- XRP has surpassed the significant resistance level of $0.5657.

- Indicators suggest a potential continuation of the bullish trend.

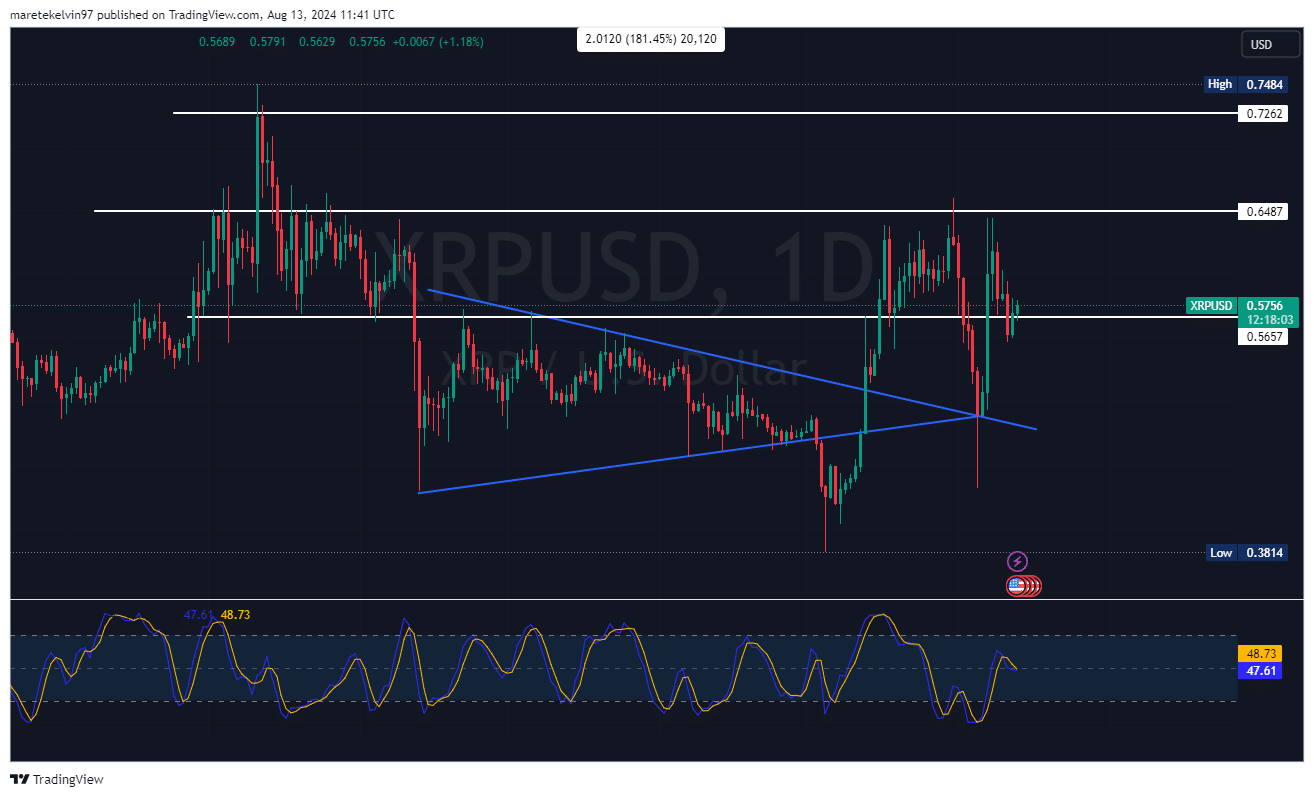

XRP has made a notable advance, breaking through the critical resistance level of $0.5657 as of this writing.

This rise came after a 14% price correction aimed at closing the fair value gap, indicating that the asset was gaining bullish momentum. This price movement may signal the start of an uptrend.

With the breakthrough above $0.5657, traders are now focusing on the next major resistance level at $0.6487.

