Ethereum co-founder Vitalik Buterin disposed of 17 billion Neiro that the project’s developers had transferred to him as part of an airdrop. This did not stop the meme coin’s value from not only recovering from a 60% decline but also reaching an all-time high (ATH).

Data: DEX Screener.

Data: DEX Screener.

The Ethereum co-founder’s wallet received 4% of the NEIRO emission, valued at approximately $130,000. Without prior notice, Buterin became the largest holder of the asset.

We are the people’s $Neuro on the people’s chain, @ethereum.

And a little fun fact: @VitalikButerin is currently our largest holder. (4% of supply, ~$130k value as of the time of this post)

— Neiro on Ethereum (CTO) (@neiroethcto) August 3, 2024

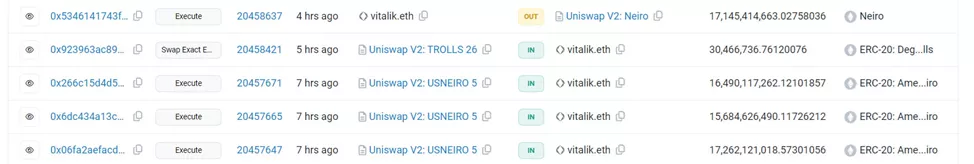

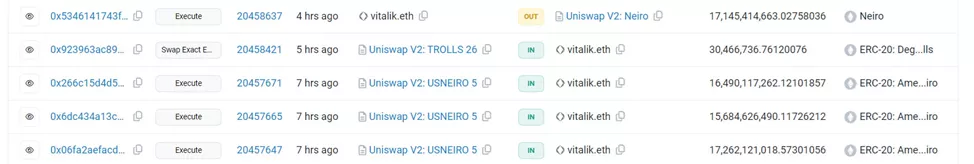

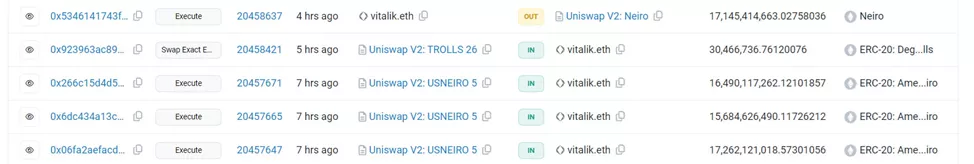

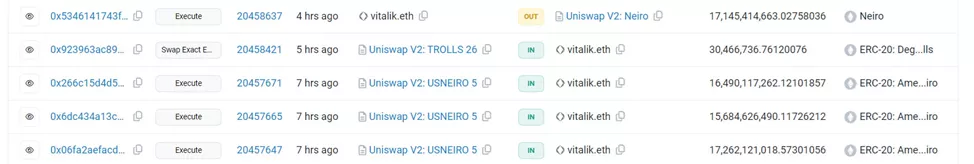

The Ethereum co-founder sold 17.1 billion NEIRO for 44.5 ETH, which was approximately $103,000 at that time.

Data: Etherscan.

Data: Etherscan.

In response, the project team requested Buterin to donate a portion of the proceeds to a shelter for homeless dogs.

Hey @VitalikButerin we see that you sold your $Neuro bag.

Our humble request is that you donate part of the proceeds to a shelter for stray dogs.

And thank you for building our playground!

— Neiro on Ethereum (CTO) (@neiroethcto) August 5, 2024

According to Cointelegraph, there are four different NEIRO tokens listed on CoinGecko, at least six variants on Uniswap, and even more possibly fraudulent accounts linked to Neiro on X. On July 29, the developer of the Solana-based version reportedly made a profit of $2.85 million from a rug pull, as recalled by the publication.

Let us remember that the lending platform Aave made $6 million in liquidations in just one day due to the collapse of the crypto market.

ForkLog discussed the reasons for the dump with experts and identified the conditions under which the major coins will begin to recover their prices. Read the full details in the article.

Follow ForkLog on social networks

Found a mistake in the text? Select it and press CTRL+ENTER

ForkLog newsletters: keep your finger on the pulse of the Bitcoin industry!

