It pays to make premium mobile phones. At least according to the statistics of Counterpoint Research, it is a very attractive market segment. In 2022, premium smartphones accounted for 21 percent of all devices sold that year. Kadoron this segment is growing, in 2016 it represented only 7 percent of the entire market, in 2020 it was 15 percent.

It depends on how much this segment, which the agency specifies as tools costing more than 600 dollars (regarding 13,800 crowns), generates income for the manufacturer. In 2016, it was 18 percent, compared to 55 percent last year. This means that roughly a fifth of the products sold generate half of all income. A great business for those who are good at it.

And that’s the catch. From the lucrative segment, there is only one manufacturer, and that is none other than Apple with iPhones. This is not surprising, you have to look at Apple’s website to make it clear that essentially all Apple products in the mobile segment fall into the premium category. The exception is the cheapest SE model, but it is the least expensive of Apple’s portfolio.

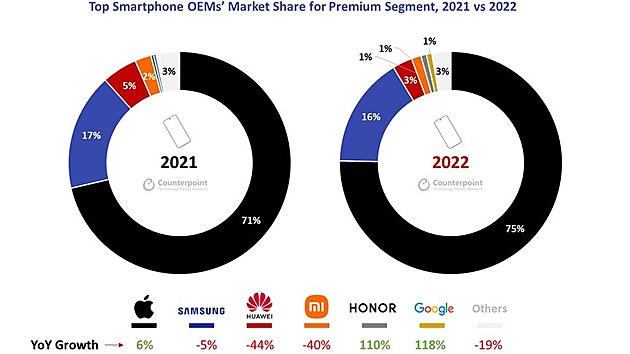

Apple had a 75 percent share in the premium segment last year, while the mid-range segment had 71 percent. The Samsung brand, which is known as a global manufacturer of luxury S series models and expensive Z series models, had 16 percent in the premium segment last year. That is, dramatically me, but still much more than the rest of the market, which basically just gloats regarding luxury mobile phones.

Smartphone sales statistics in the premium segment

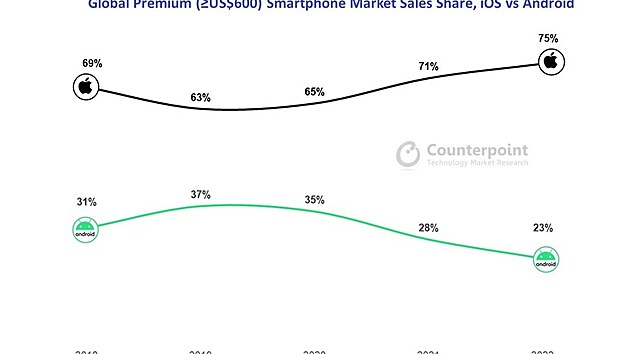

Actually, one hundred and six according to Apple and Samsung, to make it clear that for the rest of the game on the market, it makes up only nine percent of the premium segment. And in fact, many brands are fighting for 25 percent of the premium segment even for devices with the Android operating system. I mean, honestly, because those men can’t even grind in a hurry.

Smartphone sales statistics in the premium segment

Even in the case of a phone with a price below 600 dollars, Android has overwhelming power, but it means no income for the manufacturer. Why not, when 79 percent of sold devices are fighting for only 45 percent of revenue from the entire market. The result is that smartphone manufacturers with Android can sell a good device, but at a low price with little profit and falling profit. Take it anyway, but don’t wait, the aggressive entry of the BBK Electronics concern into Europe is now slightly and well-known muted for half of the group’s brands, and that is across the whole of Europe. It just had to be done.

Smartphone sales statistics in the premium segment

It is interesting that last year, despite rising inflation, which affected essentially half of the world, the sale of luxury smartphones grew. This segment is simply less inclined, not a segment of cheap tools, where the buyer must also want to buy more and sometimes think regarding an investment in the debt of several thousand crowns. The Indian market, which is extremely price sensitive, experienced a big drop in this direction last year.

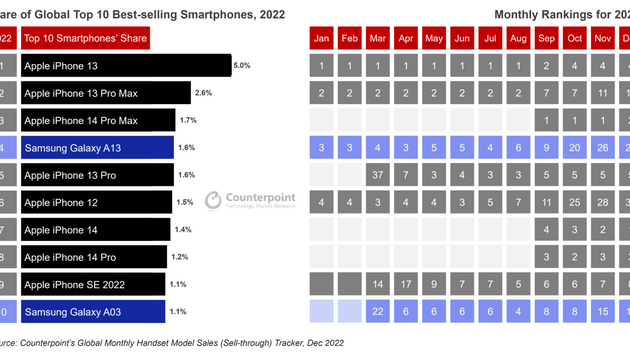

Smartphone sales statistics in the premium segment

And the world’s best-selling mobile phone for six years. In the first board there are seven phones that meet the parameters of a device with a price above 600 dollars. And don’t be surprised that it’s all iPhones. Apple took a total of eight positions in the first board, including the SE model. The remaining two places were won by Samsung, but with those full of the cheapest phones from its portfolio. Let’s add to the table that the new iPhones 14 have already started to be sold, so the first place will be selling this year as well. Unless something big happens.