2023-11-09 01:09:14

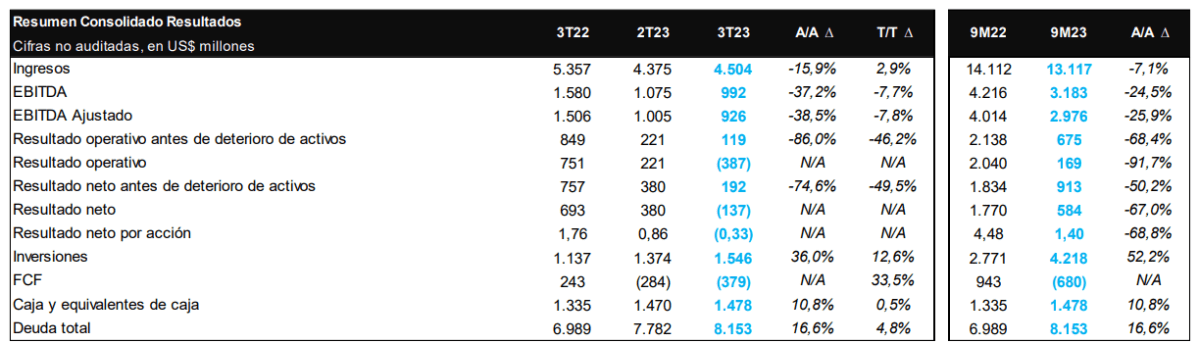

The majority state oil company, YPF, presented this followingnoon the balance of its last quarter of operations, in which although a high level of investments in the Vaca Muerta fields that allowed it to increase its production by 1% compared to the mid-year balance, the impact of The freezing of fuel in an inflationary context took its toll and the oil company ended up losing 137 million dollars.

According to the document presented on the closing hours of the Buenos Aires Stock Exchange, the company managed to close the quarter that runs from June to August with a adjusted EBITDA, that is, a balance of income before taxes of 926 million dollars, 8% less than the last balance.

In this quarter, the operator marked a level of income of 4,504 million dollars, which is 15.9% lower than the value it had reached in the same period last year. This drop in income led to, with an investment plan that was maintained -reached 4,000 million dollars in the first nine months of the year- the net result of the balance sheet was negative, for 137 million dollars. And he also scored a free cash flow also negative of $379 million.

This value marks a clear ccontrast with what happened not only in the previous quarter when the net result had been a profit of 380 million dollars, but especially with the same quarter last year when the profit had been 697 million dollars. At this point in the year, the interannual comparison is the most correct, given that it is the period in which winter gas sales are recorded.

Furthermore, the quarter reflects an increase in the level of total debt of the flag oil company that went from 7,782 million dollars in the previous quarter to 8,153 in this balance, thus adding 371 million in three months. And he also had a impairment of assets for 506 million dollars in the gas segment.

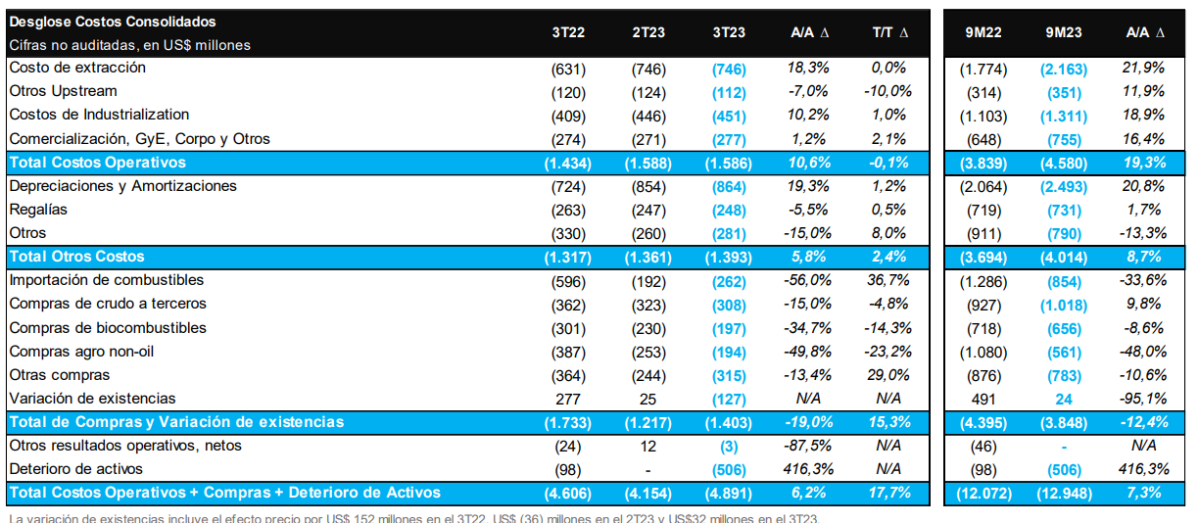

As noted, the result of the fuel sales They were the key. In the case of diesel, which represents almost 35% of the company’s income, YPF recorded a drop of 4.6% in monetary terms compared to the previous quarter, but not because of a lower sales volume, but because the price fell by 6.5%, since in terms of shipments, they rose by 2% in the quarter.

In the case of the oil The panorama was similar. The sales in volume rose 4.8% compared to the last quarter but in monetary terms they fell 1%, since prices showed a drop of 5.6% (measured in dollars).

While a highlight is in the fuel import and stocks, that is, the fuel collected and ready to sell. In the first case, YPF indicated that in the quarter only diesel imported and although they are 7.5% higher in volumes than last quarter, if compared with the same cut in 2022, it is observed that they actually decreased considerably, 56%.

While stocks not only fell 19% in the quartermarking where part of the largest volume of fuel sold came from, but rather They went to negative values, indicated in the balance sheet as -127 million dollars.

«In relation to our inventories, during the Third Quarter of 2023 sand recorded a negative inventory variation of US$ 127 million, driven mainly by lower inventories of gasoline and diesel, partially offset by higher replacement costs for our inventories; compared to a positive inventory variation of US$ 25 million during 2Q23,” the firm indicated.

Precisely, in the previous balance sheet, inventories totaled 25 million dollars and were already in a strong contraction, since In the third quarter of last year they totaled 277 million dollars.

Part of these higher costs were offset by a lower purchase of oil from other companieswhich dropped a 0.9% and volumes due to the maintenance stoppage of two refineries, and in monetary terms even more marked, 4.8% compared to the previous quarter due to the 5.6% drop in the price of oil that was agreed together with the fuel freeze.

More income from gas and exports

In the case of natural gas there was good news. TBoth revenues and volumes rose, in the first case 20.3% and in quantity 8.1% thanks to the price difference contemplated for winter gas.

The continuity of exports, especially those of oil to Chile through the Trasandino Pipeline, were beneficial since marked an increase of 21.6%. «Medanito crude oil exports continued to grow during the quarter, averaging almost 19,000 barrels per day representing a 8% of total crude oil production and 13% of Medanito crude oil production,” the firm indicated.

YPF had a total hydrocarbon production that averaged 520,000 barrels of oil equivalent, with an increase of 1% compared to the previous quarter, and 3% year-on-year, especially driven by a 5% expansion in the oil segment.

The specific production of Vaca Muerta shale oil continued to record notable growth of 20% year-on-yearl, although with a slight quarter-on-quarter decrease of 3%, while shale gas production increased by 6%.

These volumes were the result of an investment that reached 1,546 million dollars in the quarter, 13% more than in the previous balance and 36% than in the same period last year.

1699498346

#Due #freezing #fuels #YPF #presented #balance #sheet #losses #US137 #million