After the US released data on the CPI consumer price index and inflation index, world gold continued to be sold off violently, the gold price lost the mark of 2,000 USD/ounce.

Gold price today February 14: World gold lost the 2,000 USD/ounce mark

Gold fell to around $1,992 an ounce on Tuesday, hitting a two-month low, following recently released US CPI data was stronger than expected.

Evolution of world gold prices. Source: Tradingeconomics

The US consumer price index increased 0.3% in January, while in December it was 0.2%. The published data was 0.2% higher than the consensus forecast. Headline inflation in the past 12 months also increased higher than expected, increasing by 3.1% while the previous forecast was only 2.9%. Meanwhile, the base interest rate remains stable at 3.9% despite forecasts to decrease to 3.7%.

Coupled with hawkish comments from officials, this breaking news has dampened hopes of an early interest rate cut from central banks, thereby increasing the opportunity cost of holding bullion.

Markets now see regarding a 40% chance of a rate cut in May compared with the 50% rate priced in at the beginning of the week.

Elsewhere, traders are continuing to monitor geopolitical developments in the Middle East since diplomatic talks in Beirut showed potential in easing Israel-Hamas tensions.

Amid plunging gold prices, Gabelli Gold Fund (GOLDX) Associate Portfolio Manager Chris Mancini said his bullish outlook for gold remains intact through 2024.

He added that while there are still doubts regarding the timing of the Federal Reserve’s easing cycle, the inevitable interest rate cuts this year mean it’s only a matter of time before gold prices start to move higher. time problem. Mancini believes that the central bank’s unprecedented demand for gold in recent times will cause gold to continue to increase in the new year. According to him, this is the best time to buy gold.

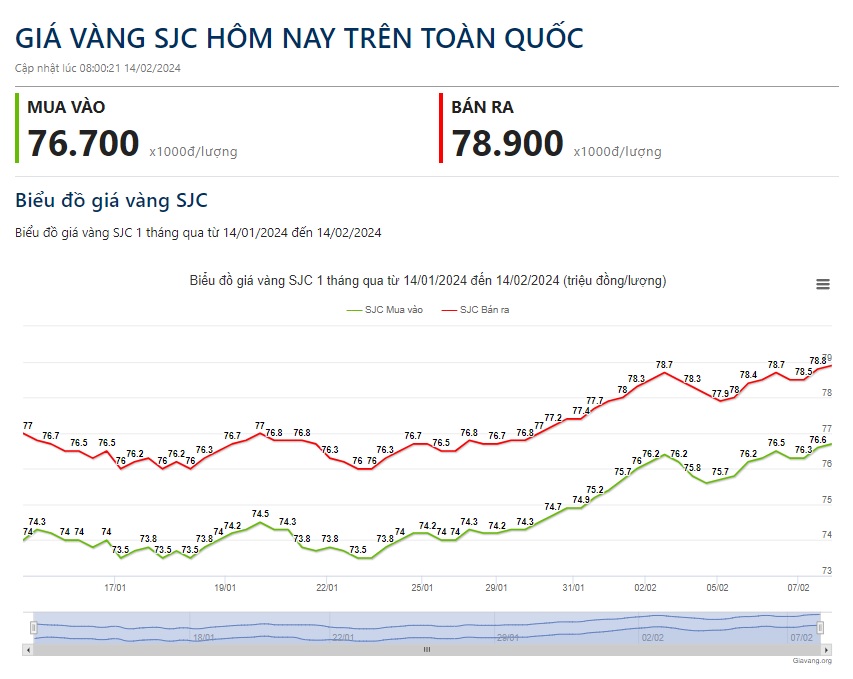

Gold price today February 14: SJC gold is still anchored at nearly 79 million VND/tael

This morning, February 14, SJC gold price nationwide was still anchored at nearly 79 million VND/tael. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 76.7 million VND/tael purchased and 78.92 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang but selling is 20,000 VND lower.

SJC gold bar price is currently listed by Phu Quy at 76.65 million VND/tael purchased and 78.9 million VND/tael sold.

PNJ brand is buying SJC gold at 76.7 million VND/tael and selling at 78.9 million VND/tael.

DOJI listed the price of SJC gold bars at 76.55 million VND/tael purchased and 78.85 million VND/tael sold.

The buying price and selling price of SJC gold listed by the Bao Tin Minh Chau brand are 76.75 million VND/tael and 78.85 million VND/tael, respectively.

The difference between domestic and world gold prices is regarding nearly 20 million VND.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael

| Area | System | Buy into | Sold out |

|---|---|---|---|

| City. Ho Chi Minh | SJC | 76.700 | 78.900 |

| PNJ | 72.500 | 75.200 | |

| Mi Hong | 77.000 | 78.000 | |

| Hanoi | SJC | 76.700 | 78.920 |

| PNJ | 72.500 | 75.200 | |

| Bao Tin Minh Chau | 76.550 | 78.650 | |

| wealth | 74.050 | 76.500 | |

| Danang | SJC | 76.700 | 78.920 |

| PNJ | 72.500 | 75.200 | |

| Nha Trang | SJC | 76.700 | 78.920 |

| Ca Mau | SJC | 76.700 | 78.920 |

| Hue | SJC | 76.670 | 78.920 |

| Bien Hoa | SJC | 76.700 | 78.900 |

| West | SJC | 76.700 | 78.900 |

| Quang Ngai | SJC | 76.700 | 78.900 |

| Bac Lieu | SJC | 76.700 | 78.920 |

| Ha Long | SJC | 76.680 | 78.920 |

| West | PNJ | 72.100 | 75.100 |

| Ben tre | Mi Hong | 77.000 | 78.000 |

| Tien Giang | Mi Hong | 77.000 | 78.000 |

| Updated at 08:00:21 February 14, 2024 | |||