Facing positive economic data, world gold prices traded stably on the first day of the week, while domestic SJC gold “evaporated” by 700,000 VND/tael.

Gold price today January 23: World gold is stable

World gold prices stabilized around 2,030 USD/ounce on Monday as investors no longer placed large bets ahead of monetary policy decisions in Japan and Europe announced this week.

In the US, fourth-quarter GDP data and the Fed’s preferred PCE inflation figures will be released this week, ahead of next week’s Federal Reserve policy meeting. The precious metal lost regarding 1% last week as the dollar and Treasury yields rebounded thanks to stronger-than-expected U.S. economic data and hawkish signals from Fed officials that tempered the decline. Expectations of an interest rate cut in March.

According to CME’s FedWatch Tool, markets now see a 47% chance the Fed will cut interest rates in March, down significantly from 81% a week ago.

Gold prices are being held back by the US dollar, while weak physical silver demand might be offset by a return to investment demand, according to the latest precious metals report from analysts at Heraeus.

Analysts point to USD strength as the main factor driving precious metal prices down last week. Gold price is trading at 2,021.3 USD at the time of writing.

Evolution of world gold prices. Source: Tradingeconomics

“It’s been a disappointing start to the year for precious metals investors, many of whom had predicted a strong industry-wide recovery in 2024. But the dollar’s recovery has been remarkable. from the end of December continues to put downward pressure on prices. We will see if this changes in the coming weeks and months,” said David Morrison, senior market analyst at Trade Nation.

Analysts at TDS say that for gold to find its footing, the market needs to see weaker economic data. “Only weaker US data is likely to convince the Fed to lean towards dovishness. This implies that gold’s target of $2,200 as we predicted is unlikely to be achieved this quarter.”

Despite the headwinds, some analysts continue to see upside potential in precious metals. In recent comments to Kitco News, James Stanley, senior market analyst at Forex.com, said that gold price action is creating more losses for bearish investors. He noted that the strong selling pressure has been met with strong buying: “A lot of bait has been set for the sellers to chase, and that will be followed by a big upward move.”

Nicky Shiels, head of metals strategy at MKS PAMP, said negative market sentiment is creating asymmetric risks for gold. Meanwhile, some analysts believe that geopolitical instability, due to the ongoing chaos in the Middle East and concerns regarding an economic recession, will continue to support gold prices in the long term.

Gold price today January 23: Domestic gold “plunges”

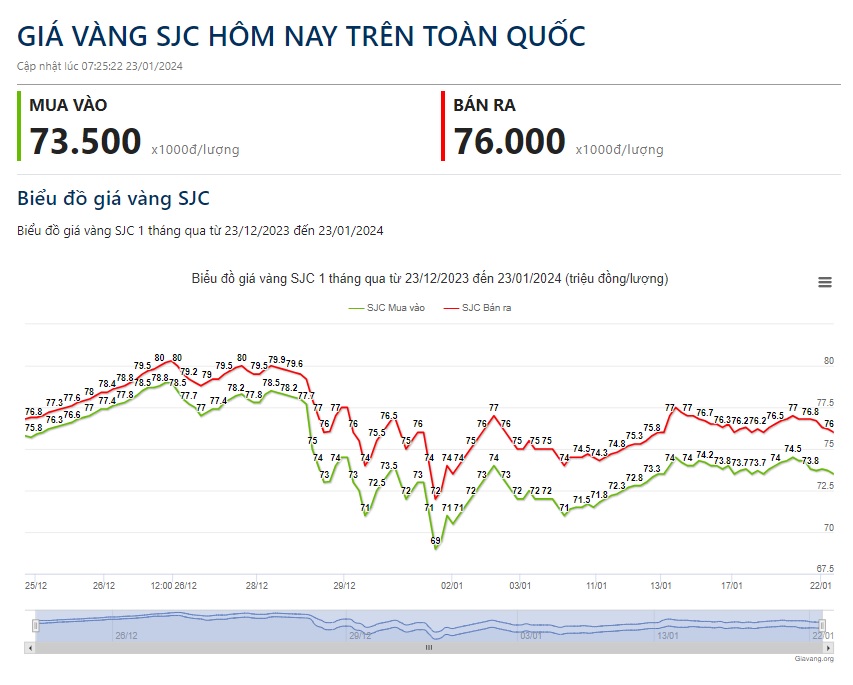

Recorded at 7:30 a.m. this morning, January 23, the domestic SJC gold price dropped sharply to around 76 million VND/tael. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 73.5 million VND/tael purchased and 76.02 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang areas but selling is 20,000 VND lower. Thus, compared to yesterday morning, SJC gold price has been adjusted down by 200,000 VND in the buying followingnoon and 700,000 VND in the selling followingnoon.

Bao Tin Minh Chau is currently buying and selling at 73.55 million VND/tael and 75.85 million VND/tael, respectively, down 450,000 VND on the buying side and 650,000 VND on the selling side compared to yesterday morning.

SJC gold bars are currently being purchased by Phu Quy at the price of 73.5 million VND/tael and sold at 75.9 million VND/tael, down 500,000 VND on the buying side and 650,000 VND on the selling side.

PNJ listed PNJ gold at 73.5 million VND/tael purchased and 76 million VND/tael sold, a decrease of 800,000 VND in buying price and 900,000 VND in selling price.

The difference between domestic and world gold prices has been shortened to regarding 16 million VND/tael.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael