2024-01-20 17:01:41

Although the 3D printer market as a whole remained under pressure in the third quarter of 2023, there are indeed growth segments and manufacturers that are doing well. In terms of market segments, the growth is in entry level 3D printers, in which Bambu Lab is growing strongly; at the technology level, the DED segment is growing. The Spanish Meltio is now the market leader in this segment.

These are some conclusions from CONTEXT’s new market analysis. “While the adversity was reflected in the broader global market, there were also opportunities and glimpses of strength in some 3D printer segments, especially in the often overlooked entry-level part of the market,” said Chris Connery, global VP of analysis at CONTEXT.

Lower capital costs might help the 3D printer market grow once more later this year

Merger plans can revive once more

Manufacturers of 3D printers continue to struggle with reluctance to invest, driven by higher interest rates. As a result, many AM companies, especially listed ones, are shifting their focus from sales numbers to increasing profitability. The necessary rounds of layoffs have been announced. And companies are looking for partners to collaborate with, which is not always successful. “While it may appear that the market has calmed down following the very public merger failures of 2023, many companies have openly stated that they are exploring more private strategic alternatives, meaning sales, mergers, acquisitions and divestitures might still be on the horizon, ” commented Chris Connery. Nano Dimension’s renewed bid for Stratasys is an example of this. Other companies – such as BigRep – have announced they will go public this year. “An additional area ripe for investment is the entry-level category, as more and more companies recognize this recently overlooked category.”

Companies see that entry level 3D printers offer similar functionality

Entry level machines cut the legs of more expensive 3D printers

Because the entry level segment has grown in Q3 of 2023. This concerns 3D printers with a price tag under $2,500. The number of printers sold increased by 9% in Q3. According to CONTEXT This is mainly due to cannibalization of the more expensive Professional systems. End users in many industries – including dental, automotive, medical and healthcare, aerospace, jewelry and consumer products – are increasingly recognizing that they can get similar functionality with much cheaper models. So these printers are no longer reserved for hobbyists and general consumers, the market analyst said. The Chinese Creality stands head and shoulders above the rest here; Bambu Lab also managed to gain market share.

Good enough solutions

As Chris Connery already outlined, the growth in entry-level models is partly at the expense of the Professional segment, 3D printers in the price range up to regarding $20,000. Here, 41% fewer printers were sold in the third quarter, the sixth consecutive quarter in which sales fell. The analyst believes that market leaders UltiMaker and Formlabs in particular are confronted with the changing attitude of customers. They have been able to charge higher prices for years by offering more functionalities. However, in these inflationary times, demand has clearly shifted to “good enough” solutions found in the entry-level price range. With the exception of newcomer Nexa3D, every vendor of professional printers saw shipments of such products decline by double digits year-over-year in the period.

Significant shrinkage of the Midrange segment without these two successes

This also applies to the Midrange systems ($20k to 100k). Here sales fell by 5%. According to Connery, this shrinkage would have been even greater if Formlabs had not achieved good sales results with the Fuse 1. The same applies to the strong growth in sales of DLP/LCD 3D printers, especially by Union Tech, to Chinese customers. Without these two white ravens, the segment would have shrunk by 17%. Stratasys has seen sales in the Midrange segment decline by 17%; 3D Systems with 28% and Markforged even with 33%.

Meltio market leader in DED systems

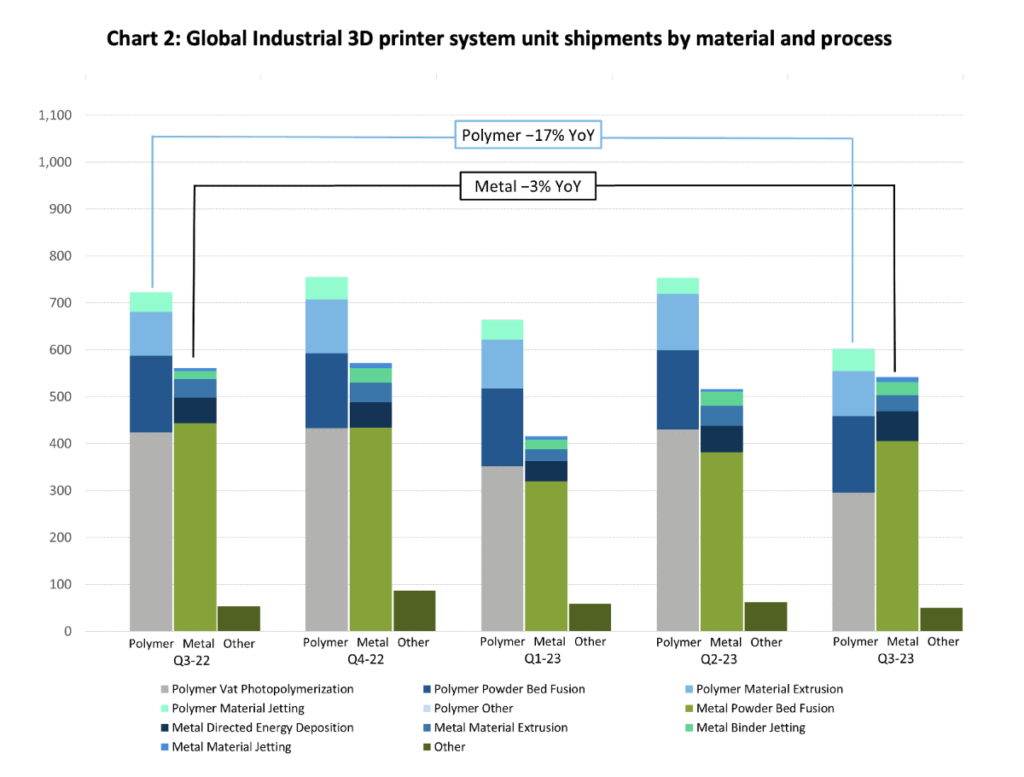

The high-end Industrial segment will also see sales decline in the third quarter on an annual basis. Industrial 3D metal printers sold 3% less; mainly caused by 9% fewer laser powder bed systems being sold. In China, sales fell by 8%; in the US by 6%. Because prices have risen due to inflation and more high-quality multilaser systems have been sold, manufacturers saw their turnover increase by 8%. However, there is a technique that is quite strong: Direct Energy Deposition (DED). This market segment has grown. And Meltio became the market leader in Q3. Another segment that saw an increase in the number of 3D printers sold is polymer powder bed systems. EOS saw strong year-on-year growth in this segment. Stratasys saw sales of plastic 3D printers grow by 11%.

Growth acceleration at the end of 2024 and in 2025?

Are the prospects bad now? Chris Connery is not pessimistic regarding the medium term. According to him, the market is ready for a recovery in the coming years. In the short term, the market for industrial systems will remain stagnant because borrowing money is not yet becoming cheaper. Chris Connery: “Fears of regional recessions have largely subsided and the fundamental value of additive manufacturing is being recognized across all sectors, paving the way for accelerated growth as capital costs decline in the second half of the year and into 2025.”

Photo: the DED market is growing. A newcomer in this segment is Makino, which presented the AML 500 at Formnext.

URL Copied

1705791373

#Companies #discovering #good #entry #level #printers

:quality(80)/cdn-kiosk-api.telegraaf.nl/5f9a547e-c1df-11ef-9e5b-12d34ffe7c36.jpg)