- As of now, PEPE is trading within a descending triangle, indicating a potential rally towards the $0.00001000 level.

- Increased buyer interest in PEPE is backed by several technical indicators.

Pepe [PEPE] has struggled to bounce back from the support level of $0.00000773 after a recent market downturn led to further price drops.

However, it now seems ready for a recovery, trading within the same descending triangle and responding positively from the support level it previously could not maintain.

The question remains, will this be enough of a trigger to push PEPE’s price higher in the short term? AMBCrypto is investigating the likelihood of this happening.

What can a descending triangle mean for PEPE?

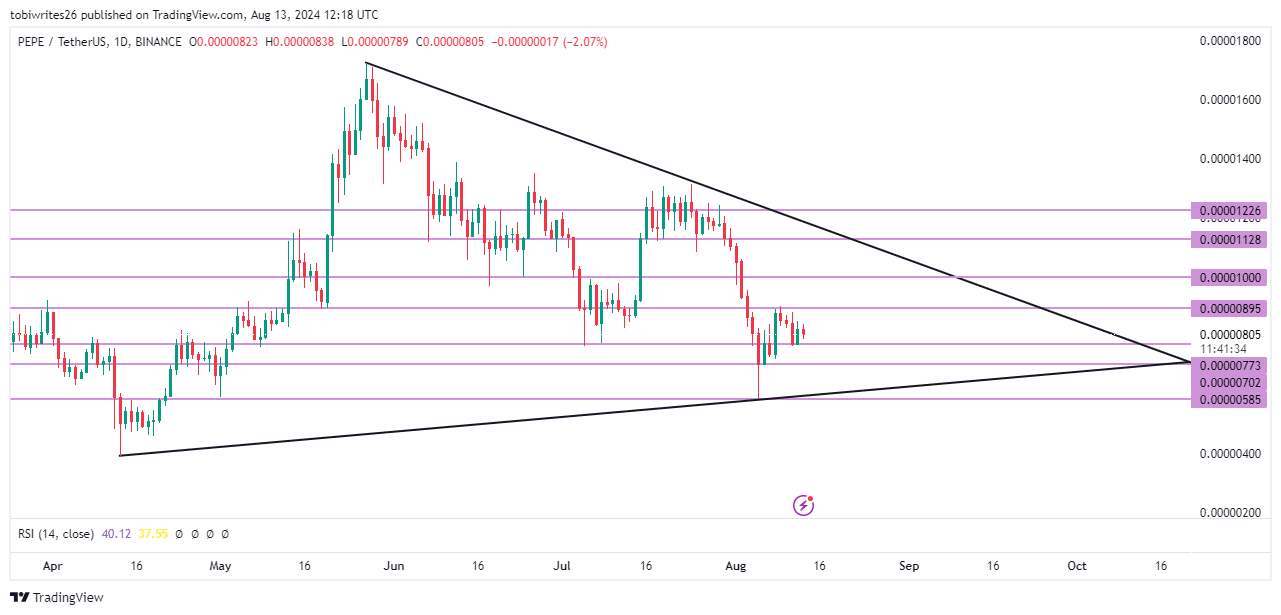