Source: TradingView

The trajectory between these two points is essential. If the altcoin can sustain its momentum and navigate through sell-offs on its ascent, a rally toward this target could unfold.

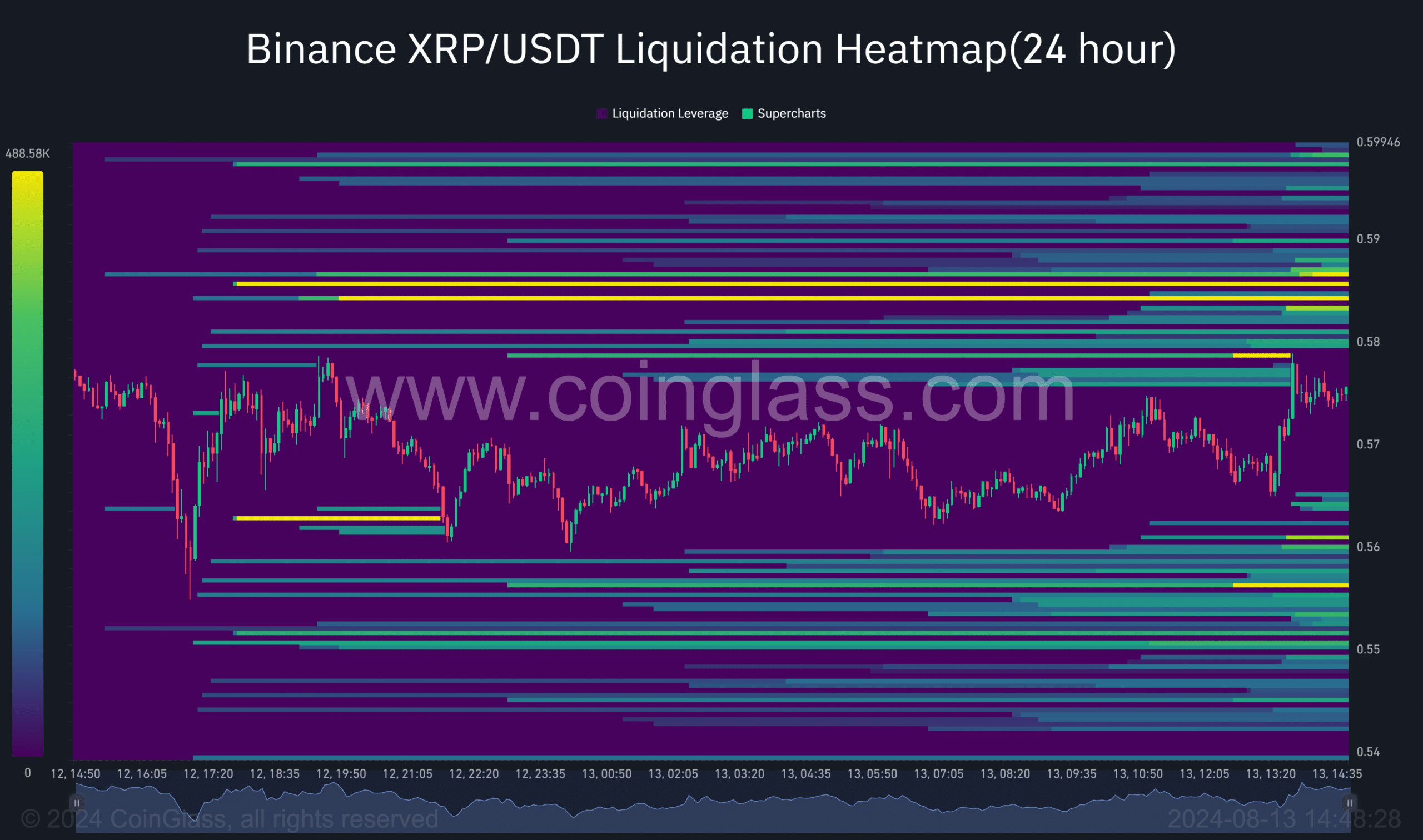

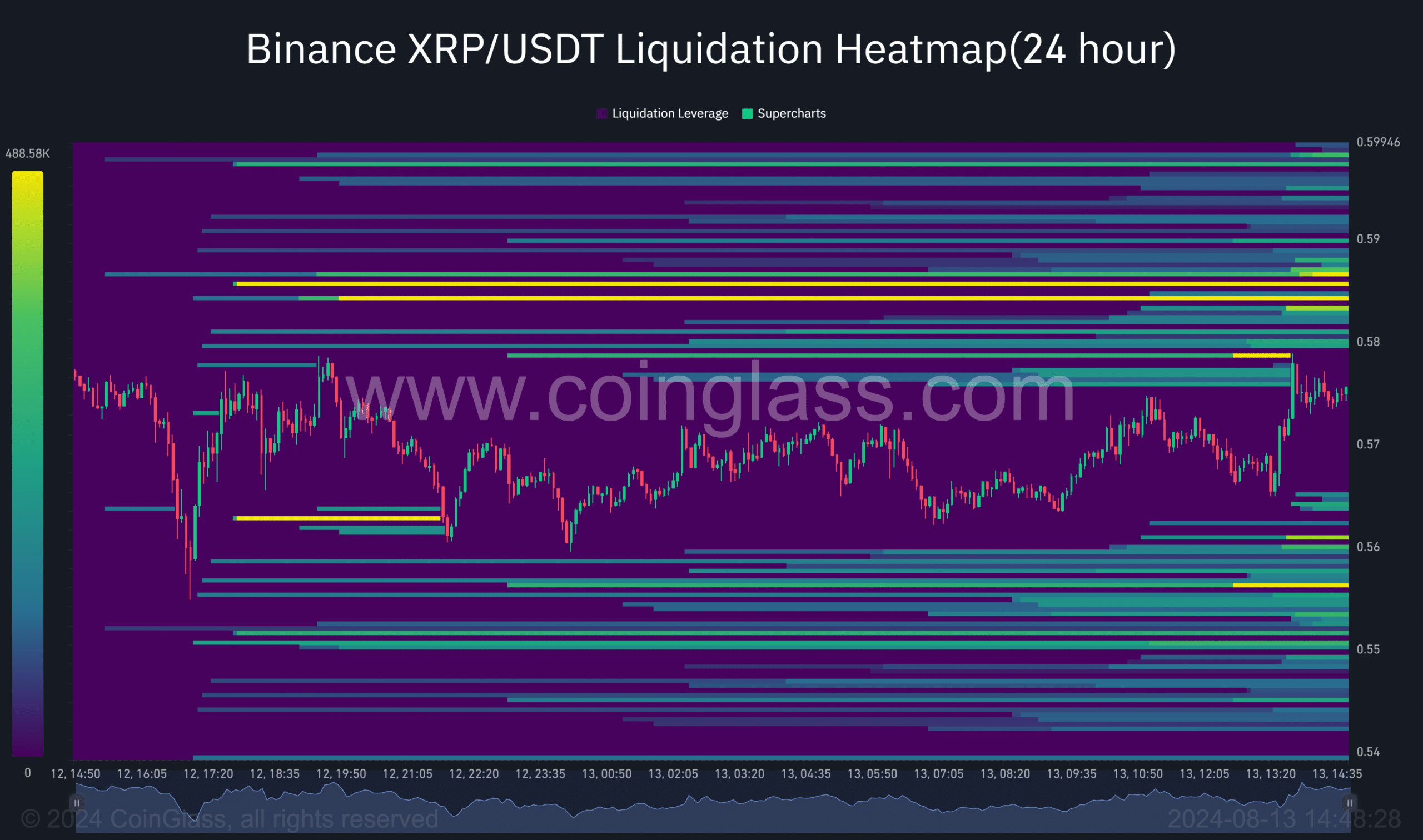

XRP liquidation levels reveal a bullish outlook

AMBCrypto’s examination of Coinglass’ liquidation heatmap data suggests an intriguing liquidation scenario ahead. The next major liquidation bottom is at $0.58, with 208,640 XRP involved.

More importantly, there are additional liquidation bottoms above this level, which can act as attractors for price movements and may incite further bullish actions.

Source: Coinglass

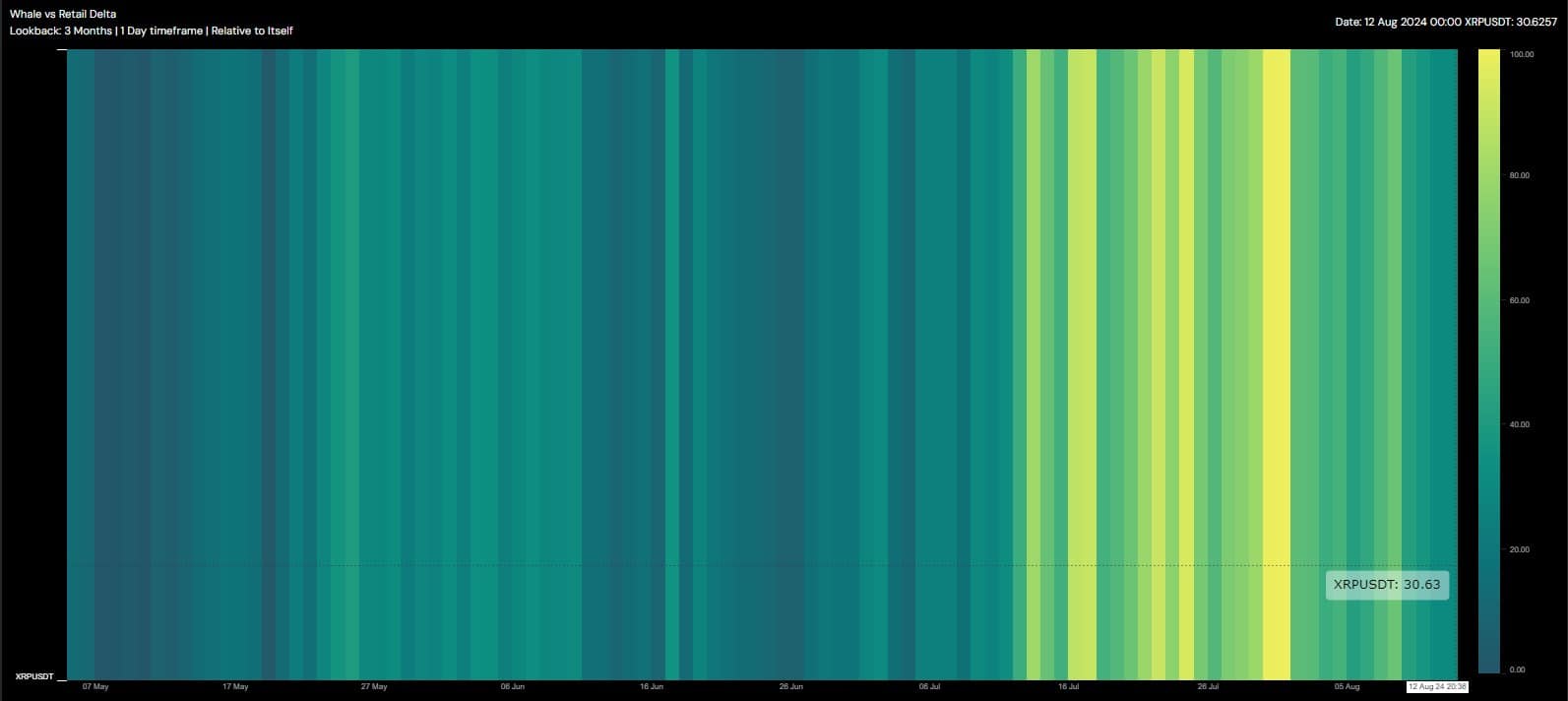

