixed interest in the first years, and then the interest is limited to a certain limit in the following years.

4. CIMB Niaga Bank

CIMB Niaga Bank offers products Xtra Mortgagewhich offers promotional interest rates ranging from 4.75%-7% for the first few years. This product also offers high payment flexibility, including early repayment features without penalties.

This makes CIMB Niaga one of the banks that is quite competitive in providing mortgage offers with low interest rates in the Indonesian market.

5. Bank BNI

BNI Bank offers products BNI Home which is known to have competitive interest. Customers can get fixed interest starting from 6.75% for the first 1 to 3 years.

This program also has many tenor options and can be used to buy a new house, a used house, renovate a house, or refinancing.

6. Indonesian Sharia Bank (BSI)

For those who prefer the sharia banking system, Bank Syariah Indonesia (BSI) offers mortgages based on contracts. Murabahah or Musharakawhich is interest free.

Instead, customers pay an agreed margin at the start, so that installments remain constant throughout the term.

This Sharia mortgage is suitable for customers who want to avoid the risk of interest rate fluctuations and adhere to sharia values.

7. Gem Bank

Permata Bank has a program Permata Free Mortgagewith promo interest rates starting from 5.99% for fixed tenors up to 5 years. This program also provides installment flexibility that can be adjusted to the customer’s income.

In addition, this program allows customers to pay installments with lower interest at the beginning, as well as accelerate repayment without penalty.

Subsidized Housing Mortgage Calculation Simulation

After knowing some bank options with low interest mortgages, let’s do a simple simulation to see how much the monthly mortgage installments are. For this simulation, we will use the following scenario:

- Subsidized house prices: Rp. 150,000,000 (The price of subsidized houses is usually lower than commercial houses).

- Down payment: 10% of the house price, which is IDR 15,000,000.

- Loan amount: Rp. 135,000,000 (house price – down payment).

- Fixed interest rate: 5% per year.

- Mortgage tenor: 20 years (240 months).

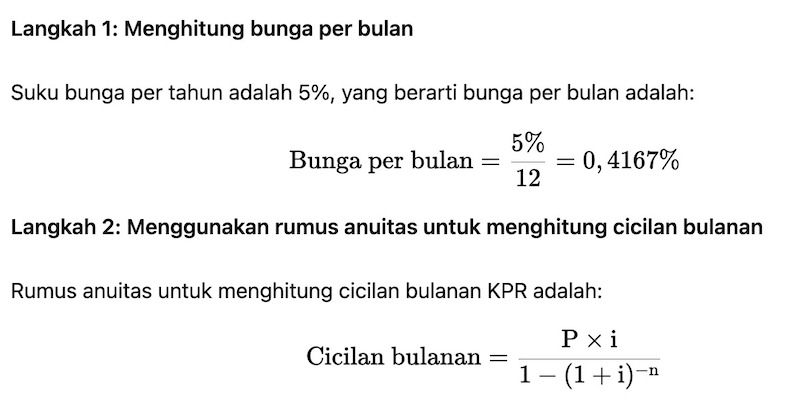

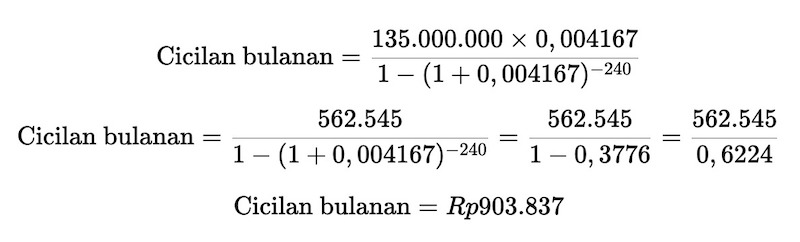

The calculation uses the annuity method, where installments are calculated based on fixed interest and tenor.

Where:

- P = loan amount (Rp. 135,000,000),

- i = interest per month (0.4167% = 0.004167),

- n = number of months (240 months for a 20 year term).

So, the monthly installments that must be paid by customers for subsidized housing with a price of IDR 150,000,000 and a fixed interest of 5% per year are around Rp 903.837 per month for 20 years.

Tips for Choosing a Low Interest Mortgage

-

Pay attention to bank promotions: Many banks offer low interest rate promotions for a certain period. Make sure you take advantage of these offers.

-

Choose the appropriate tenor: Longer tenors can reduce the amount of monthly installments, but the total interest paid will be greater. Conversely, shorter tenors will accelerate repayment with lower total interest.

-

Calculate total mortgage costs: In addition to interest rates, pay attention to other associated costs, such as insurance, notary fees, and administration fees.

-

Pay attention to payment flexibility: Some banks provide the option to pay off early without penalty, which can be an advantage if you have more funds in the future.

Choosing a low-interest mortgage requires research and comparison from various banks. Each bank offers its own advantages, depending on your needs and financial capabilities. By using the calculation simulation above, you can get an idea of the amount of monthly installments you need to pay for a subsidized house.

Taking a mortgage is a long-term commitment, so make sure you choose the right bank and mortgage program, and plan your finances carefully so you can meet your installment obligations smoothly. (Z-10)

#Interest #Mortgages #Calculation #Simulations #Subsidized #Homes