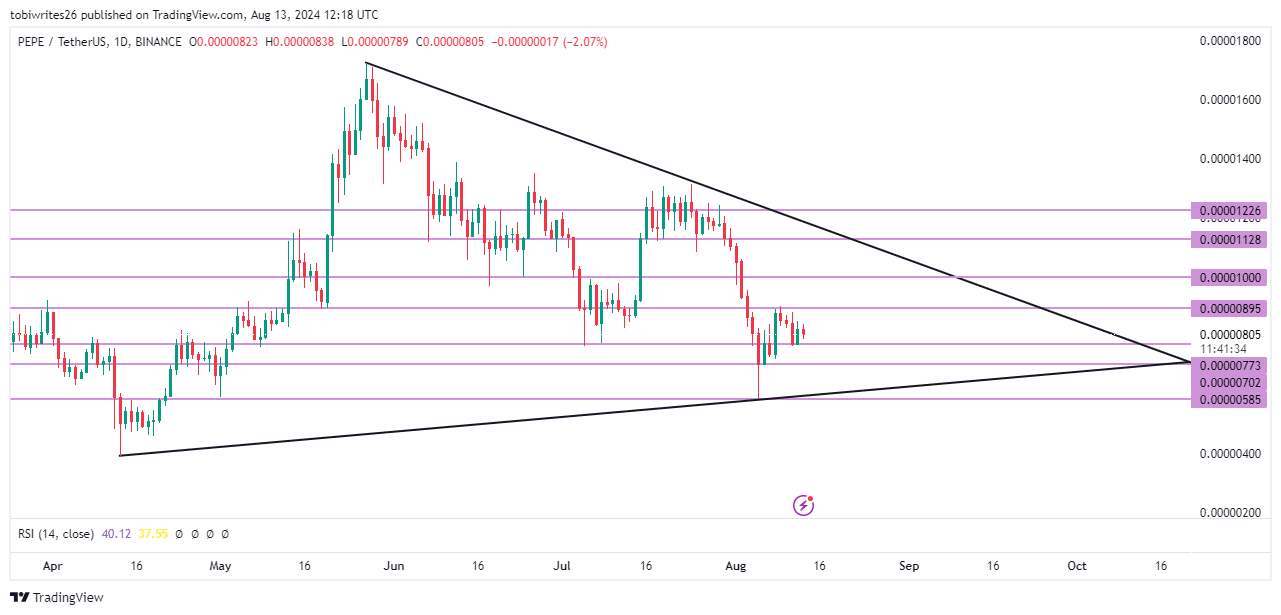

A descending triangle demonstrates that PEPE’s price has been oscillating between two levels: upper and lower limits.

This formation suggests that the market might either rise and breach the upper boundary or continue to decline and break the lower boundary.

In PEPE’s case, the outlook points toward a bullish breakout. At the time of this writing, it has bounced from the support level of $0.00000773 to $0.00000805.

If this level holds, it could propel the price to the next resistance point at $0.00000895 and potentially to $0.00001000.

Source: TradingView

If the support weakens under bearish pressure, PEPE may find more sustainable lower support levels at $0.00000702 or $0.00000585.

Positive signals from technical indicators

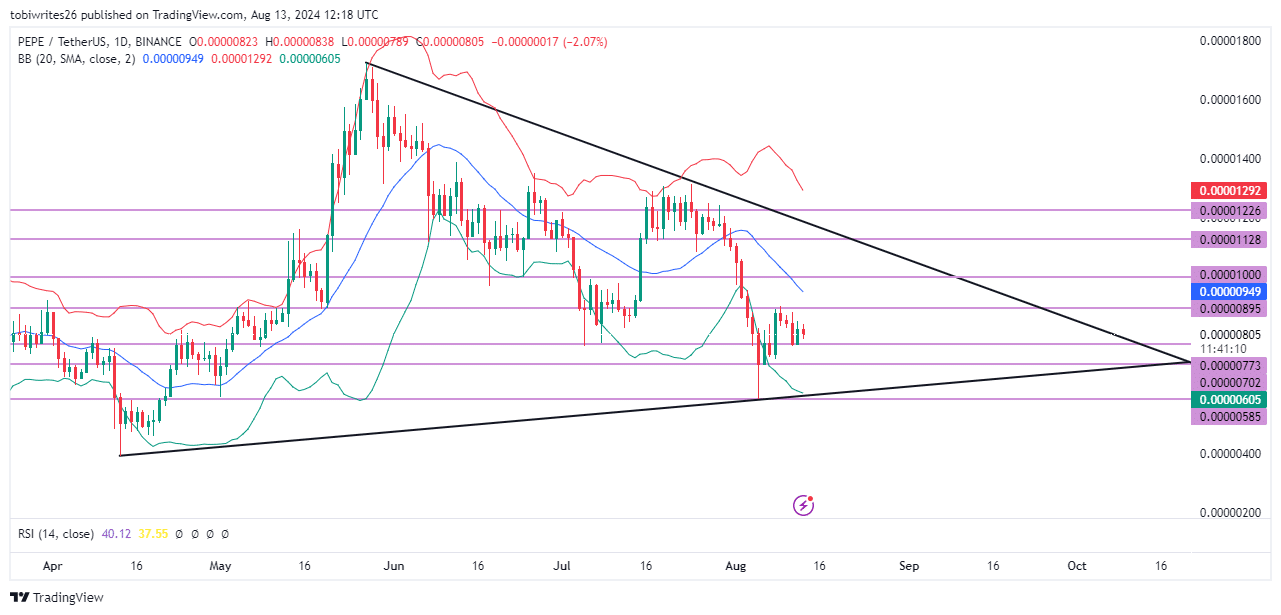

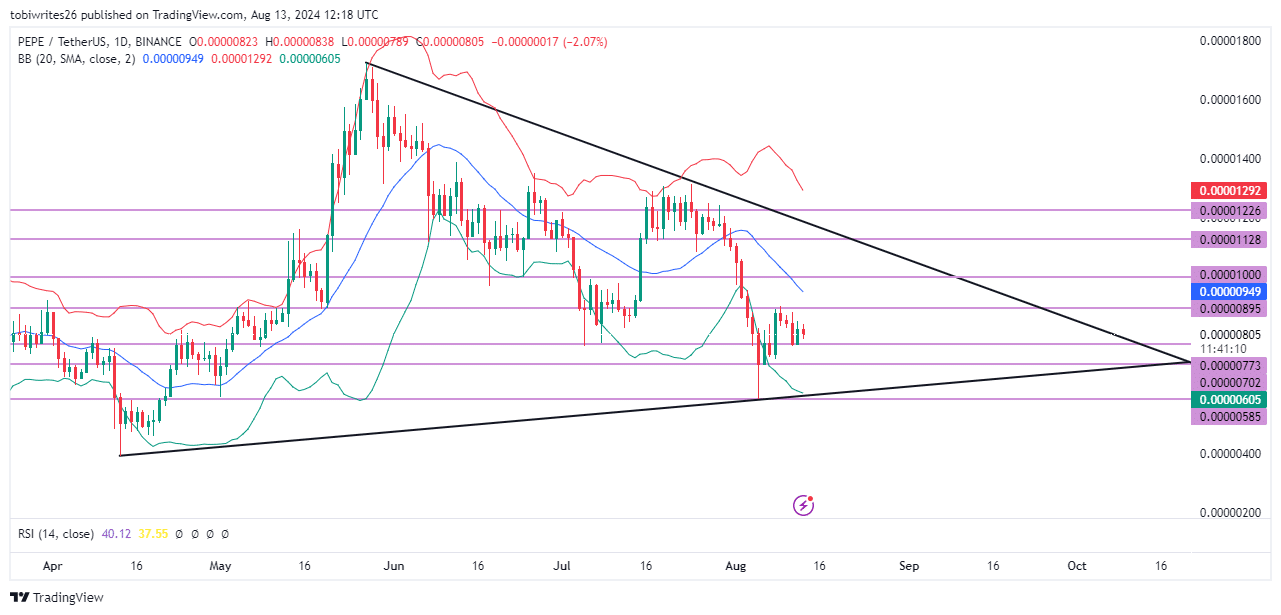

Bollinger Bands, which feature a moving average enclosed between two standard deviation lines, indicate that PEPE is currently oversold.

This creates an opportunity for a potential rally towards the mid-band at $0.00000949 or even higher to $0.00001000.

