At the 2024 Investment Strategy Report, AFA Capital experts provided analysis and forecasts regarding promising and interesting industry groups this year.

Information technology: Solid long-term prospects

According to AFA Capital, global IT spending maintains long-term growth. According to Gartner’s forecast, spending on the IT sector in 2024 will grow steadily at 8%, reaching 5.1 trillion USD.

According to IDC forecasts, the US will account for 35.8% of total DX spending worldwide by 2023, a spending ratio of 33.5%. Therefore, the prospects for IT businesses here are still great, especially FPT, which has the ability to compete in personnel costs and is expanding its penetration into these two markets.

Growth expectations in Asia – Pacific: These are potential markets with high economic growth rates. Besides, the demand for digital transformation remains positive, especially in Japan.

It is expected that the Vietnamese market has the potential to develop thanks to large space and fast growth rate. Vietnam’s data center market is forecast to grow to 1.04 billion USD in 2023, up from 561 million USD in 2022 and achieve a compound growth rate of 10.7%.

Textile industry: Going through the stormy season

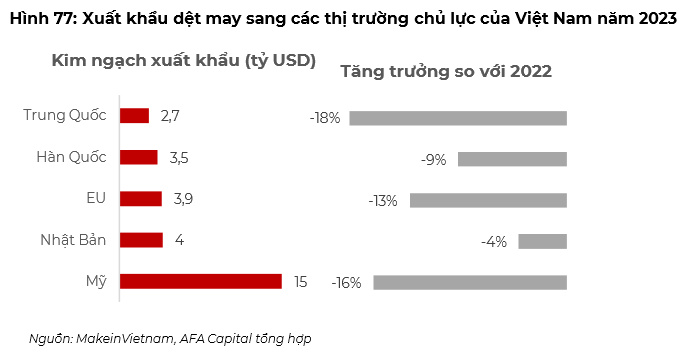

The main driving force comes from export markets, of which the US is the main market. Based on the prospect of world economic recovery and forecasts of Vietnam’s economic situation, Vitas has set a target for textile and garment export turnover in 2024 to reach 44 billion USD, an increase of 9.2% compared to 2023. AFA Capital It is expected that Christmas and New Year will release inventory, creating momentum for the industry next year.

Export prospects for the three markets EU, Korea, and Japan recover more slowly than the US market. Vietnam’s market share forecast in this market does not improve significantly, forecast to only reach regarding 9.7%, equivalent to 2023.

Besides the bright forecasts, AFA Capital offers risks to keep in mind:

Vietnam is gradually losing its competitive advantage from cheap labor when competing with a number of other competitors such as Cambodia, Bangladesh,… According to a report by the Vietnam Chamber of Commerce and Industry (VCCI), the cost Vietnam’s textile and garment industry workers in 2023 will be at 280 USD/month, including wages and other allowances.

Vietnam has not taken full advantage of incentives from the EU-Vietnam Free Trade Agreement (EVFTA) to increase competitiveness. Specifically, Vietnamese businesses face limitations in their ability to meet EVFTA’s fabric origin standards.

Fishery industry: Recovery from the bottom

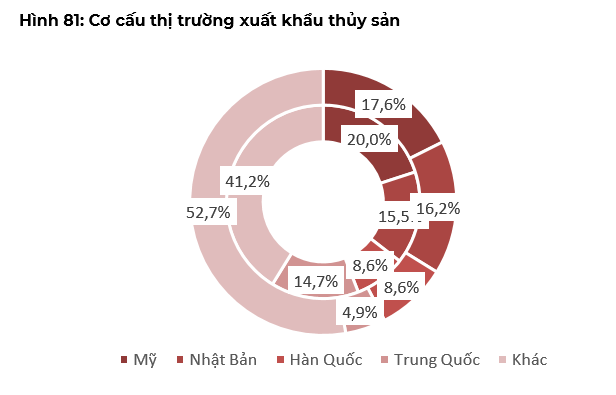

According to AFA Capital, reduced inventories promote pangasius exports. For the pangasius industry, it is forecast that inflation in main markets such as China and the US will cool down along with reduced inventories, which will promote consumption demand to recover from 2H2024.

Demand recovery in the US market supports the industry’s export revenue. It is expected that pangasius demand in the US will recover from the second quarter of 2024. The reason is that pangasius has average competitiveness compared to other aquatic species in this market.

Demand in the Chinese market recovered. Based on forecasts that the spending ability of Chinese consumers will improve thanks to the support policies of the Chinese Government, AFA Capital Pangasius demand in China is expected to recover positively from the second half of 2024.

Risks to note:

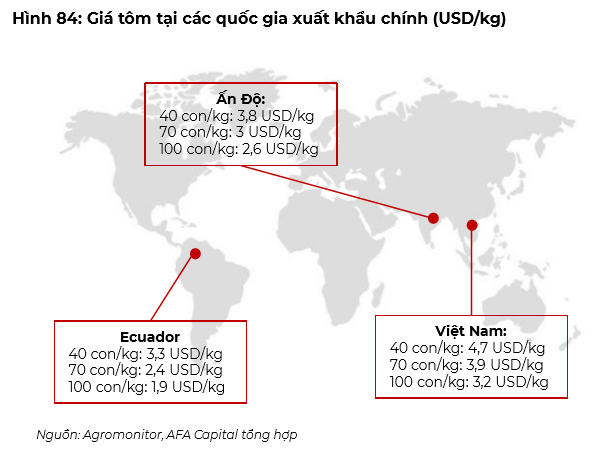

Shrimp supply tightens: According to forecasts, shrimp supply from large countries such as Vietnam, Ecuador, and India will begin to decline in the first half of 2024 because Ecuador is facing a crisis of low prices while costs increase, in addition to Meanwhile, India is applying farming in stages due to concerns regarding oversupply.

Pangasius exports are under competitive pressure: Many countries are investing and expanding pangasius farming areas, threatening Vietnam’s position as the world’s largest pangasius exporter. Besides the favorable factors from the Chinese market, this market also has challenges, especially fierce competition from pangasius suppliers from other countries such as Indonesia, India, Thailand, …

Steel industry: The domestic market is the main driving force

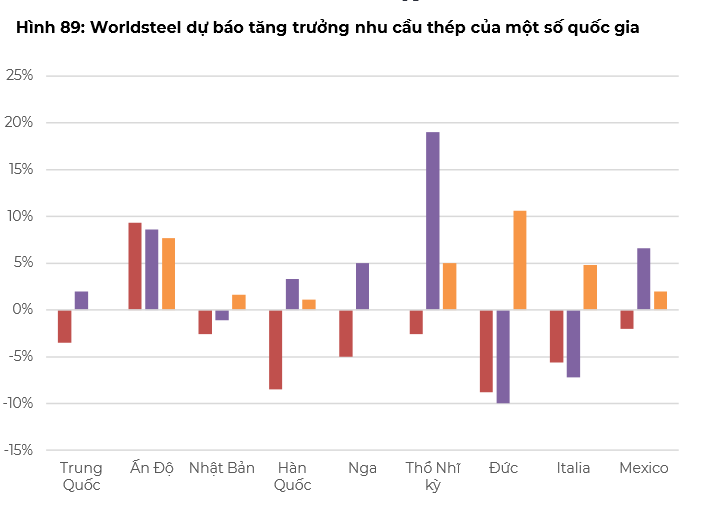

The low difference between domestic and Chinese steel prices will help the domestic steel industry avoid competition from Chinese steel imported into Vietnam. Currently, the difference between domestic and Chinese steel is at 30 – 35 USD/ton (lower than the average of 50 USD/ton).

The recovery of apartment supply will positively impact domestic construction steel demand.

