2023-04-18 11:41:07

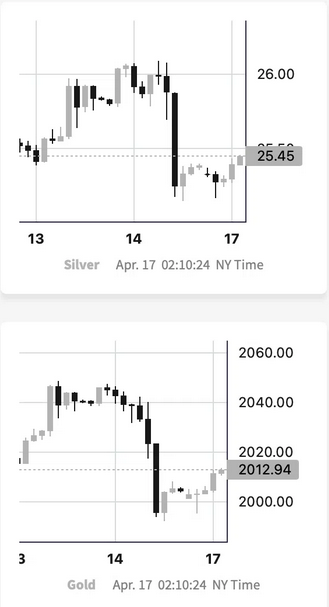

(This article was written before Monday’s trading, which saw gold fall below the $2,000 levels for spot contracts)

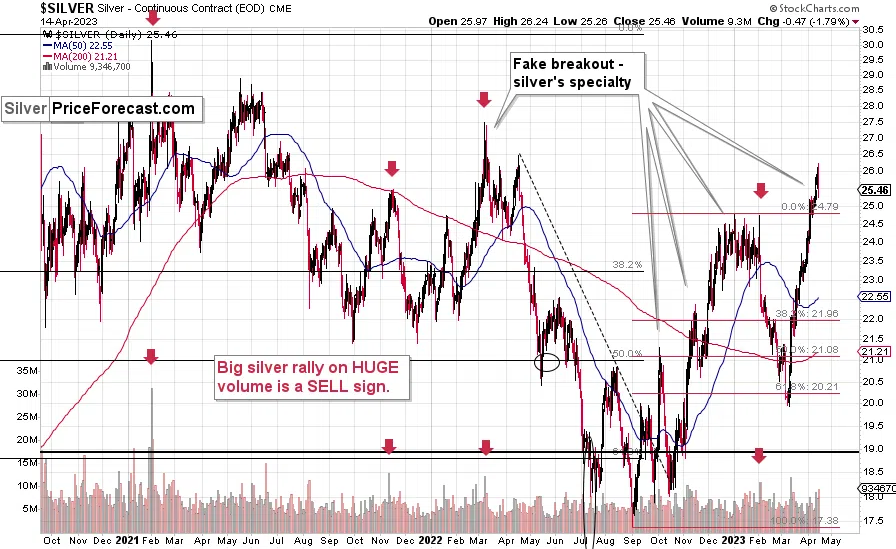

Silver and mining stocks fell on Friday following halting its collapse. Have precious metals reached the top?

While I can’t give any guarantees, it’s very likely that you’ve already peaked at this point. Gold has not yet fallen below $2,000, however what it has done suggests that it is regarding to turn around.

Gold price chart

Specifically, gold moved lower with volume obviously higher, and what happened – following the sharp rally – marks the beginning of a decline in many cases. This includes the March 2022 and January 2023 summits.

However, the signal coming from the US Dollar Index seems to be the most important.

Gold daily chart

Breakouts towards new yearly lows and moves below previous significant lows are seen as important bearish events… as long as they are confirmed.

Alternately, while many do not realize this, there is a stronger sign in the opposite direction if the breakouts are invalidated. The more important the support level, the deeper the bullish effects of the breakdown stop.

What did the US currency do on Friday?

rose. The dollar rebounded just above the previous lows.

And it wasn’t just making up “some bottoms.” It has reached a yearly low! Just when everyone was expecting to see a new, stronger slide, USDX has risen from the ashes like a phoenix!

This may not sound very exciting right now, but just wait. History tends to repeat cycles, so the current cycle ends with “Then USDX went up”.

Why is this important for those interested in gold price forecasts?

Because of the extremely negative correlation between gold and the dollar index, which you can see at the bottom of the chart above. It’s very close to -1, which is its lowest. But even without looking at the so-called linear correlation coefficient, it is quite clear that gold and USDX have been moving in a mirror-like manner for almost a year.

Since the US Dollar Index appears to have bottomed out, it is likely that gold may have bottomed out. But a return below $2,000 would confirm that.

Please note that volume also clearly increased during Friday’s decline. When did that happen following a short-lived rally, too? In early 2023. And yes – that was when the spike ended.

Therefore, what we mentioned above is a bearish confirmation.

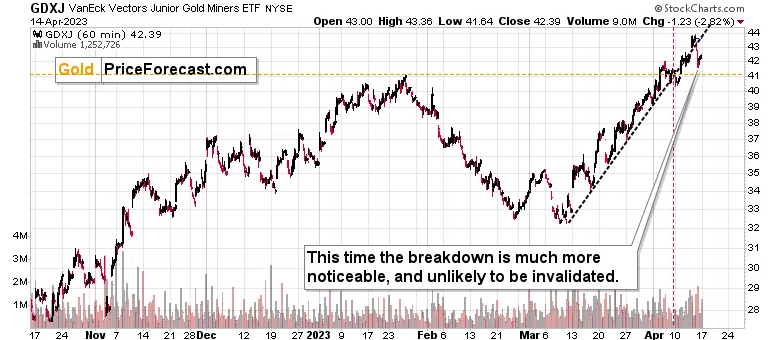

The Vandyck Jr. Gold Mining Fund Index (NYSE:GDXJ) – which includes emerging mining stocks – fell on Friday, but just like gold and silver, it hasn’t fallen below its previous yearly high… yet.

Just like in the case of silver, we see subtle evidence on the hourly chart above that this reversal is regarding to happen. Namely, the magnitude of the move below the ascending and choppy support line is much larger than what we saw earlier in April.

The first breakout attempt was nullified, (remember what I wrote regarding failing earlier today?) and a rally followed. This time, the bounce took the GDXJ to rise slightly but it is definitely not above the support line, which has now turned into resistance.

Gold – silver price chart

Source: SilverPriceForecast.com

So far in today’s pre-market trading (on Monday), gold and silver are only slightly higher, suggesting that the breakout in GDXJ will not fail.

In addition to this, there is the situation in the forex market, which indicates that gold is regarding to move below the $2,000 level which is the most important level, and that the next big move in the precious metals sector will be to the downside. It is very easy now to be bullish in the precious metals market because it is very easy to look at the recent past and think that what happened recently will happen once more. This is what most people tend to do. And most people don’t tend to do great in the markets, right?

This is the main reason – people tend to do what is easy rather than look behind the events and then act calmly and analyze past patterns. You see, people have been emotional…perhaps longer than our species, as many other creatures are emotional too.

This is not likely to change anytime soon. Instead of blindly following the herd, it is better to take a deep breath and look at the situation from a holistic perspective. It would be very easy to notice that some patterns repeat if one looks at the situation properly.

At the moment, this “big view” tells us that the situation in the precious metals market is not as bullish as many think. In fact, it is not bullish at all.

1681853535

#Gold #reached #peak..and #dollar #resurrected