Source: TradingView

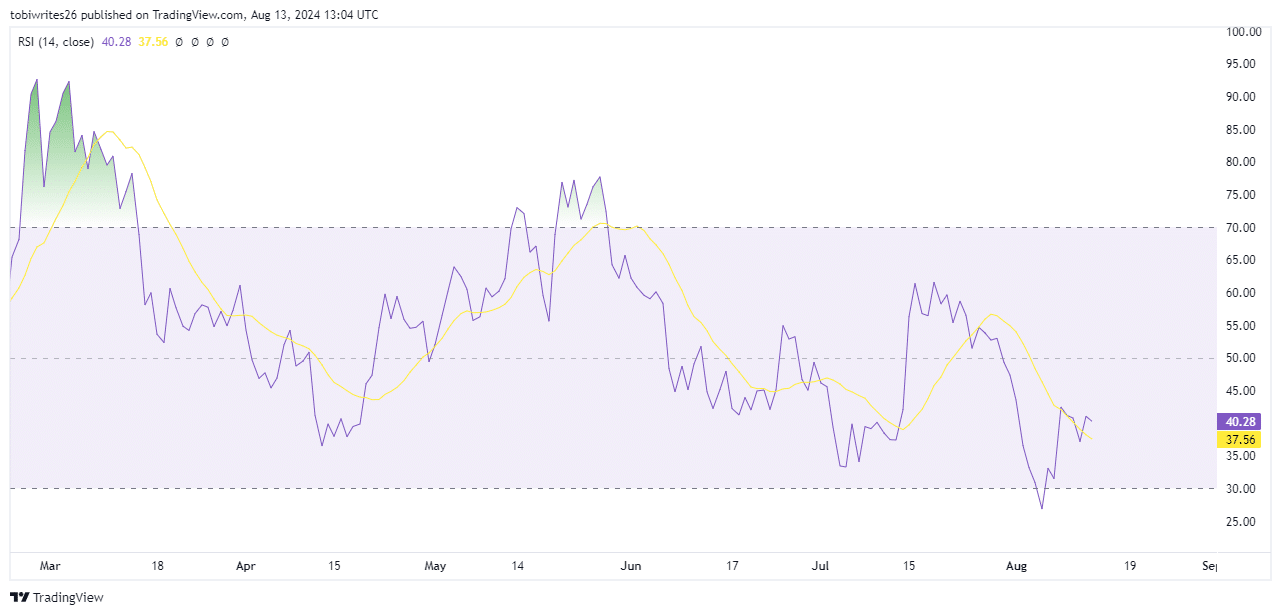

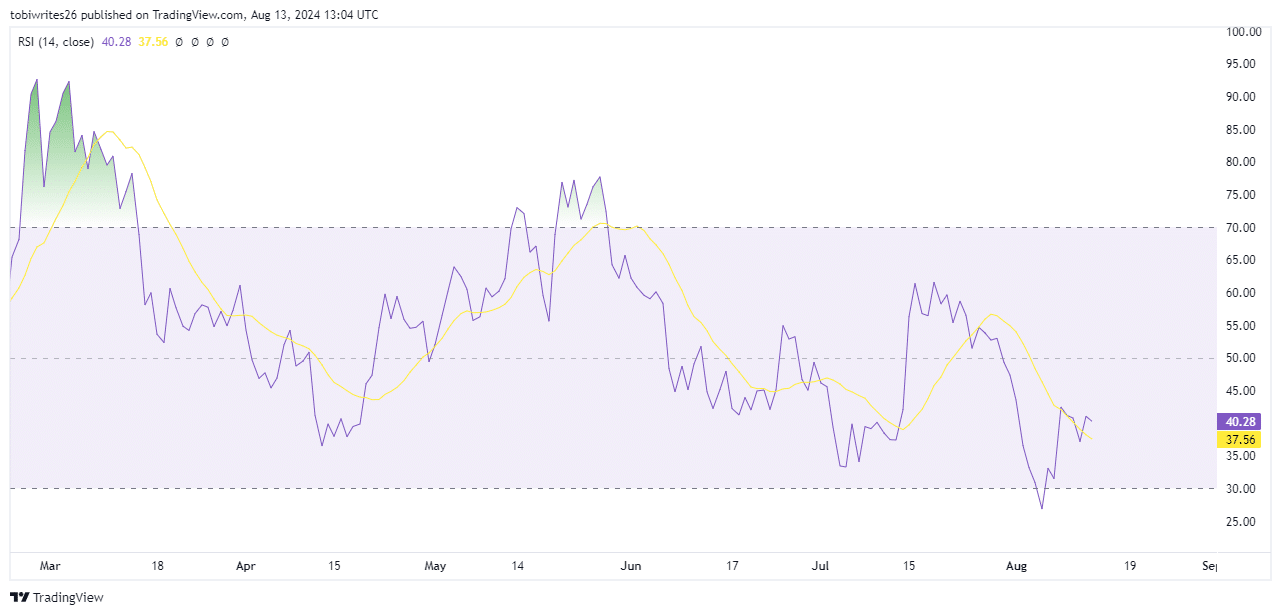

The relative strength index (RSI), which gauges the speed and magnitude of price movements in one direction, supports this perspective.

With a current reading of 40.28, it suggests that upward momentum could be gaining strength.