Iron ore and coking coal prices are expected to decrease in 2024. According to the World Bank, iron ore prices in 2024 are expected to be at 108 USD/ton; down 11% compared to the expected level of 121.3 USD/ton in 2023. The average export price of Australian coking coal (FOB price) for the whole year is expected to be only 190 USD/ton; plummeted for the second consecutive year and down 24.0% compared to the expected level of 250 USD/ton in 2023.

However, there are risks from the Chinese Real Estate market. China’s real estate sector has not shown signs of warming up in the context of excess supply becoming a serious problem hindering recovery.

In addition, the EU’s carbon border adjustment mechanism (CBAM) might create long-term challenges for steel exports. The EU announces Implementing Regulation (EU) 2023/1773 regarding the obligation to report the purpose of the carbon border adjustment mechanism (CBAM) during the transition period, effective from September 16, 2023.

Infrastructure investment: Key industry

Real estate market: One of the reasons slowing down the progress of public investment projects and affecting the rate of capital disbursement is due to problems in compensation and site clearance. In addition, other related reasons such as updating, reviewing, and announcing construction material prices and construction price indexes do not promptly reflect market changes, fuel prices, and construction materials. increased, increasing costs for businesses, negatively affecting construction investment; High interest rates at the beginning of the year caused contractors to slow down.

Availability of debt capital:

The Ministry of Finance has just issued document No. 14447/BTC-DT reporting to the Prime Minister on the 11-month accumulated state budget investment capital payment situation, estimated to implement the 12-month plan in 2023.

According to the report, regarding disbursement of planned capital in 2023: Estimated payment from the beginning of the year to December 31, 2023 is 579,848.8 billion VND, reaching 73.5% of the plan (reaching 81.87% of the plan assigned by the Prime Minister), ( the same period in 2022 reached 67.27% of the plan and 75.11% of the plan assigned by the Prime Minister). Of which the socio-economic recovery and development program is 72,686 billion VND (reaching 56.1% of the plan assigned by the Prime Minister).

Number of newly signed projects:

With large public investment projects that have been and are being implemented such as the North-South expressway, Long Thanh airport, North-South high-speed train and especially expanding the construction and completion of Ring roads in the southern provinces, it will helping the infrastructure construction industry receive positive expectations.

Important national projects and projects in the Transport sector are mentioned in Decision 884/QD-TTg in 2022, Decision 1316/QD-TTg in 2022, Decision 347/QD-TTg in 2022. 2023 and Decision 817/QD-TTg in 2023.

Retail industry: Long-term potential

Currently, although the scale of Vietnamese e-commerce is still small, it is estimated that by 2022, the scale of retail e-commerce transactions will only account for regarding 8.5% of total retail sales of goods and consumer service revenue. use. In 2023, it will account for regarding 7.8-8%.

Vietnam’s e-commerce scale will reach 16.4 billion USD in 2022, 20.5 billion USD in 2023 and is expected to reach regarding 32 billion USD in 2025. This is equivalent to a growth rate of 25%/year. Data Lab’s forecasts that Vietnam will increase 8 places in the top 30 largest consumer markets in the world this decade and account for 1.1% of the world’s consumer class population by 2030.

According to research by Mordor Intelligence, Vietnam’s retail market is forecast to witness a compound annual growth rate (CAGR) for the period 2023-2028 reaching 12.05%, regarding 2 times the growth rate. Estimated GDP for the same period. The forecast growth rate of Vietnam’s retail industry in the next 5 years far exceeds that of East Asian, Southeast Asian markets and the world’s average growth rate.

In 2024, AFA Capital It is expected that tax incentives will continue to be implemented to stimulate the economy. However, the impact is no longer too great and it will be time to stop these incentives to ensure budget revenue.

When tax incentives stop, it will have a less positive short-term impact on the retail industry. 2, Chain operating costs including labor and logistics costs are expected to fluctuate slightly and be relatively stable in 2024. Oil price factors, which are logistics input costs, will impact freight rates. changes and affects the retail industry, this is a risk factor if oil prices fluctuate in 2024.