2023-05-15 14:16:18

The new coin issuances of the past ten years alone might fill a couple of seasons of a Netflix series: millionaires who came out of nothing, defrauded investors, cyber attacks, and a lot of twists and turns would characterize the production. Two analysts at Visual Capitalist looked at CoinKickoff data to find out what happened to these new coins.

When the Bitcoin network was launched in 2009, BTC was an abstract economic concept that required serious technical knowledge to use. The early Bitcoin believers were often weird freaks whose world view and vision didn’t necessarily agree with each other, so as BTC became more and more popular, the BTC community slowly began to fall apart. Bitcoin forks and new blockchains appeared, and over the years less and less technical knowledge was required to issue a new coin. While in the first half of the 2010s it was a huge challenge to create a new cryptocurrency, since the launch of Ethereum in 2015, almost anyone can have their own token.

On the one hand, this technical development made many old cryptocurrencies obsolete, and on the other hand, it gave many new projects the opportunity to be born. This transformation is also clearly shown in the figure below, which shows how many tokens ran aground in a given year. Scams are marked with blue, useless or joke coins with yellow, failed ICOs with purple, and tokens that are no longer used by anyone or have extremely low trading volume:

Source: CoinKickoff

According to the research, a total of 2,383 coins were minted between 2013 and 2022. Of these, 1,584 (66.5%) fell into the category of unused, low-traffic tokens, 22% were due to fraud, and 10% failed to In the framework of an ICO bring the project to market.

Unsurprisingly, following the great crypto frenzy of 2017, 2018 was the year with the most victims, as 751 failed coins were counted from this year. At that time, among other things, BitConnect scam is memorable unveiling, and with the year bringing a massive BTC decline, it’s no wonder that investors simply let go of many of the fledgling new cryptocurrencies. The air around the founders of many projects ran out, and following a few months the activity stopped completely. More than half of the hundreds of coins put into circulation in 2017 will be “bankrupt” by the end of 2022.

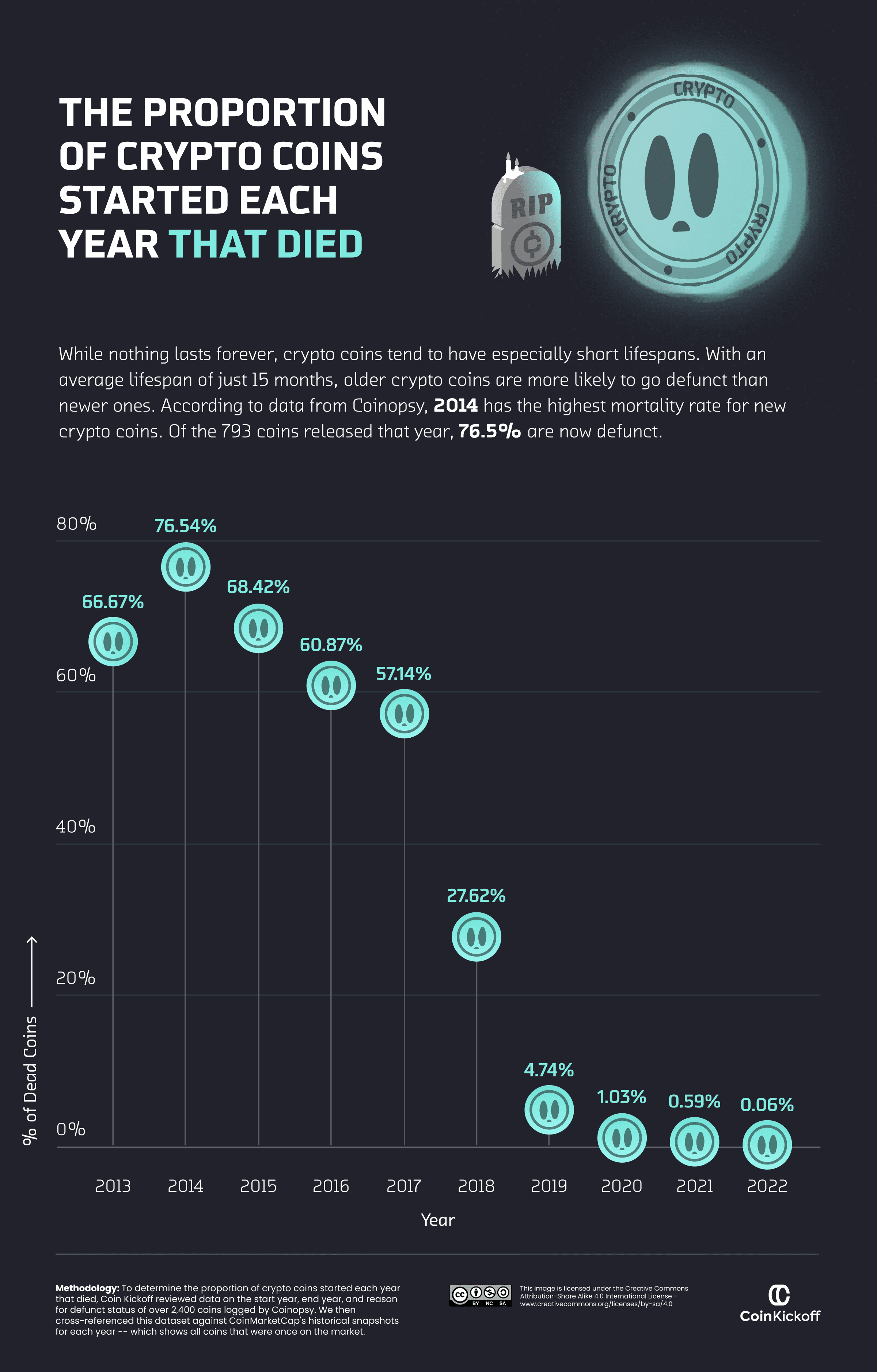

The figure below shows what percentage of new cryptocurrencies launched in a given year can be considered defunct by the end of 2022:

Source: CoinKickoff

Partly due to the research methodology, and partly due to the characteristics of the market, the chance of survival of cryptos increased amazingly following 2018. After the trend reversal in 2018, in 2019 and 2020 the failure rate decreased first to 4.74% and then to 1.03%, and since then it has been below 1%. It is hard to imagine that the number of new issuances on death row will continue to decrease with the birth of a lot of meme coins for Uniswap and Pancakeswap, but it is certain that as the market reaches an increasingly mature status, the chances of spectacular failures also decrease.

Article source: Visual Capitalist

1684164468

#true #cryptocurrencies #doomed #birth