There has been no bond issuance in January 2024

According to a report by the Vietnam Bond Market Association (VBMA) compiled from HNX and SSC, as of the information announcement date January 19, 2024, there are currently no corporate bond issuances recorded in 2024. In December 2023, there will be 83 private issuances with a total value of more than 65,680 billion VND. These issuances have an average interest rate of 7.4%/year, with an average term of 6 years.

In 2023, the total value of corporate bond issuance is recorded at VND 333,988 billion, with 29 public issuances worth VND 37,070 billion (accounting for 11.1% of the total issuance value) and 316 issuances to the public. individual issuance worth VND 296,917 billion (accounting for 88.9% of the total).

Corporate bond redemption value and issuance value by industry group

According to VMBA, businesses bought back 4,290 billion VND of bonds in January. The total value of bonds bought back by businesses before maturity in 2023 reached 248,880 billion VND, an increase of 8.2% over the same period last year. 2022 and equivalent to 74.5% of issuance value. Banks are the leading industry group, accounting for 51.5% of the total value of pre-mature repurchases (equivalent to VND 128,159 billion).

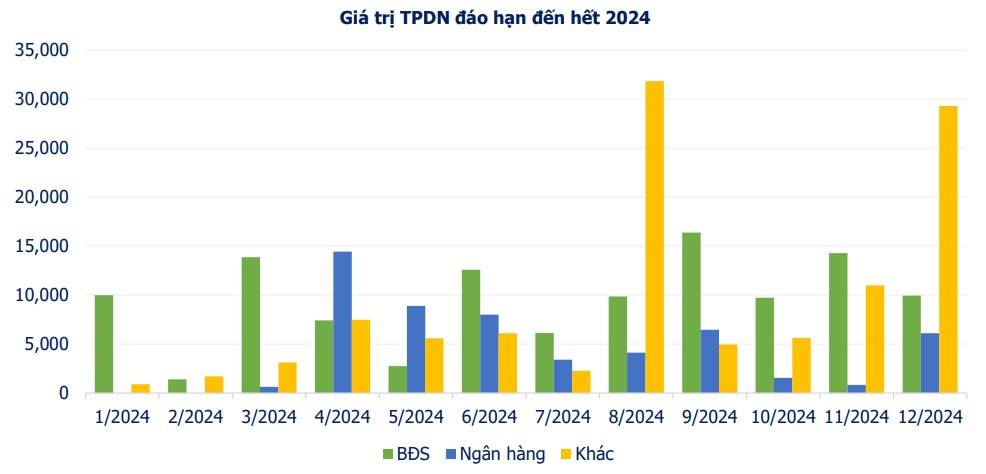

In the remainder of 2024, the total bond value will mature at VND 278,863 billion. 41% of the upcoming bond value belongs to the Real Estate group with nearly 114,403 billion VND, followed by the Banking group with nearly 54,497 billion VND (accounting for 20%).

Value of corporate bonds maturing until the end of 2024

In the near future, there will be two notable private bond issuances from Ban Viet Commercial Joint Stock Bank (BVBank) and Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank):

Ban Viet Commercial Joint Stock Bank (BVBank) approved a plan to issue individual bonds in 2024 with a maximum total value of VND 5,600 billion, expected to be divided into 6 issuances. This is a non-convertible bond, without warrants, with collateral, par value of 100,000 VND/bond, maximum term of 8 years and fixed interest rate of 8%/year.

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) approved a bond issuance plan with a maximum total issuance value of 3,000 billion VND, maximum term of 6 years. Interest rates are floating and will be specifically announced at the time of issuance.

Besides, regarding the primary bond marketon January 17, 2024, the State Treasury called for bids for a total of VND 8,250 billion in Government bonds, with terms of 5 years (1,500 billion), 10 years (3,000 billion), 15 years (3,000 billion) , and 30 years (750 billion).

From the beginning of 2024 to January 17, the State Treasury has mobilized 9,258 billion VND in Government bonds with terms from 5 years to 30 years, reaching regarding 7.29% of the plan to issue 127,000 billion VND in the first quarter. .

Next week (January 22 – January 26), the State Treasury will call for bids for 8,500 billion VND of Government bonds, with terms of 5 years (2,000 billion), 10 years (2,000 billion), 15 years (2,000 billion). ), 20 years (1,000 billion) and 30 years (1,500 billion).

About the secondary bond market, secondary market transaction value reached VND 43,253 billion, of which the average daily outright transaction value decreased by 13.5% compared to last week, the average resale transaction value (repo) 5% off per day. Foreign investors bought a net of 321 billion VND in government bonds during the period. The average yield of government bonds at VBMA’s transaction office decreased compared to last week for terms from 1-7 years, and increased slightly for longer terms such as 10-30 years.