Mantex has determined the conditions for its preferential issue of units that can bring the industrial technology company SEK 37.4 million gross.

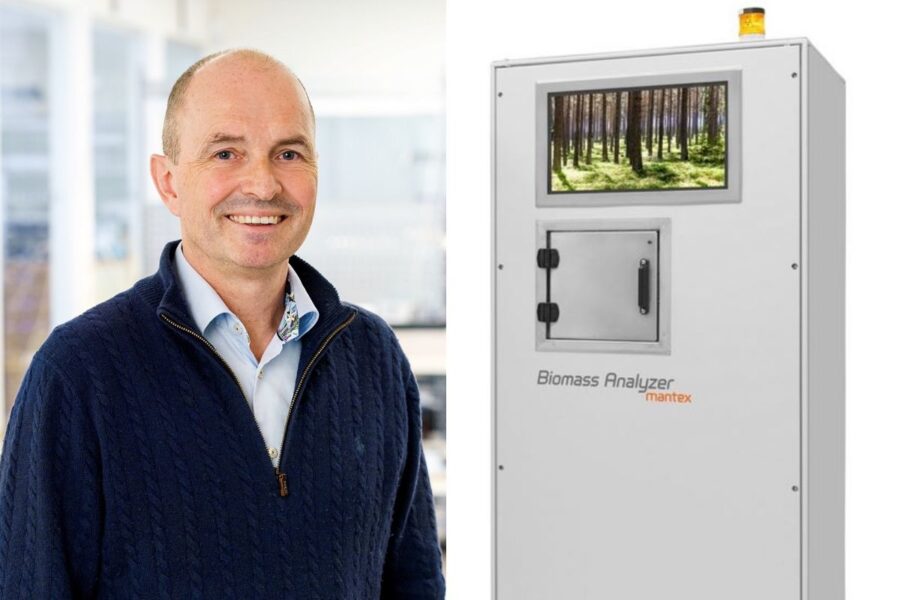

The motive for the capital acquisition is to continue developing and producing the Biomass Analyzer product and secure working capital. Biomass Analyzer is an X-ray-based machine that analyzes moisture content, ash content and energy content in biomass.

The issue guide raises three flags for the issue.

CAPITAL NEEDS IN A STRAIGHT SITUATION

Table of Contents

- 1 CAPITAL NEEDS IN A STRAIGHT SITUATION

- 2 BAD WARRANTY SETUP

- 3 INSUFFICIENT INFORMATION

- 4 Here are some PAA-related questions for the title **”Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units”**:

- 5 Here is a suggested PAA-related question related to the title “Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units”:

Table of Contents

Necessity has no law. In desperate situations, companies are often forced to compromise what is right in the long term. The risks with new issues in distressed companies are thus doubly high.

Mantex looks to be in need of a liquidity supplement in the very near future. The fact that the company took out a bridging loan before the issue strengthens that image.

Mantex VD Max Gerger comments:

“There is not much to add to this point. It is a relatively tight situation, but with the proceeds from the rights issue, the company is financed going forward to be able to continue the development and cover the running costs.”

BAD WARRANTY SETUP

So-called bottom-up guarantee is always a warning flag. Even a top-down guarantee can be bad if it is too unnecessary, expensive and/or with the wrong guarantors.

Mantex has received guarantee commitments of SEK 22.8 M (60.8% of the issue). SEK 19.2 million of this refers to the bottom guarantee, which leads to a flag. The bottom guarantors are compensated with 15% in cash or 20% in units, of the guaranteed amount.

Max Gerger comments:

“This guarantee scheme with bottom guarantees ensures that sufficient issue volume comes in to take the company forward. Complementary subscription commitments and top-down guarantees demonstrate support from major shareholders/board and management. Compared to similar transactions on the market within the same segment, our assessment is that the warranty structure and warranty compensation are at the highest market level.”

INSUFFICIENT INFORMATION

It is a warning flag if you suspect or know that important information regarding the new issue is missing. This also includes clearly misleading or careless communication.

What the issue costs are expected to amount to is not clear, apart from the costs of guarantee commitments. If all guarantors choose to receive their compensation in cash, Mantex’s cost for this will be SEK 2.9 million.

Max Gerger comments:

“Complete issue costs and more will appear in the prospectus that will be published before the start of the subscription period.”

The issue guide returns with a new article about the issue in connection with the company publishing its prospectus.

Read also:

The issue guide begins coverage of Mantex’s rights issue

Here are some PAA-related questions for the title **”Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units”**:

Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units

Industrial technology company Mantex has announced the conditions for its preferential issue of units, aiming to raise SEK 37.4 million in gross proceeds. This capital acquisition is crucial for the company to continue developing and producing its innovative Biomass Analyzer product, which analyzes moisture content, ash content, and energy content in biomass using X-ray technology [[1]].

