2023-10-10 10:11:52

Three economists look at the budget drawn up by the federal government. The combination of measures does not appeal to them. “Cronyism”, “deception”, “short term”, we hear.

On Monday, the federal government agreed on the 2024 budget, with a total effort of 1.7 billion euros, i.e. an improvement in the budget balance of 1.2 billion euros and 500 million allocated to new policies. With the measures taken previouslyan effort of 4.8 billion is made for next year, making it possible to reduce the budget deficit to 2.9% of gross domestic product (GDP).

The economists we interviewed were more than doubtful regarding the preparation of this budget.

Waiting for…

“There are no big surprises. The big discussions are still to come,” summarizes Giuseppe Paganoprofessor of economics at UMons. “It’s a transition budget, end of cycle.”

“A budget is annual, therefore we don’t have to have a long-term vision every time“, agrees this specialist in Belgian public finances. “We will have to wait for the next government. Depending on its composition and the constraints imposed by Europe, it will have to determine how to significantly reduce debt and at what pace. “

“For public finances, we need jobs that contribute to the PPI and social security.”

Philippe Defeyt

Economist (IDD)

The problems of flexijobs

The two big pieces of this budgetary composition are the flexijobs and the tax on the big Belgian banks.

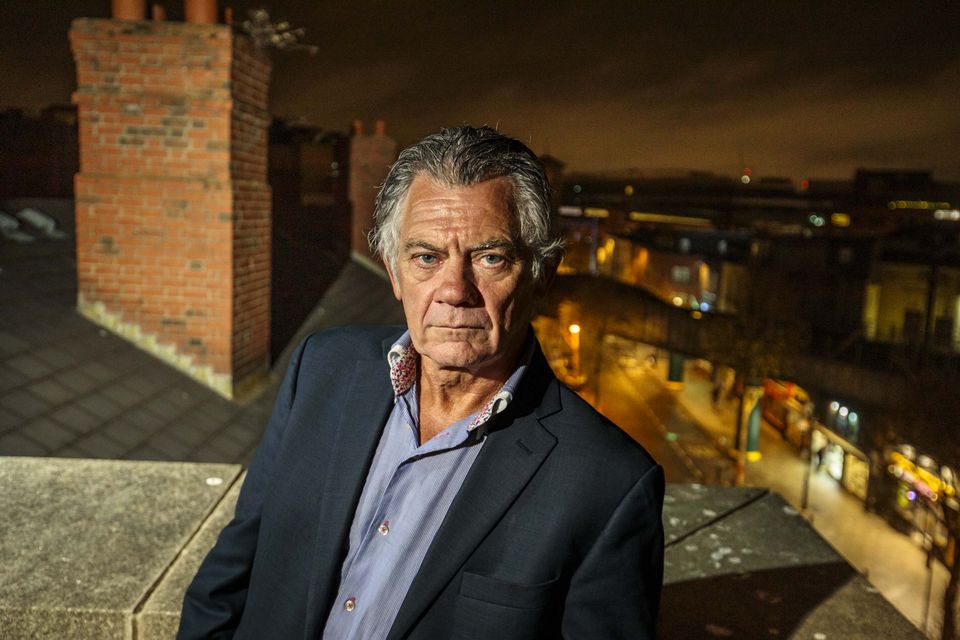

“We are witnessing a new complexitywhile we are told that we want to simplify everything”, grumbles Stephen of Callataÿ (Orcadia). Examples? The economist aligns them. “We are told regarding flexijobs extended, but not to all sectors. Sectoral scales will be applied, but not in the hospitality industry. For what? Is a job in the hospitality industry better or worse than in a taxi company?

The Economist Philippe Defeyt (Institute for Sustainable Development) also says it is furious regarding this measure. “The more we create this type of job, the more we impoverish social security. This will create a problem in the long term. We want to reach an employment rate of 80%, but the recipes do not follow. It’s good for the restaurateur who can make a pensioner work on Saturday evening, otherwise he wouldn’t have found help… But for public finances, we need jobs that contribute to the PPI and social security. Et It is not with flexijobs that we are going to solve the shortage problem.”

“Why discriminate once morest the big banks? This looks like cronyism!”

Stephen of Callataÿ

Economist (Orcadia)

Demolition-reconstruction and big banks

Stephen of Callataÿ further highlights the complexity around VAT maintained at 6% for demolition-reconstruction. “Only for homes of less than 200 m², with cellar and attic, for a first owner, etc. We will have to hire an army of controllers! And it’s the kind of gift that has never shown its effectiveness . Generally, it is the intermediary who puts the money in his pocket.”

The bank tax does not escape criticism. “We are launching a progressive ‘thing’ for the big banks, but why discriminate once morest the big banks? It looks like cronyism!”, gets angry with the Orcadia economist.

“We have to get used to the idea that we will not escape additional taxes because the State has enormous needs.”

Giuseppe Pagano

Professor specializing in Belgian public finances (UMons)

“The simple citizen”

“What we wanted was to spare the ordinary citizen,” explained Alexia Bertrand (Open Vld), the Secretary of State for the Budget. Successful? “The government has chosen not to hit the average citizen, or voter, but it is a choice in a transitional government without much (r)evolution“, judge Giuseppe Pagano.

According to him, “we must come to terms with the idea thatwe will not escape additional taxes because the State has enormous needs, for aging, security, urgent aid, hospitality, training, defense with the war in Ukraine and now in Israel…”

Stephen of Callatäy criticizes the Secretary of State’s formula. “We are made to believe in magic. If we tax businesses, do we believe that we are not taxing the citizen? And we are delighted to reach the 3% deficit, but we remain among the worst performers. We should hurry up and get things back on track!”

The Orcadia economist still points to a “Magritte world”. The distribution between a third of revenue, a third of expenses and a third dedicated to “Others” particularly makes him tick. “The ‘Others’ category is no effort! And who can believe that if Belfius transfer a dividenddoes this improve Belgium’s balance sheet situation? It’s deception. The State is the shareholder. If you sell your house for 200,000 euros, you are not any richer following the operation!”

“We should have taken environmental measures, there are none.”

Stephen of Callataÿ

Economist (Orcadia)

What is missing?

“We should have taken environmental measures, there are none,” points out Étienne de Callataÿ. Gold, Belgium is one of the countries that taxes pollution the least. I would also have hoped for serious measures to strengthen tax and social fraud. There is no real desire to take on companies that cheat.”

1696933822

#Federal #budget #magic #Étienne #Callataÿ