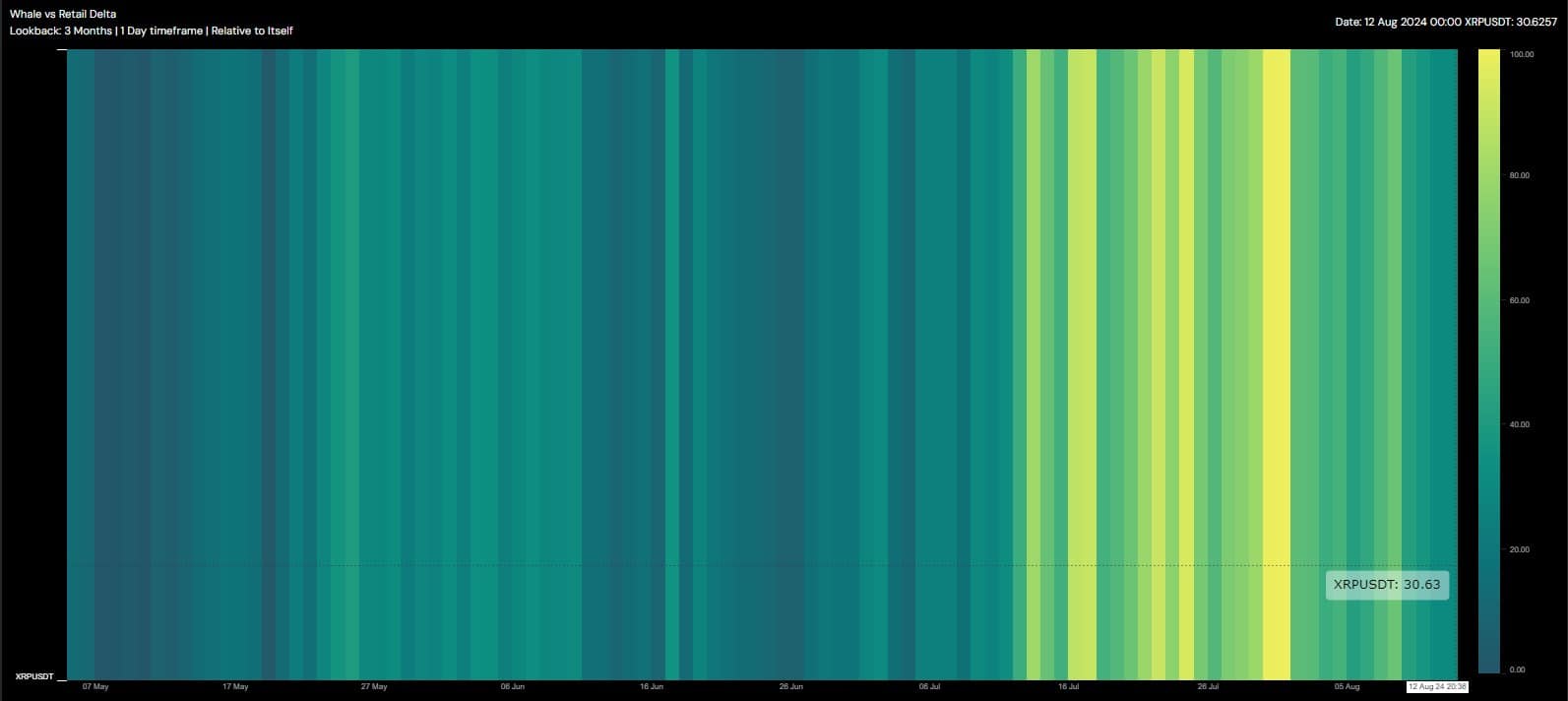

Whale activity signals confidence

At the time of reporting, the delta between whale and retail activity stood at an impressive 30.63, indicating heightened interest among XRP holders.