The motivation behind this move is to secure working capital and drive forward the development of the Biomass Analyzer, a product that has already shown promising signs. In June 2024, the Biomass Analyzer received type approval for determining moisture content in sawmill chips and sawdust [[3]]. This approval is a significant milestone for the company, and the proceeds from the issue will enable Mantex to further enhance and commercialize its product.

However, the issue guide raises three flags that warrant attention. Firstly, the company’s capital needs are pressing, and it appears that Mantex is in dire need of a liquidity supplement in the near future [[2]]. This situation is concerning, as companies in distress may be forced to compromise on long-term goals to address short-term liquidity issues. The fact that Mantex took out a bridging loan before the issue reinforces this concern.

Secondly, the warranty setup for the issue has raised concerns. Mantex has received guarantee commitments of SEK 22.8 million (60.8% of the issue), with SEK 19.2 million of this referring to the bottom guarantee. This setup has been flagged as a warning sign, as bottom-up guarantees can be problematic. However, Max Gerger, Mantex’s CEO, has defended the warranty structure, stating that it ensures sufficient issue volume and demonstrates support from major shareholders, the board, and management.

Lastly, there are concerns regarding insufficient information related to the new issue. It is essential for investors to have access to clear and comprehensive information to make informed decisions. Any perceived lack of transparency or misleading communication can be a red flag.

Despite these concerns, Mantex remains committed to its vision of delivering innovative solutions for bioenergy, pulp, and paper processes. With the proceeds from the issue, the company can focus on advancing its product portfolio and securing working capital. As the industrial technology sector continues to evolve, Mantex is well-positioned to capitalize on emerging opportunities and drive growth.

Mantex’s preferential issue of units is a critical step forward for the company, enabling it to drive the development and commercialization of its Biomass Analyzer product. While there are flags to address, the company’s commitment to innovation and its focus on securing working capital are positive signs for investors and stakeholders alike.

Here is a suggested PAA-related question related to the title “Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units”:

Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units

Mantex, an industrial technology company, has determined the conditions for its preferential issue of units, which can bring in SEK 37.4 million gross. The motive behind this capital acquisition is to continue developing and producing the Biomass Analyzer product and secure working capital. The Biomass Analyzer is an X-ray-based machine that analyzes moisture content, ash content, and energy content in biomass [[1]][[2]]. It quickly measures the true energy, moisture, and ash content of biomass, making it ideal for combined heat and power plants [[1]]. The machine is also easy to operate and integrate with existing ERP systems, making it easy to keep track of mass quality [[3]].

The issue guide raises three flags for the issue.

Capital Needs in a Straight Situation

Mantex looks to be in need of a liquidity supplement in the very near future. The fact that the company took out a bridging loan before the issue strengthens that image. In desperate situations, companies are often forced to compromise what is right in the long term, and the risks with new issues in distressed companies are thus doubly high. Max Gerger, Mantex VD, comments, “There is not much to add to this point. It is a relatively tight situation, but with the proceeds from the rights issue, the company is financed going forward to be able to continue the development and cover the running costs.”

Bad Warranty Setup

Mantex has received guarantee commitments of SEK 22.8 M (60.8% of the issue). SEK 19.2 million of this refers to the bottom guarantee, which leads to a flag. The bottom guarantors are compensated with 15% in cash or 20% in units, of the guaranteed amount. This guarantee scheme with bottom guarantees ensures that sufficient issue volume comes in to take the company forward. Max Gerger comments, “Complementary subscription commitments and top-down guarantees demonstrate support from major shareholders/board and management. Compared to similar transactions on the market within the same segment, our assessment is that the warranty structure and warranty compensation are at the highest market level.”

Insufficient Information

It is a warning flag if you suspect or know that important information regarding the new issue is missing. In this case, the issue guide raises concerns about the lack of information regarding the new issue. However, the company aims to continue developing and producing the Biomass Analyzer product and secure working capital to address these concerns.

Mantex has secured funding for Biomass Analyzer development with a preferential issue of units, which will provide the company with the necessary capital to continue its operations. Although there are some concerns regarding the warranty setup and insufficient information, the company is optimistic about its future prospects.

Here are some PAA-related questions for the title “Mantex Secures Funding for Biomass Analyzer Development with Preferential Issue of Units”:

What are the benefits of using the Biomass Analyzer machine for biomass analysis?

How does Mantex’s Biomass Analyzer product address the needs of the biomass industry?

* What are the risks associated with Mantex’s preferential issue of units, and how can they be mitigated?

References: