- The number of addresses holding over 10,000 ETH has declined.

- The price of ETH has struggled to recover the $3,000 price level.

The price range of $3,000 for Ethereum [ETH] now seems like a distant memory as the cryptocurrency continues to battle to reclaim that level.

Despite several attempts at recovery, ETH has consistently fallen short, leading to increasing concerns among investors and market participants.

During this ongoing struggle, some large holders, commonly known as “whales,” have begun to reduce their holdings.

Ethereum whales are cutting back on their holdings

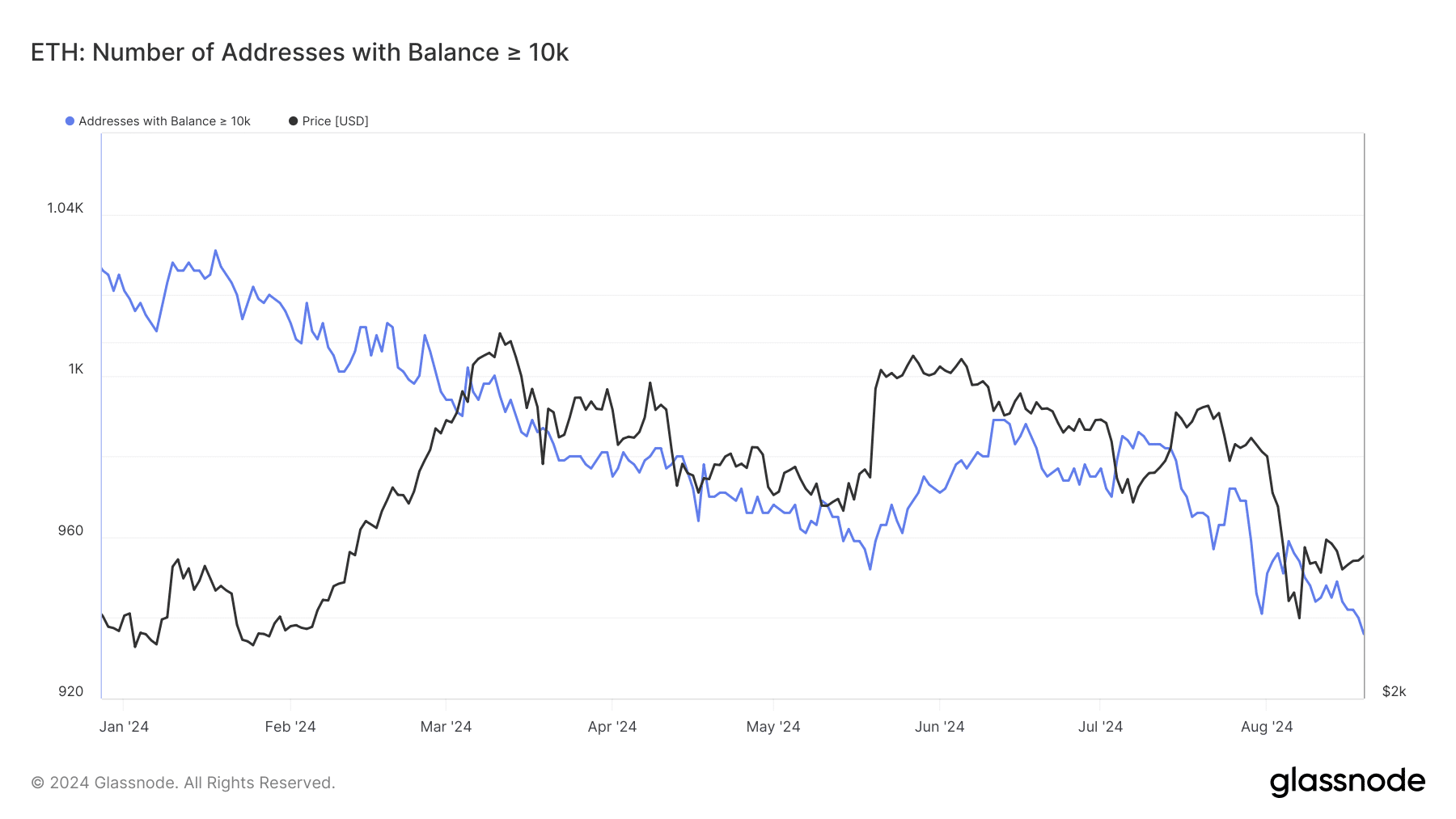

An analysis of Ethereum addresses containing 10,000 or more ETH, via Ethereum, shows a significant drop in recent weeks.

This decrease suggests a possible shift in market sentiment among large holders. Throughout 2024, there has been a noticeable reduction in the number of these large addresses, particularly in recent months.

At the start of the year, approximately 1,020 addresses held 10,000 or more ETH. However, this number has been steadily declining, dropping below 960 in August 2024, the lowest level seen since 2017.

Source: Glassnode

The consistent decline in the number of large ETH addresses may be interpreted as a bearish signal.

When whales offload significant portions of their holdings, it can indicate a lack of confidence in Ethereum’s short- and medium-term price prospects.

This trend could signify that these large holders are taking profits, reallocating their portfolios into other assets, or anticipating a further downturn in the market.

Possible market impact

As these large holders continue to sell their ETH, the market may experience increased selling pressure. Without adequate demand from new buyers to absorb this greater supply, the price of Ethereum could continue to decline.

This reversal might suggest that these entities believe Ethereum’s price has reached a level that represents good value, leading to increased buying activity.

Slight increase in Ethereum’s price

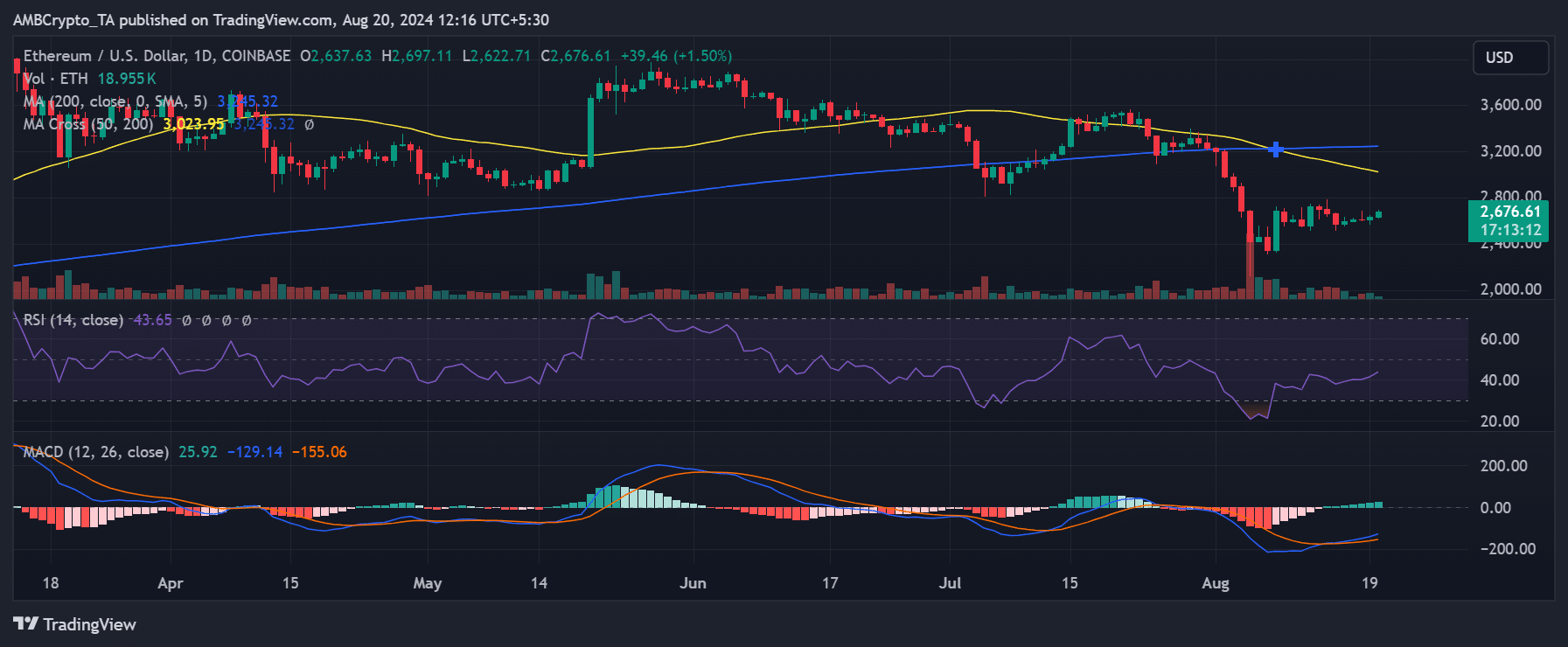

Ethereum experienced a slight gain during the last trading session, with AMBCrypto’s analysis indicating an increase of nearly 1%.

This rise brought the price to approximately $2,637. As of this writing, ETH continues to trade with a gain of over 1%, maintaining a level around $2,637.

Source: TradingView

Throughout 2024, the price of Ethereum has experienced considerable fluctuations. The year began with a strong upward movement, peaking around March.

However, since that peak, its price has gradually decreased over the months. This downward trend has continued into August 2024, reflecting the diminishing number of major ETH addresses.

This is an automatic translation of our English version.

- The number of addresses holding more than 10,000 ETH has decreased.

- ETH price has failed to recover the $3,000 price level.

The price range of Ethereum [ETH] is now starting to feel like a distant memory as the cryptocurrency continues to struggle to reclaim that level.

Despite recovery attempts, ETH has been consistently falling short, leading to growing concerns among investors and market participants.

Amid this ongoing struggle, some large holders, often referred to as “whales,” have begun to reduce their holdings.

Ethereum Whales Reduce Their Holdings

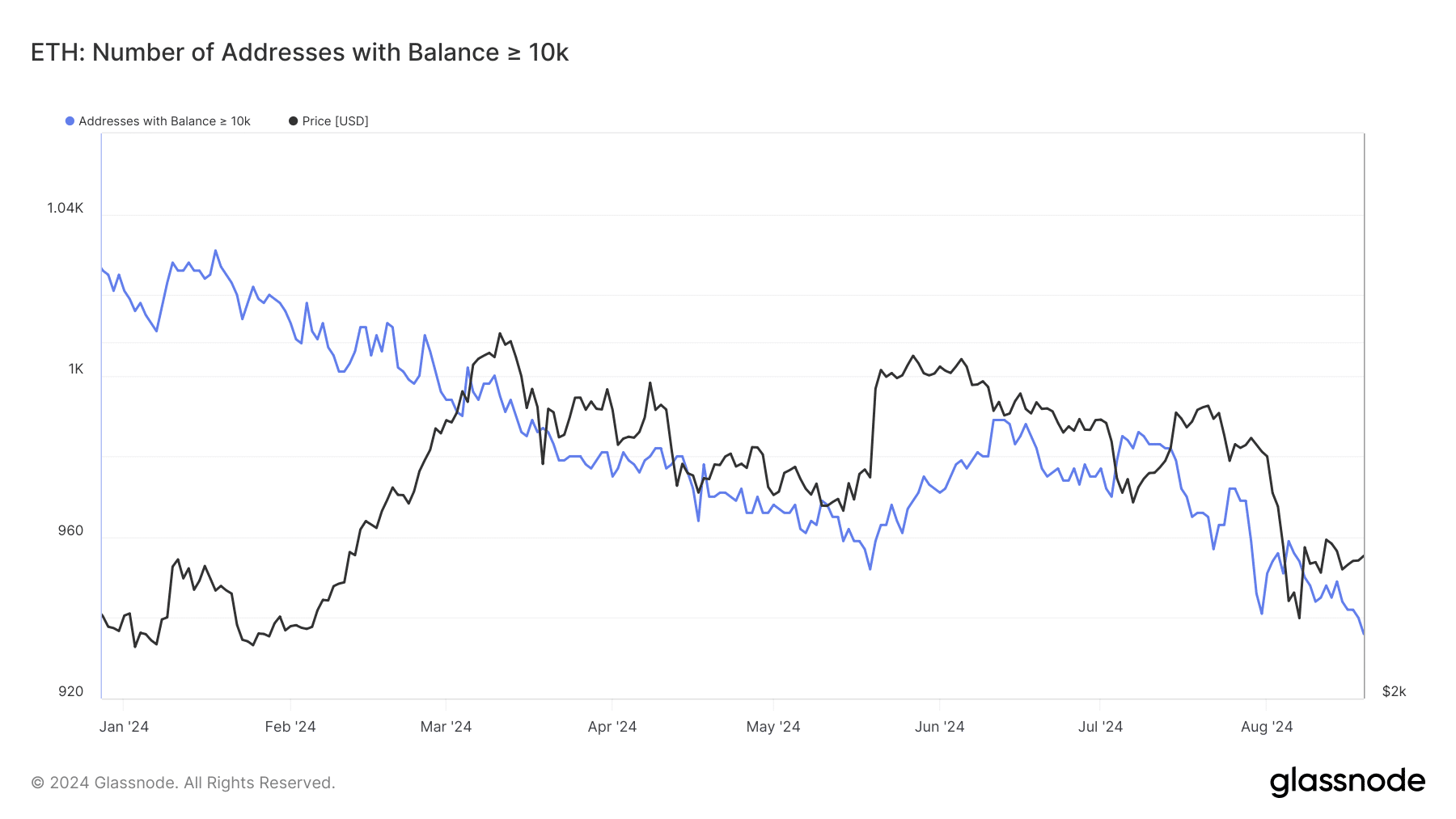

An analysis of the addresses of Ethereum containing 10,000 or more ETH in Glassnode reveals a significant decline in recent weeks.

The drop indicates a possible shift in market sentiment among large holders. Throughout 2024, there has been a noticeable decline in the number of these large addresses, with a particularly pronounced drop in recent months.

At the beginning of the year, the number of addresses holding 10,000 or more ETH was around 1,020. However, this figure has been steadily declining, falling below 960 in August 2024, marking the lowest level observed since 2017.

Source: Glassnode

The steady decline in the number of large ETH addresses could be interpreted as a bearish signal.

When whales start dumping significant portions of their holdings, it may reflect a lack of confidence in Ethereum’s short- and medium-term price outlook.

This trend could indicate that these large holders are taking profits, reallocating their portfolios to other assets, or preparing for a possible further market decline.

Potential Impact on the Market

As these large holders continue to sell their ETH, the market may face increased selling pressure. Without sufficient demand from new buyers to absorb this increased supply, the price of Ethereum could continue to decline.

On the other hand, if the trend in the major directions begins to stabilize or even reverse, it could indicate a renewed accumulation phase among large holders.

This reversal could suggest that these entities believe the price of Ethereum has reached a level where it represents good value, leading to increased buying activity.

Slight Increase in the Price of Ethereum

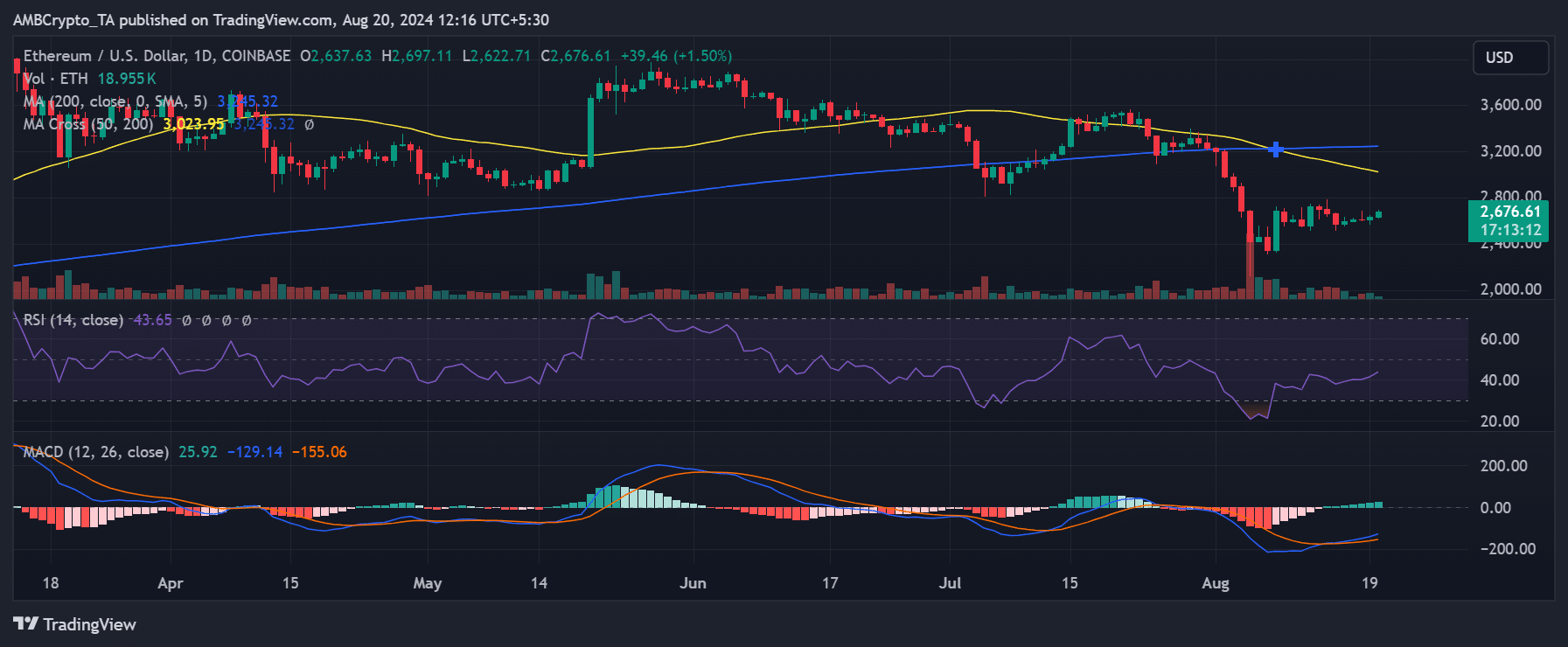

Ethereum saw a slight gain in the last trading session, with AMBCrypto analysis showing an increase of almost 1%.

The surge brought the price to around $2,637. At the time of writing, ETH continues to trade with an increase of over 1%, maintaining its level at around $2,637.

Source: TradingView

Throughout 2024, the price of Ethereum has seen significant fluctuations. The year started with a strong upward movement, peaking around March.

However, since that peak, its price has been gradually declining over the following months. This downward trend has persisted into August 2024, reflecting the declining number of major ETH addresses.

Benefits of Monitoring Ethereum Whale Activity

Understanding the movements of significant Ethereum holders can provide crucial insights into market trends. Here are some benefits to tracking whale activity:

- Identifying Market Sentiment: Whale actions often reflect broader market trends, serving as an indicator of investor confidence.

- Strategic Investment Decisions: Investors can make more informed decisions based on data regarding large-holder movements.

- Timing the Market: Recognizing a potential accumulation phase can signal a good entry point for new investors.

Practical Tips for Investors

Here are some practical tips for investors looking to navigate Ethereum’s current market conditions:

- Stay Informed: Regularly check news and analytics platforms for updates on Ethereum and market trends.

- Utilize Analytical Tools: Tools like Glassnode provide valuable data about whale activity and market dynamics.

- Diversify Your Portfolio: Avoid putting all your investments in one asset; diversify across different cryptocurrencies for better risk management.

Case Study: Historical Whale Activity and Market Trends

A look back at previous instances of whale activity reveals valuable insights:

| Year | Whale Actions | Market Reaction |

|---|---|---|

| 2017 | Massive accumulation before sudden price increase | ETH surged from $10 to $400 within months |

| 2020 | Large sell-offs preceding significant price drops | ETH fell from $400 to $200 during market correction |