Source: TradingView

Growing bullish sentiment

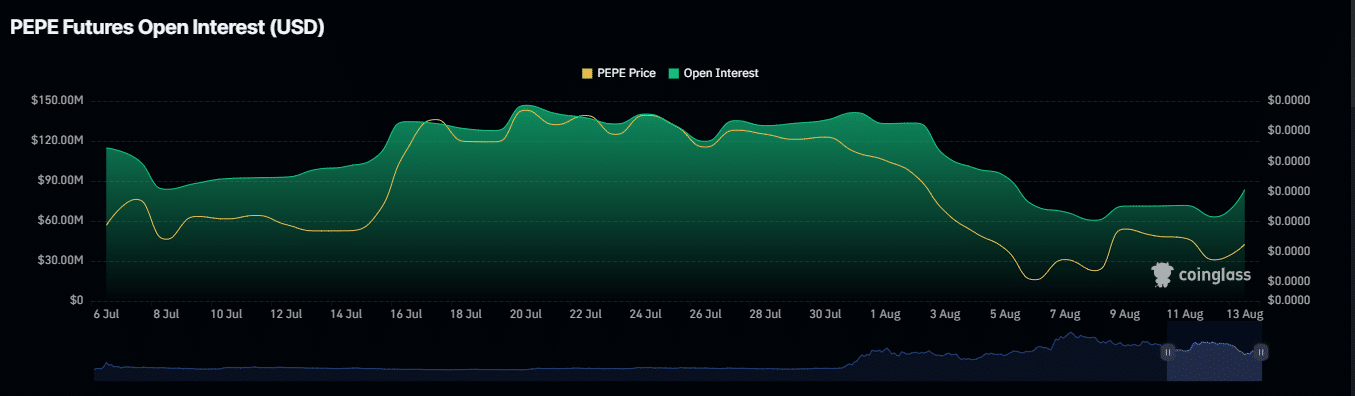

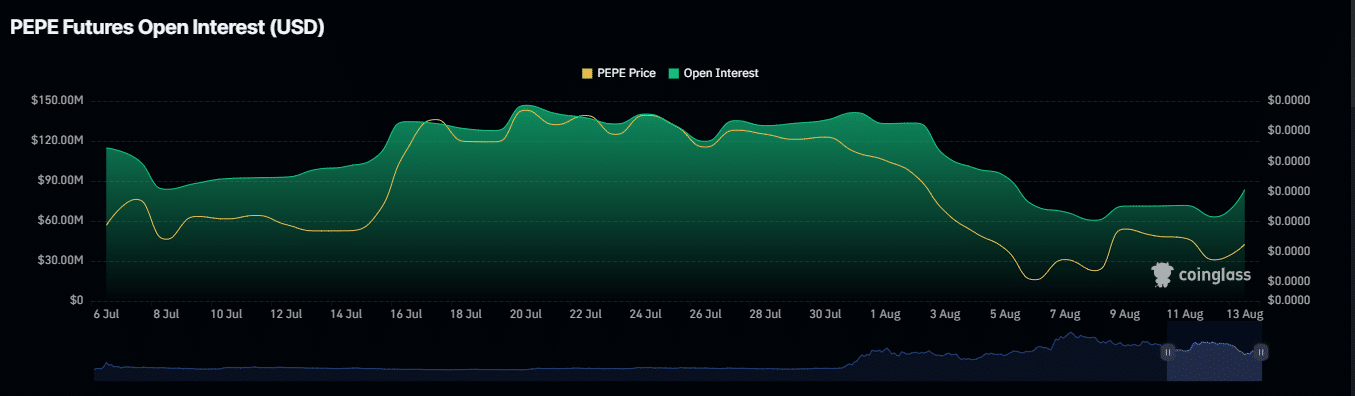

According to Coinglass, open interest in PEPE derivatives has reached a peak of $83.46 million, the highest level since August 6.

Source: Coinglass

High open interest indicates strong market engagement, which could significantly enhance PEPE’s price due to increased liquidity.

In summary, both the market structure and technical indicators suggest a promising future for PEPE, potentially leading its price to new highs in the near term.

This is an automatic translation of our English version.

- At the time of writing, PEPE was trading inside a descending triangle, suggesting a possible rally towards the $0.00001000 mark.

- The growing interest of buyers in PEPE was supported by multiple technical indicators.

Pepe [PEPE] failed to recover from the support level at $0.00000773 after a recent market crash triggered further declines.

However, it now appears poised for a rebound, trading within the same descending triangle and reacting positively from the support level it previously failed to break.

The question is, will this be enough of a catalyst to push the PEPE price higher in the short term? AMBCrypto is looking into whether this is possible.

Where can a descending triangle take PEPE?

A descending triangle indicates that the price of PEPE has been fluctuating between two levels: the upper and lower limits.

This pattern suggests that the market may rise and break the upper boundary, or continue to fall and break the lower boundary.

In the case of PEPE, the trajectory favors a bullish breakout. At the time of writing, it has bounced from the support level of $0.00000773 to $0.00000805.

If this level holds, it could push the price to the next resistance level at $0.00000895 and potentially the next one at $0.00001000.

Source: TradingView

If the support falters under bearish pressure, PEPE could find lower support levels at $0.00000702 or $0.00000585 more sustainable.

Bullish clues from technical indicators

Bollinger Bands, which consist of a moving average contained between two standard deviation lines, suggest that PEPE has been oversold.

This sets the stage for a possible rally towards the mid-band at $0.00000949 or even higher to $0.00001000.

Source: TradingView

The relative strength index (RSI), which measures the speed and magnitude of directional price movements, supports this view.

With a reading at the time of writing of 40.28, it indicated that momentum for an upward move could be building.

Source: TradingView

Bullish sentiment increases

According to Coinglass, open interest in PEPE derivatives has peaked at $83.46 million, the highest since August 6.

Source: Coinglass

High open interest indicates strong market participation, which could significantly boost the price of PEPE due to increased liquidity.

In summary, both the market structure and technical indicators point to a bullish future for PEPE, which could drive its price to new highs in the short term.

This is an automatic translation of our English version.