Shares in Asia rose on Tuesday, with Hong Kong leading the gains, as optimism grew over strong profits expected to be announced by big tech leaders this week. The rebound in Asian markets followed Wall Street’s recovery from a $2 trillion selloff. UBS Group AG upgraded shares in China to overweight, citing resilient earnings despite concerns regarding the nation’s property and macro worries. Technology firms were the driving force behind Hong Kong’s market rise. Japanese shares also maintained their advance, even as the yen briefly strengthened once morest the dollar following Finance Minister Shunichi Suzuki’s warnings once morest excessive currency moves.

According to Dong Chen, chief Asia strategist at Banque Pictet, Asia is expected to see strong earnings growth compared to other markets. He highlighted India, South Korea, Taiwan, and China as countries that will lead the region’s earnings growth. Investors are eagerly waiting to see if earnings will meet the high expectations for artificial intelligence. This week, around 180 companies representing over 40% of the S&P 500 market value are due to report their results. The focus on earnings comes following a recent market downturn driven by geopolitical fears and signals from the Federal Reserve indicating no rush to lower rates.

Looking at the futures for US shares, they remained relatively unchanged following the S&P 500 halted its six-day rout, and the Nasdaq 100 rose 1%, driven by gains in big tech companies such as Nvidia Corp. Apple Inc. also received positive attention, being named a top pick for 2024 at Bank of America Corp. based on optimism over its upcoming results.

In the bond market, treasuries were steady in Asia ahead of a series of bond auctions that will test investors’ appetite following yields reached their highest level in 2024. On the other hand, Australian and New Zealand bonds advanced.

The dollar showed stability once morest major peers, providing relief to the region’s markets following its recent surge. Emerging market currencies also experienced gains, with a broader gauge rising in four out of five sessions following a 2024 low last week.

The Bank of Japan is expected to leave its benchmark interest rate unchanged this Friday. Investors will be closely watching for any hints of a less dovish tilt as the yen continues to trade at a 34-year low.

Another focal point in Asia is China’s role as a major lender to developing nations. A report suggests that the head of China’s central bank wants creditors engaged in debt restructurings to agree on how to fairly share the burden of relief.

In corporate news, Chinese bubble-tea maker Sichuan Baicha Baidao Industrial Co. saw its shares plunge more than 31% in its Hong Kong trading debut, highlighting the challenges the financial hub is facing in reviving investor confidence. Tianjin Construction shares also slumped 30% on their Hong Kong debut.

In the commodities market, gold extended its losses following experiencing its biggest daily decline in nearly two years. The decrease in tension in the Middle East, coupled with signs that the Federal Reserve will maintain higher rates for a longer period, has impacted demand. However, oil prices nudged higher as traders assessed the next steps between Israel and Iran, following signs of easing hostilities following a recent exchange of attacks.

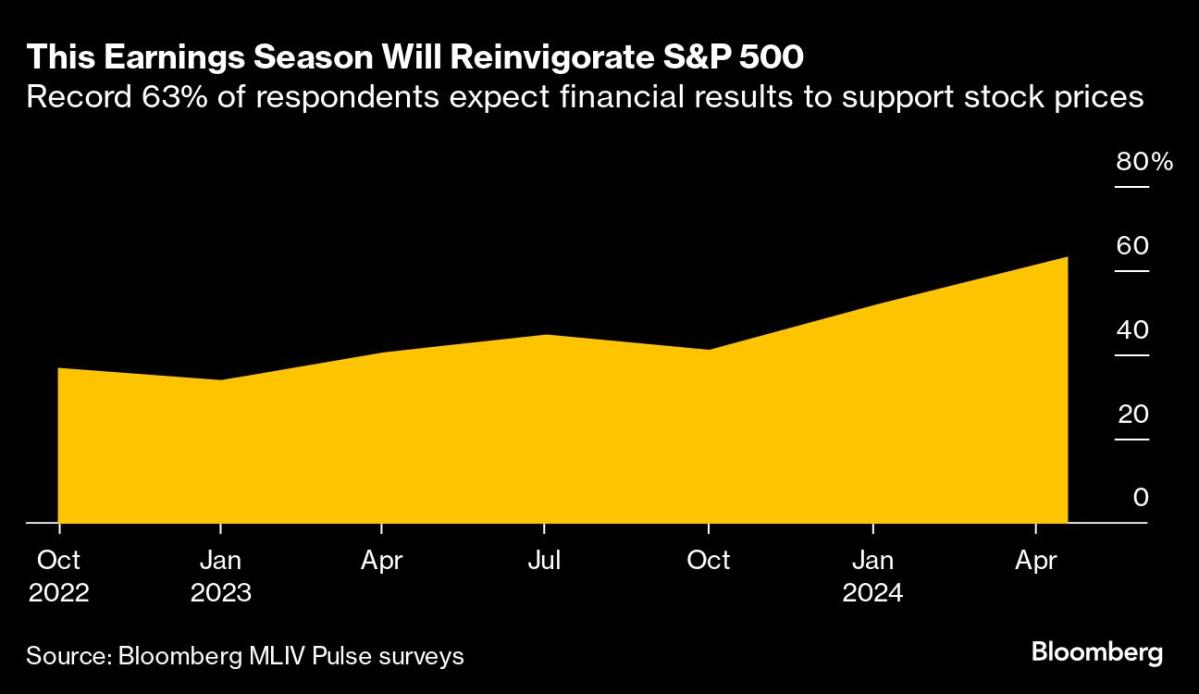

As the earnings season kicks off, Bloomberg’s Markets Live Pulse survey reveals that nearly two-thirds of respondents expect earnings to boost the US equity benchmark. This marks the highest vote of confidence for profits since the poll began asking the question in October 2022.

However, the challenge for S&P 500 returns this earnings season is for companies to produce earnings and outlooks that support the already elevated multiples, according to Megan Horneman at Verdence Capital Advisors. The so-called “Magnificent Seven” megacaps, including Microsoft Corp., Alphabet Inc., Meta Platforms Inc., and Tesla Inc., are expected to report their results this week, with profits forecasted to rise by nearly 40% compared to a year ago, as reported by Bloomberg Intelligence.

The key to future profits is seen to be artificial intelligence (AI), and its contributions to the earnings mix will be closely monitored. Traders are looking for insights into AI’s potential impact on profits. A team at Bank of America, including Ohsung Kwon and Savita Subramanian, emphasized the significance of AI for future earnings.

In terms of upcoming key events, this week will see the release of various economic indicators and earnings reports. Among them are Eurozone S&P Global Manufacturing and Services PMI, US new home sales, Tesla and PepsiCo earnings, Germany IFO business climate, the Bank of England chief economist’s speech, US durable goods data, IBM, Boeing, and Meta Platforms earnings, US GDP and jobless claims, Microsoft, Alphabet, Airbus earnings, Japan’s rate decision and economic forecasts, US personal income and spending figures, and Exxon Mobil and Chevron earnings.

Overall, the positive momentum in Asian markets, driven by anticipated strong earnings from big tech companies, is reflective of a broader trend. The focus on AI and its potential contributions to profits highlights its increasing importance in the business and investment landscape. As these trends continue to unfold, investors will need to closely monitor the performance and outlook of companies in this sector.

This article was generated by artificial intelligence.