Ethereum co-founder Vitalik Buterin has made headlines once again by offloading a massive 17 billion NEIRO tokens, which had been transferred to him through an airdrop by developers. The intriguing twist is that despite this substantial sell-off, the meme coin not only recovered from a 60% initial drop but also surged to achieve a new all-time high (ATH). This unexpected market movement has left many investors and analysts eager to understand the implications.

Data: DEX Screener.

Vitalik Buterin and the NEIRO Surge

Buterin’s wallet received a staggering 4% of NEIRO’s total supply, valued at approximately $130,000 at the time. This windfall made him the largest single holder of the asset without prior knowledge of the airdrop’s massive implications.

We are the people’s $Neuro on the people’s chain, @ethereum. And a little fun fact: @VitalikButerin is currently our largest holder. (4% of supply, ~$130k value as of the time of this post)

— Neiro on Ethereum (CTO) (@neiroethcto) August 3, 2024

Once the initial excitement of the airdrop wore off, Buterin decided to sell 17.1 billion NEIRO, which converted into 44.5 ETH, valuing around $103,000 at the time of the transaction.

Data: Etherscan.

The Community Response

Following Buterin’s significant sell-off, the NEIRO project team tweeted a heartfelt request encouraging him to donate part of the proceeds to a local shelter for stray dogs. This move highlights how intertwined community and philanthropy are within the crypto space.

Hey @VitalikButerinwe see that you sold your $Neuro bag. Our humble ask is that you donate part of the proceeds to a stray dog shelter. And thank you for building our playground!

— Neiro on Ethereum (CTO) (@neiroethcto) August 5, 2024

Market Analysis

The NEIRO token, like many meme coins, has likely benefitted from speculative trading patterns. As of now, there are four different NEIRO tokens tracked on CoinGecko, with reports of various listings on platforms like Uniswap. This diversity has created confusion among potential investors, with some fraudulent projects masquerading as legitimate NEIRO tokens.

Additionally, the recent surge in NEIRO prices followed a broader trend in the cryptocurrency market, where some assets experienced dramatic recoveries after significant drops. Cointelegraph noted that the developer behind a Solana-based iteration of NEIRO profited $2.85 million due to a sudden price manipulation scheme, further complicating the ecosystem around this asset.

Community Sentiment and Future Prospects

Given the unpredictable nature of meme coins and the volatility of the cryptocurrency market, community sentiment plays a crucial role in the future price trajectory of NEIRO. With the impact of Buterin’s decisions reverberating through the market, many stakeholders are closely watching how NEIRO develops following this incident.

Expert Opinions

Industry experts emphasize the importance of due diligence when investing in meme coins. Understanding the dynamics of supply, community engagement, and external factors influencing market movements can help investors navigate this volatile landscape effectively.

Case Study: NEIRO’s Rapid Price Changes

| Time Period | Price Before Buterin’s Sell-Off | Price After Sell-Off |

|---|---|---|

| Pre-Sell-Off (Approx.) | $0.06 | $0.024 |

| Post-Sell-Off (Current) | Recovering from lows | $0.1 (ATH) |

This table illustrates how NEIRO prices reacted around Buterin’s transaction and the subsequent recovery. Investors need to remain informed of such fluctuations and analyze possible causes for price increases or decreases.

Practical Tips for Investors

- Stay Informed: Keep up with news related to Ethereum, Vitalik Buterin, and NEIRO tokens to anticipate market movements.

- Diversify: Consider diversifying your portfolio to mitigate risks associated with meme coin investments.

- Community Engagement: Participate in community discussions and follow project updates to gain insights and build networks.

- Research Thoroughly: Before committing to any token, conduct thorough research to distinguish between legitimate projects and potential scams.

The cryptocurrency market continues to evolve rapidly, and with it, opportunities and challenges for investors alike. As this landscape develops, staying informed and adaptable will prove invaluable for success in trading or investing in assets like NEIRO.

Follow ForkLog on social networks

Found a mistake in the text? Select it and press CTRL+ENTER

ForkLog newsletters: keep your finger on the pulse of the bitcoin industry!