Political tensions along with the move to increase gold purchases by central banks around the world are pushing gold prices up. Meanwhile, domestically, people’s shopping needs near Tet also boosted gold prices.

Gold price today February 1: World gold increased slightly following the FOMC meeting

World gold prices continued to increase during Wednesday’s trading session in the United States, following the somewhat “hawkish” statement just announced by the FOMC. At the time of the survey, world gold was trading at 2,041 USD/ounce, up 0.2% on the day but still 0.91% lower on the month.

Evolution of world gold prices. Source: Tradingeconomics

The Federal Reserve’s just-concluded Open Market Committee meeting issued a statement keeping interest rates unchanged but said that there will not be any rate cuts until the Fed has “great confidence”. more” in terms of annual inflation, the target is moving towards 2%. The statement also said the US economy is growing at a “solid” pace. Traders considered the statement a bit hawkish and are now awaiting a press conference from Fed Chairman Jerome Powell.

Traders begin focusing on this Friday morning’s US monthly jobs report from the Department of Labor.

The World Gold Council reports that global central banks are continuing to purchase and accumulate gold in 2023 and will continue to do so in 2024. According to WGC statistics, the total amount of gold purchased by banks Central purchases in 2023 are 1,037 tons. Thus, the central bank has nearly doubled its average gold purchases over the past 10 years.

China’s central bank is the largest buyer with 225 tons in 2023. Meanwhile, the National Bank of Poland was the second largest buyer of gold last year, buying 130 tons and increasing its gold holdings. holding increased to 57%.

Risk aversion remained high mid-week following the Iranian-backed Houthi drone attack on US troops in Jordan.

The major external markets today saw a weaker US dollar index. Nymex crude oil prices are lower and trading around $76.00 a barrel. Meanwhile, the benchmark 10-year US Treasury bond yield is currently at 3.982% and down from earlier in the day. This information all supports gold prices to increase.

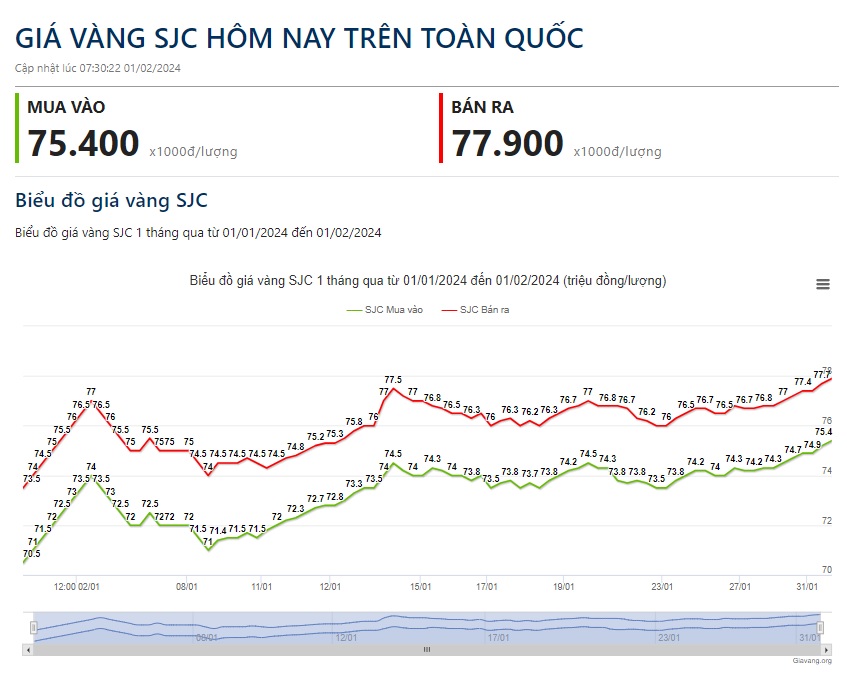

Gold price today February 1: SJC gold is approaching the mark of 78 million VND/tael

Domestic gold price continued to increase sharply to nearly 78 million VND/tael. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 75.4 million VND/tael purchased and 77.92 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang areas but selling is 20,000 VND lower. Thus, compared to yesterday morning, the price of SJC gold bars has been adjusted to increase by 500,000 VND in both directions.

Meanwhile, the price of SJC gold bars was listed by Phu Quy at 75.4 million VND/tael purchased and 77.8 million VND/tael sold, an increase of 500,000 VND on the buying side and 450,000 VND on the selling side.

SJC gold bars were bought by PNJ brand at 75.4 million VND/tael and sold at 77.9 million VND/tael, an increase of 500,000 VND in both directions compared to yesterday morning.

At DOJI, SJC gold bars have been adjusted to increase by 400,000 VND on the buying side and 500,000 VND on the selling side to 72.25 million VND/buy amount and 77.85 million VND/sell amount, respectively.

Meanwhile, at Bao Tin Minh Chau brand, the buying and selling prices of SJC gold bars are 75.45 million VND/tael and 77.8 million VND/tael, respectively, an increase of 500,000 VND in both directions.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael