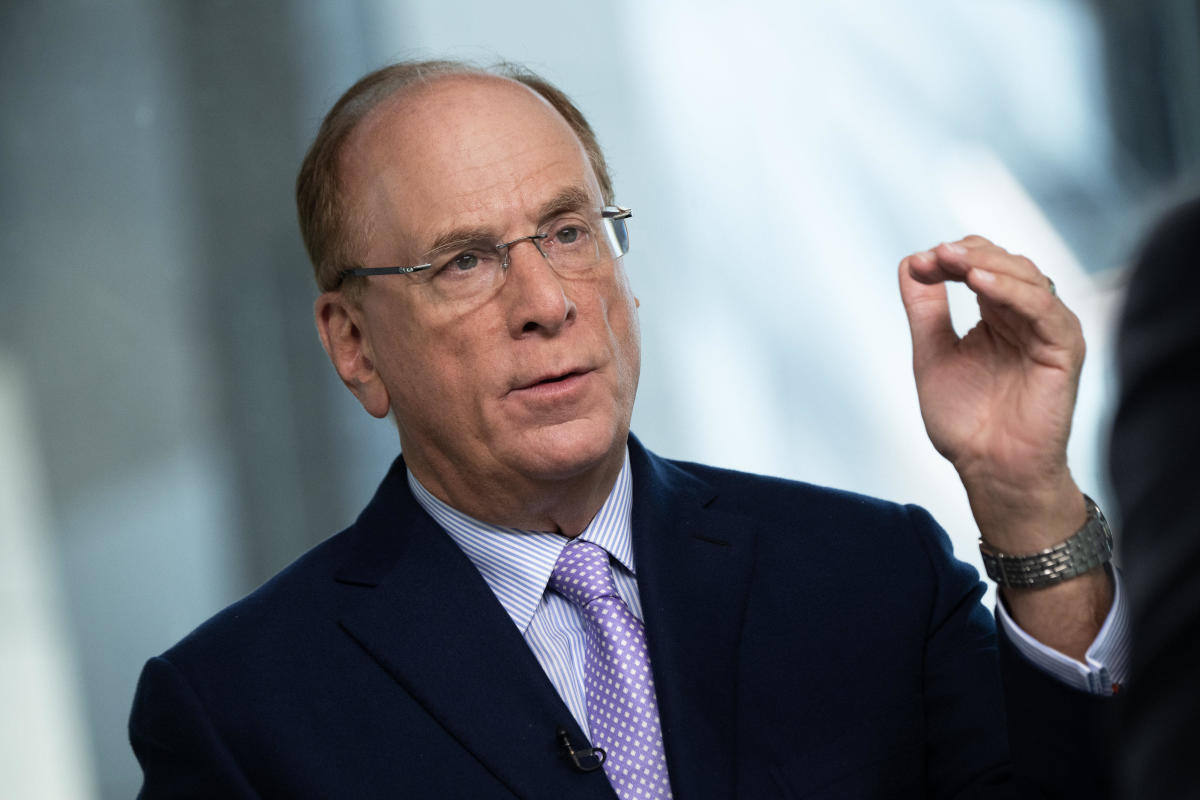

Americans are facing significant challenges when it comes to retirement. As our population ages, the strain on the U.S. retirement system is becoming more apparent. This is a concern that BlackRock CEO Larry Fink recently addressed in his annual shareholder letter.

In his letter, Fink suggests that one way to address the retirement crisis is for Americans to work longer before they retire. He questions the idea that the ideal retirement age is 65, pointing out that this concept originated during the time of the Ottoman Empire. Fink believes that the retirement age should be reevaluated given the significant changes in life expectancy over the years.

Fink notes that in the early 1950s, many 65-year-olds did not have the opportunity to retire because they had already passed away. This means that more than half of workers who had paid into Social Security never received any benefits. While it is a positive development that people are living longer, Fink warns that this demographic shift is putting immense strain on the country’s retirement system.

The future of Social Security is currently a topic of debate, especially in light of the funding shortfall that it is projected to face in less than a decade. Some Republican lawmakers have proposed raising the retirement age for claiming Social Security benefits, aligning with Fink’s view that as Americans live longer, they should also work longer. However, this viewpoint fails to consider the challenges that older workers face in the workplace, such as ageism and health issues.

Retirement expert Teresa Ghilarducci agrees with Fink that the retirement system is not working for most households. However, she disagrees with the notion that working longer is the solution. Many Americans have not been able to save for retirement, and relying solely on individuals to save for their old age has proven to be ineffective. Ghilarducci believes that working longer is not a viable option for most people, as they often do not retire when they want to anyway.

Fink’s comments on the retirement crisis are significant due to his position as the CEO of BlackRock, the world’s largest asset manager. His firm manages trillions of dollars, including many retirement accounts. It’s important to note that Fink’s suggestions, such as working longer, align with the interests of his company, as it would likely result in individuals accumulating more retirement assets.

Fink also highlights Australia’s retirement system as a success story. The country’s system, which began in the early 1990s, requires employers to contribute to a worker’s retirement fund. As a result, Australia now has one of the largest retirement systems in the world. Fink suggests that the U.S. should consider implementing similar automatic retirement investing options to help workers save for their future.

The future trends related to these themes are of great significance. As the retirement crisis intensifies, it is likely that policymakers will continue to explore options for reforming the retirement system. This might involve increasing the retirement age, expanding access to retirement plans, or exploring new models for retirement savings. Additionally, the rising cost of living and increasing healthcare expenses will have a significant impact on individuals’ ability to save for retirement.

Recommendations for the industry include encouraging employers to offer retirement plans and automatic enrollment, as well as providing financial literacy education to help individuals make informed decisions regarding their retirement savings. Policymakers should also focus on strengthening the Social Security system to ensure its long-term sustainability.

In conclusion, the U.S. retirement system is facing immense strain due to changing demographics and the challenges of inadequate retirement savings. BlackRock CEO Larry Fink suggests that Americans should consider working longer before retiring to alleviate this crisis. However, experts argue that this is not a viable solution for most people, as many face difficulties in the workplace and have not been able to save for retirement. The future of retirement will likely involve reforms to the system, such as increasing access to retirement plans and exploring new models for retirement savings. Policymakers and industry leaders must take action to address the pressing retirement crisis and ensure that Americans can retire with financial security.