Jerome Powell’s upcoming remarks are highly anticipated by investors as they seek clues regarding the Federal Reserve’s stance on interest rate cuts. In his last speech, Powell hinted at the likelihood of keeping borrowing costs high for a longer period, citing the lack of progress in reducing inflation and the persistent strength of the labor market.

The most recent price data suggests stubborn underlying inflation, and with expectations for a robust employment report, it is unlikely that Powell will deviate from his previous stance. After the rate decision on Wednesday, markets expect the Fed to hold borrowing costs at a high level. Rate reductions have been pushed further into 2024, and investors anticipate at most two cuts by year-end.

The monthly jobs report will also be in focus as it provides insights into the state of the US labor market. Economists anticipate a moderation in non-farm payrolls growth in April, but the pace remains strong, supported by stable, low unemployment.

Analysts from Bloomberg Economics predict that Powell will adopt a more hawkish stance, indicating that the median FOMC participant expects fewer rate cuts this year. They suggest that Powell might even hint at the possibility of no cuts or a potential hike, although the latter is not the current baseline expectation.

Looking internationally, Canada’s gross domestic product data for February may offer a slight boost to the economy, giving the Bank of Canada options to consider as it weighs the timing of any potential pivot to easier monetary policy.

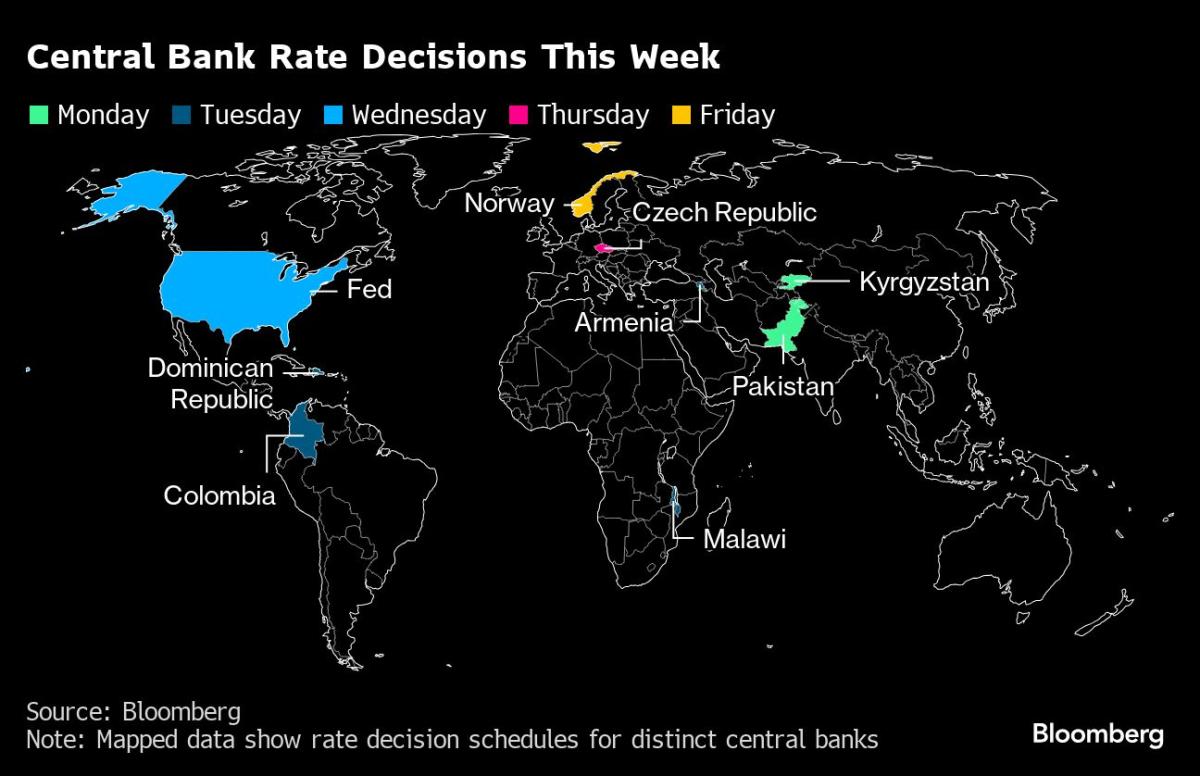

In euro-zone news, there are indications that inflation may have stopped slowing down, and the economy may be on a path to growth. Chinese surveys will shed light on the strength of expansion in the country. Furthermore, central banks in various countries, including Norway and Colombia, will announce rate decisions, while the Organization for Economic Cooperation and Development (OECD) will release new global forecasts.

Moving to Asia, China’s official purchasing manager index data will provide insights into whether manufacturing activity expanded for a second consecutive month in April. Several countries, including Australia, South Korea, Thailand, Sri Lanka, and Vietnam, will release trade figures, shedding light on global commerce trends.

Japan is expected to show a rebound in industrial output for March, alongside data on retail sales and the unemployment rate. South Korea’s consumer inflation data is projected to show a slight slowdown in price growth, yet remaining above the central bank’s target.

In Europe, data on inflation in the euro zone may reveal that the slowdown stalled in April, with consumer prices rising 2.4% compared to the previous year. Germany and Spain may exhibit faster inflation rates based on national data released on Monday. GDP numbers will also be published, with expectations of minimal growth in the first quarter following the shallow recession in late 2023.

Switzerland will provide consumer price data, which is expected to show inflation well below the central bank’s targeted ceiling of 2%. Inflation trends in Turkey will also be closely monitored, as investors await signs of slowing consumer-price growth.

Regionally, the Czech central bank is anticipated to cut borrowing costs, while Malawi and Norges Bank may raise and hold rates, respectively.

In Latin America, Mexico’s first-quarter flash output data is likely to show a slight contraction in the economy. Brazil will release a range of reports, including inflation figures, current account data, and industrial production numbers. Chile’s indicators, including retail sales, unemployment, industrial production, manufacturing, copper output, and GDP-proxy figures, will be released to gauge the strength of its economy. Peru’s inflation report is expected to show prices within the target range, but still above the 2% target. Colombia’s central bank is widely expected to continue its easing cycle with a second consecutive half-point cut, while also publishing its quarterly inflation report and monetary policy outlook.

As we observe and analyze these economic indicators and developments, several potential future trends and implications emerge. The global economy continues to recover from the impact of the pandemic, with central banks carefully considering the appropriate timing for policy adjustments. Inflation remains a key concern, as some countries experience stubborn price increases. However, the pace of growth and the strength of labor markets provide reasons for optimism.

Looking ahead, policymakers, investors, and businesses must monitor global trends and adapt accordingly. The potential for interest rate adjustments, inflation trajectories, and trade figures can significantly impact investment decisions and economic strategies. As uncertainties persist, it is crucial to consider both regional and global economic developments and devise strategies that account for potential shifts in these trends.

Overall, the interconnectedness of the global economy necessitates a comprehensive understanding of the factors driving economic growth and the implications for various industries. While challenges remain, embracing emerging trends and making informed decisions based on accurate and timely information will position businesses and individuals for success in an ever-evolving world.