Australia’s A$3.3 trillion superannuation system is supposed to boost people’s retirement incomes. The government says as much in its proposed leglislated objective for superannuation. The system is supported by billions of dollars of tax breaks each year, ostensibly to that end.

But there’s just one problem – increasingly, much of what is saved is never spent.

Our new report, Super savings: Practical policies for fairer superannuation and a stronger budget, points out that without an overhaul, super tax breaks are set to do little more than boost the inheritances of Australians with well-off parents.

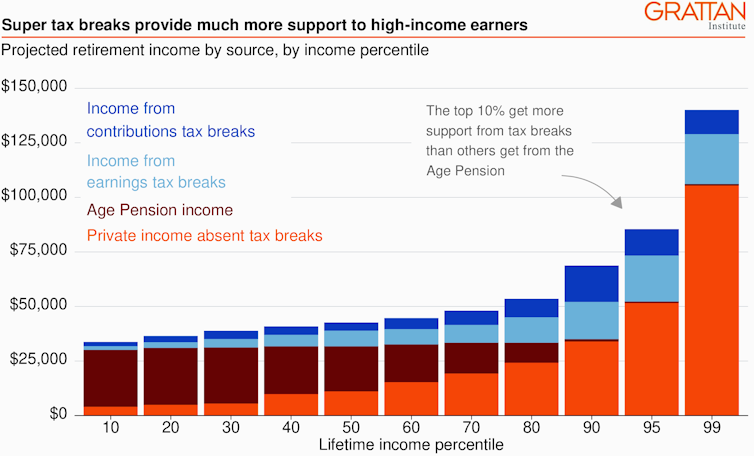

Super contributions and super earnings are both taxed more lightly than other income. These tax breaks cost the budget regarding $45 billion (2% of Australia’s gross domestic product, or GDP) each year.

Treasury predicts that figure will hit 3% of GDP by 2060, and that the cost of super tax breaks will overtake the cost of the age pension by as soon as 2036.

Click for notes

Super tax breaks are also unfair: regarding two-thirds go to the top 20% of earners.

This means the tax breaks provide the biggest boost to the super accounts of high earners, who will almost all have a comfortable retirement regardless, and who tend to save the same regardless of the tax rate imposed.

The wealthiest 10% of Australians get a bigger boost to their retirement savings from super tax breaks than poorer Australians get from the age pension.

Click for notes

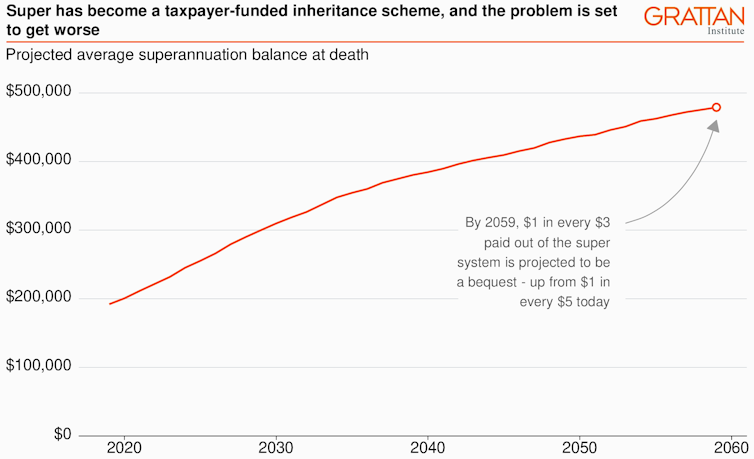

But much of what is saved for retirement never actually gets spent in retirement.

Earlier research by Grattan Institute and the 2020 Retirement Income Review found that, for a variety of reasons, spending falls substantially during retirement. Retirees often end up leaving much of their nest egg untouched, bequeathing it to their children.

This means billions of dollars in super tax breaks simply end up boosting the inheritances received by the children of well-off parents. It makes super a taxpayer-funded inheritance scheme.

This problem is set to get worse. With the rate of compulsory superannuation legislated to rise from 10.5% of wages to 12% by 2025, future generations of retirees are set to retire with even larger nest eggs that they will never spend.

Treasury projects that by 2059, one in every three dollars paid out of the super system will be a bequest, up from one in every five today.

Click for notes

Big inheritances boost the jackpot from the birth lottery. They help richer children get richer. Among the Australians who received an inheritance over the past decade, the wealthiest fifth received on average three times as much as the poorest fifth.

To help reverse this, the government needs to rein in the super tax breaks.

How to make super fairer

The government’s policy, announced in February, of taxing the earnings on balances bigger than $3 million at 30%, instead of 15%, will help.

But the threshold ought to be lowered to $2 million. Balances between $2 million and $3 million are very unlikely to be spent in retirement, so winding back tax breaks on earnings on balances bigger than $2 million would further wind back taxpayer-funded bequests.

And there’s more. Currently, many wealthier Australians receive a larger tax break per dollar contributed to super than many low income earners.

Yet low earners have more to be compensated for. Putting money into their super cuts their age pension in retirement, and they live shorter lives, meaning less time to enjoy their super in retirement.

À lire aussi :

The super giveaway that allows the wealthy to amass even more tax-free

The pre-tax contributions of people earning more than $220,000 a year should be taxed at 35%, instead of the 30% charged to those earning more than $250,000 currently. That would still offer a 10% tax break on super contributions for high earners (given the top marginal rate of 45%) and at least a 15% break on the contributions of low and middle earners.

And the annual pre-tax contributions cap should be lowered from $27,500 to $20,000. Contributions above this level tend to be made by people close to retirement with already-high balances.

Tax earnings in retirement the same as while working

On the earnings side, the tax-free earnings enjoyed by retirees on their first $1.7 million ($1.9 million from 1 July this year) of their super should go.

Superannuation earnings in retirement should be taxed at 15%, the same as superannuation earnings before retirement. This would save the budget at least $5.3 billion a year, and much more in future, and make taxing super more simple.

More than 70% of this revenue would come from the top 20% of retirees. The top 10% would pay an extra $7,000 to $7,500 a year on average, wereas the poorest half would no more than $200 more each.

Both sides of politics say they agree that super shouldn’t be a taxpayer-funded inheritance scheme. But there’s a long way to go before that vision is reality.

The Grattan Institute’s new report, Super savings: Practical policies for fairer superannuation and a stronger budget. was released on Monday