2023-04-21 15:54:50

Posted Apr 21, 2023, 5:11 PMUpdated on Apr 21, 2023, 5:54 PM

A few hours following the validation of the bulk of the text by the Constitutional Council, the unpopular new reform of the pay-as-you-go pension system, with its flagship measure raising the retirement age from 62 to 64, was promulgated on April 15, 2023 in the “Official Journal”.

A highly symbolic reform, deemed “brutal, unfair and unjustified” by the eight main French unions, which caused the biggest mobilizations in the street for decades in metropolises such as sub-prefectures and strikes with strong disruption.

This project was unveiled on January 10, 2023 by the Prime Minister, Elisabeth Borne, following a few months of consultations with the social partners and political forces. It plans to raise the legal retirement age to 64 in 2030 and D’accelerate the extension of the contribution period to 43 years from 2027 (i.e. also one more quarter per year). But no one will have to work for more than 44 years. And the age of the end of the haircut will remain at 67 years.

officials like the agents of the special regimes will have to work two more years. Although the extinction of special diets (EDF, RATP) will only concern future recruits.

Elisabeth Borne, January 10, 2023, during the presentation of the reform project.Bertrand Guay/AP/GIRL

To soften these painful parametric adjustments, the executive had put forward “justice” decisions: a reorganized so-called “long career” mechanism and the possibility for certain professions – soldiers, active categories of the public service, caregivers to the hospital… – to continue to “leave earlier”. Still, these devices did not prevent threshold effects for those who started working early… Threshold effects on which the Prime Minister agreed during the debate in the Assembly to make concessions.

Au social progress component, Elisabeth Borne had highlighted the increase in the contributory minimum for a full career to 85% of the minimum wage (i.e. 1,200 euros gross per month), from September. This will concern people who are going to retire and also those who are already there.

The executive had decided to go quickly. The reform, presented to the Council of Ministers on January 23, was examined in Parliament in February and March via an amending social security financing billa flexible legislative vehicle that allowed it to limit debates over time.

On March 16, 2023, Elisabeth Borne at the rostrum of the Assembly announced, under the boos of the benches of the left, to trigger article 49.3 of the Constitution and to engage the responsibility of her government to have the reform project validated without a vote. retreats.Jacques Witt/SIPA

After weeks of fierce debates and negotiations under high tension, the Joint Joint Committee (CMP) which brought together deputies and senators on March 15 agreed on a common text. The Senate confirmed its positive vote on March 16, which left little doubt. On the other hand, the executive not being certain of having a majority in the Assembly, Elisabeth Borne resolved to draw article 49.3 of the Constitution which allows adoption without a vote. The two motions of censure tabled once morest the government having been rejected – one with only 9 votes – the reform is definitively adopted.

A sign of great tension, the Constitutional Council was under guard on April 14. Any demonstration near its headquarters, located in a discreet wing of the Royal Palace, was prohibited.Gabrielle Cezard/GIRL

The reform then passed the decisive milestone of the Constitutional Council, which validated most of the text on April 14. Unsurprisingly, the institution censured several “social riders” who “had no place” in a law of a financial nature. Among these: the index on the employment of seniors which was to be compulsory from this year for companies with more than 1,000 employees. Also censored, the CDI seniors, an addition of right-wing senators, which was to facilitate the hiring of long-term job seekers, over 60 years old.

Emmanuel Macron, during his speech to the French on April 17.Romuald Meigneux/SIPA

A few hours following this validation, Emmanuel Macron promulgated the law. “The planned developments […] will come into force gradually from this fall,” he said in a televised address on April 17.

The head of the procession with union leaders during the April 13 demonstration once morest the pension reform.Chang Martin / SIPA

But for the unions united in an unprecedented inter-union, the fight is not over. After three months of mobilization deemed “historic”, they call on employees to make Monday May 1 an “exceptional and popular day of mobilization once morest pension reform and for social justice”. They are also counting on the second request for a shared initiative referendum – on which the Constitutional Council, which refused the first, must decide on May 3.

“We will also see whether it is necessary to challenge the implementing decrees before the administrative judge. And we will be vigilant on the implementation of the measures, which promises to be complicated on a concrete level for the people who will liquidate their pension from the autumn, under the new rules”, indicated Laurent Berger, the secretary general. of the CFDT.

—————————-

MAIN MEASURES:

—————————-

Overview of the main measures provided for in the amended Social Security financing law for 2023, which reforms the pay-as-you-go pension system.

The legal retirement age raised to 64 years, the contribution period set at 43 years earlier than planned

Getty Images

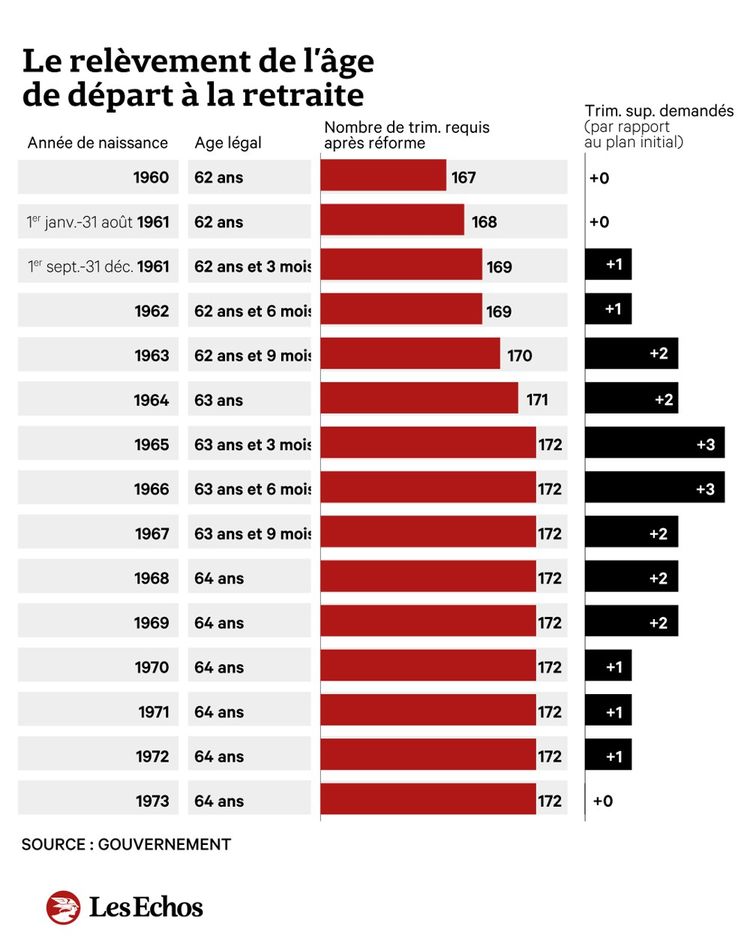

the legal age of departure will be postponed from September 1, 2023. The shift will be at the rate of three months per year of birth to bring the legal age to 63 years and 3 months at the end of the five-year term then to 64 years by 2030.

The duration of contributions required to benefit from a full pension, which was to increase from 42 to 43 years (172 quarters) by 2035, will finally reach this target in 2027. People born in the second part of year 1961 constitute the first generation concerned.

Important points, the starting age at the full rate is set at 62 years for disabled people and the age for cancellation of the discount remains unchanged at 67 years.

An extra charge for mothers

Shutterstock

The reform plans to apply a premium for mothers who have contributed as many quarters as necessary to have a full pension at age 63, but who must wait another year to be able to retire. This premium may reach 5% and is reserved for people in the public and private sectors who have obtained at least one quarter of increase for maternity, adoption or child rearing.

This measure is supposed to cushion the shock of the postponement of the legal age which will cause many mothers to lose a large part of the benefit of the quarters acquired in respect of maternity.

Small revalued pensions

HJBC/Shutterstock

The government will increase the value of small pensions. The idea is to raise the minimum pension to 85% of net minimum wage (around 1,200 euros) for people who have had a full career and have worked full time. People retiring in September 2023 and having a small pension will be able to see it increased to 100 euros.

However, this boost must be prorated to the period actually contributed and should therefore be significantly lower for many people.

Current retirees who have contributed at least 120 quarters will be able to benefit from a revaluation of up to 100 euros. Here once more, however, this will be done in proportion to the number of quarters contributed. The approximately 1.8 million current retirees affected by the promised boost will no doubt have to take their troubles patiently to benefit from it because it involves reconstructing careers that began sometimes a very long time ago. A technical challenge. The law therefore leaves until September 2024 to effectively upgrade current retirees.

Measures supposed to cushion the arduousness

Shutterstock

The reform plans to strengthen the rights associated with the hardship account, provided for employees exposed to certain difficult working conditions, such as night work, hot, cold or noise. The hardship account may in particular be used to finance retraining leave.

The law also provides for the creation of prevention funds to finance preventive measures for employees exposed to certain difficult working conditions, but also for agents in the health sector. It also sets the retirement age at 60 for persons recognized as permanently incapacitated following an occupational disease or an accident at work.

Facilities for long careers

ALLILI MOURAD/SIPA

After hours of debate in the Assembly on this subject, the reform broadens the conditions of access to the long career system, allowing those who started working early to benefit from early retirement. Initially reserved for people who started working before the age of 20, the system was finally extended to people who started working before the age of 21. Those who started at 20 will be able to leave at 63.

Knowing that it will no longer be necessary to have contributed at least 44 years, contrary to what was wanted by the government at the start of the debates on its reform. The minimum contribution required to benefit from the scheme is now set at 43 years. These measures will however have to be detailed by decree.

Closed special diets

GILE MICHEL/SIPA

For the sake of fairness between employees, the law provides for the closing of special schemes while respecting the said “grandfather clause”. In other words, from September 2023, new recruits from the RATP, companies in the electricity and gas industry (IEG), the Banque de France, the Economic, Social and Environmental Council or even clerks and notary employees will be affiliated to the general scheme.

Those who are already in one of these special regimes will be able to continue to benefit from the status. They will however see their retirement age postponed by two years. Even if this will be done from lower age limits than those in force for the majority of employees for many of them.

Special schemes (SNCF, RATP, EDF, etc.) should also benefit from a staggered timetable for implementing the postponement of the legal age, due to the gradual ramping up of the previous reform.

Facilitated phased retirement

Shutterstock

The reform makes the conditions for access to gradual retirement more flexible and extends this system to civil servants. It must allow from 62 years to reduce his working time and to cushion the shock by touching part of his retirement.

1682168619

#Pensions #change #reform