This increase in whale activity could lead to significant price movements, particularly since the previous level of indecision has been surpassed.

Therefore, many whales are likely to take long positions as they remain optimistic about the target of $0.6487.

Source: Hyblock Capital

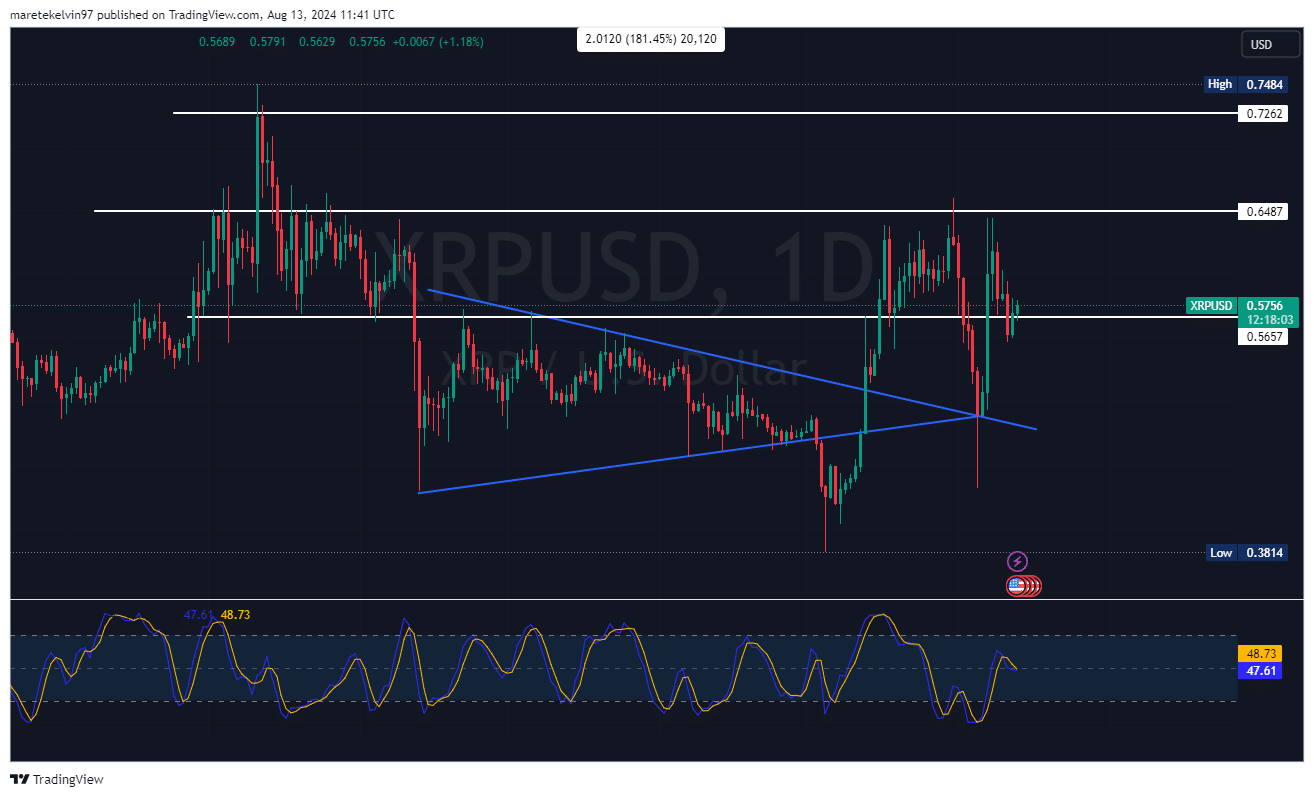

Interestingly, AMBCrypto’s review of Coinglass net flow data revealed consistent outflows over the last 24 hours.

This trend of outflows, even as prices rise, usually indicates a phase of accumulation as investors withdraw their assets from exchanges, likely to hold them long-term. This behavior reflects confidence in XRP’s future potential.

Source: Coinglass

The technical breakout, positive net outflows, and whale activity have converged to create an optimistic outlook for XRP.

However, the journey to $0.6487 may only be feasible if XRP can capitalize on this recent success and sustain the bullish accumulation trend.

This is an automatic translation of our English version.

- XRP breaks above a key resistance level of $0.5657.

- Metrics indicate a possible continuation of the bullish rally.

XRP has made a significant move, breaking the key resistance level of $0.5657 at the time of writing. This advance came after a 14% price correction to cover the fair value gap, a sign that the asset was gaining bullish momentum. This price movement could mark the beginning of an uptrend.

With the break above $0.5657, market participants are now eyeing the next major resistance level at $0.6487.

Source: TradingView

The path between these two points is crucial. If the altcoin can maintain its momentum and overcome sell-offs on its way up, then a rally towards this target could occur.

XRP Liquidation Levels Paint a Bullish Picture

AMBCrypto’s analysis of Coinglass’ liquidation heatmap data indicated an interesting liquidation landscape ahead. The next major liquidation bottom was at $0.58, with 208,640 XRP at stake. More importantly, above this level there are additional liquidation bottoms that act as magnets for price action, potentially triggering further bullish moves.

Source: Coinglass

Whale Activity Indicates Confidence

At press time, the delta between whales and retailers stood at an impressive 30.63, implying increased interest among XRP holders. This increased whale activity could initiate a significant move in price movements, considering that the level of indecision has already been surpassed. Therefore, most whales may take long positions, remaining bullish on the target level of $0.6487.

Source: Hyblock Capital

Interestingly, AMBCrypto’s analysis of Coinglass net flow data showed consistent outflows over the past 24 hours. This pattern of outflows, despite rising prices, typically indicates accumulation as investors remove their assets from exchanges, possibly to hold them for the long term.

Source: Coinglass

The technical breakout, positive net outflows, and whale activity have converged to paint a bullish picture for XRP. However, the path to $0.6487 may only be within reach if XRP can build on this recent success and maintain the bullish accumulation trend.

Technical Analysis and Market Sentiment

Given the current bullish momentum surrounding XRP, technical indicators also play a critical role in forecasting future price movements. Some key indicators to watch include:

- Relative Strength Index (RSI): The RSI is currently trending in the bullish territory, suggesting that XRP has room for further appreciation without entering overbought territory.

- Moving Averages (MA): The 50-day and 200-day moving averages have turned bullish, indicating a potential golden cross which often signals a significant uptrend.

- Bollinger Bands: With XRP’s price venture above the upper band, it highlights strong bullish momentum, yet traders should remain cautious to avoid potential pullbacks.

Market Influencers and Future Outlook

As XRP traverses the landscape of increasing prices and potential resistance levels, multiple factors could influence its trajectory:

| Influencer | Potential Impact |

|---|---|

| Regulatory Developments: | New regulations or legal clarity regarding XRP’s status can greatly affect investor sentiment. |

| Market Trends: | Overall crypto market trends, Bitcoin’s price movements, and institutional adoption rates can influence XRP’s price. |

| Technological Updates: | Upcoming updates or changes within the XRP ledger may generate investor interest and potentially push prices higher. |

Practical Tips for XRP Investors

For investors looking to capitalize on XRP’s bullish momentum, consider the following practical tips:

- Stay Informed: Regularly check updates on regulatory news and community sentiment.

- Diversify Holdings: While XRP may be on the rise, diversifying investments across multiple cryptocurrencies can reduce risk.

- Set Exit Strategies: Establish profit-taking levels and stop-loss orders to manage potential volatility.

- Engage with the Community: Join online forums and social media groups to exchange views and stay updated on market trends.