2023-06-07 10:37:55

The Minister of Economy, Sergio Massa, announced that in the first installment of the bonusthe complementary annual salary, the gross salaries of up to $880 thousand will be exempt from Income Tax. The measure will benefit more than 8,000 workers from Río Negro, and more than 29,000 Neuquinos.

In this sense, the Draft Decree that increases the exemption of subparagraph z of article 26 of the Income Tax Law implies that Christmas bonuses, or complementary annual salaries, will be exempt from income tax if the monthly remuneration of the worker does not exceeds $880 thousand gross, which is equivalent to 10 times the Minimum Vital and Mobile Salary.

This is a one-time extraordinary benefit for the bonuses of workers who pay income tax, with the aim of rebuilding purchasing power and projecting that this improvement in pocket wages translates into greater consumption and economic activity.

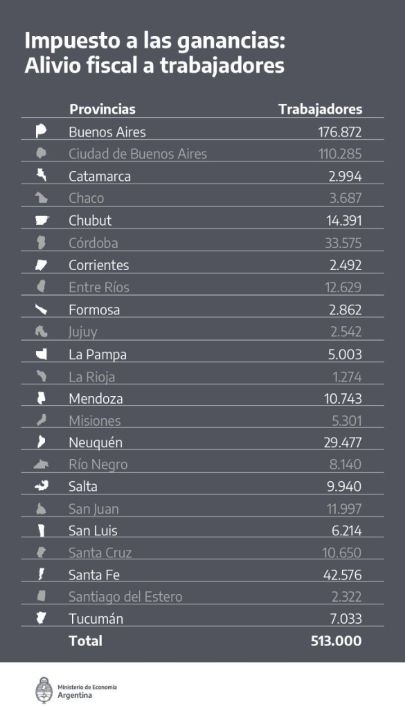

The measure benefits 513,000 workers throughout the country who are subject to income tax withholdings and register monthly gross wages of between $506,230 and $880,000. In this sense, more than 50% of the workers who today pay the Income Tax are reached by the benefit on the Christmas bonus.

The measure announced by Massa implies an average out-of-pocket improvement per employee of more than $110,000 ($112,600), and an increase over the average out-of-pocket monthly salary of 26%.

In the case of the bonus, the tax withholding is calculated month by month. For this reason, the measure proposes to return the amount withheld for these salaries in two equal and consecutive monthly installments, together with the collection of the monthly remunerations accrued in the months of June and July. For this, employers must display the return in a separate line of the salary receipt, clearly identifying the benefit of the measure.

1686134699

#Christmas #bonuses #pay #Income #Tax #limit #amount #wages