In the United States, economic activity is slowing down and inflation is slowly receding. The acceleration of consumer prices in France confirmed the ECB’s determination to continue its rate hikes.

Equity markets continued to rebound following the announcement of rate hikes in line with expectations and comments pointing to an upcoming slowdown in the process of raising key rates. Central bankers also pointed to the resilience of economic activity despite restrictive policies.

Initially falling bond yields eventually remained stable. The American 10-year rate is around 3.5% and the German 10-year rate close to 2.20%.

In the United States, economic activity is slowing down and inflation is slowly receding. However, in terms of the labor market, the US economy added 517,000 non-farm jobs in January, a number well above expectations. However, job creations in the private sector slowed to 106,000 once morest 180,000 expected. Applications for unemployment benefits fell during the week of January 23, to 183,000 once morest 186,000 the previous week. Finally, the unemployment rate crumbled by 0.1 point to 3.4%, and the average hourly income rose at an annual rate of 4.4%, slightly higher than expected.

Durable goods orders (excluding transport) fell by -0.2% in December.

In Europe, economic uncertainties and pressure on household purchasing power led to a marked drop in German retail sales in December, down 5.3%, once morest an expected increase of 0.2%.

As for inflation, the acceleration in consumer prices in France, from 6.7% in December to 7% in January in harmonized data from the European Union, following that announced by Spain has confirmed the ECB in its determination to continue its rate hikes at the next meetings.

In this context, the S&P 500 index ended the week up +1.62% while the Nasdaq technology index rebounded by +3.31%. The Stoxx 600 Europe index rose by +1.23%.

This week, corporate earnings releases will continue and might lead to a return to volatility.

The essentials in a nutshell

Central banks take center stage

The disconnect between the financial markets and the discourse of central banks was illustrated on Wednesday and Thursday, following the announcements by the American Federal Reserve (Fed) and the European Central Bank (ECB).

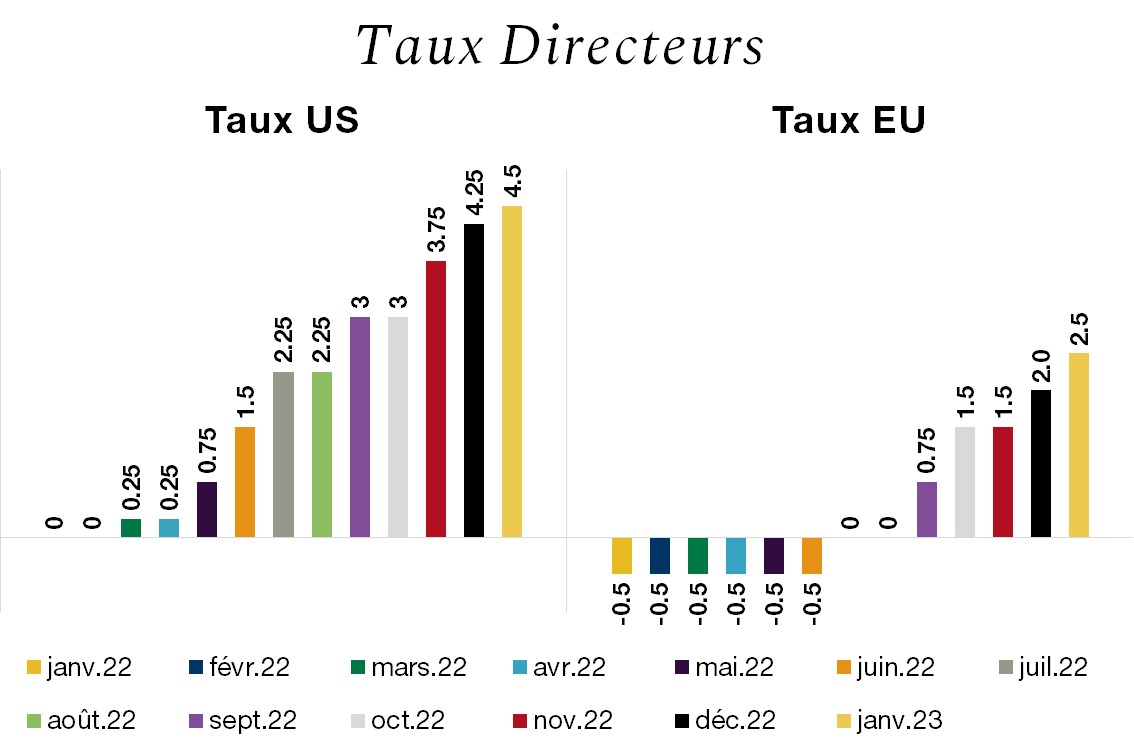

The Fed, as expected, raised its key rates by 25 basis points, placing fed funds in the range of 4.50-4.75%. Its chairman, while acknowledging that the fight once morest inflation was having an effect, stressed that recent progress was not enough to halt the rate hike and that a pivot was currently in place. unthinkable.

Investors did not want to believe that a cycle of two increases was still envisaged and continued to bet on a rate cut within the year.

Same scenario for the ECB, which raised its rates once more by 50 basis points on Thursday, as announced in December, and indicated that it expects an increase of the same magnitude in March. Lagarde highlighted the good performance of the European economy, which held up better than expected, and that despite a slowdown in the rise in prices, there was still a long way to go. Another point, the ECB will launch in March its balance sheet reduction program (9,000 billion euros) by 15 billion euros per month. As for reinvestments, they will be directed primarily towards issuers with better climate performance.

The markets immediately interpreted these decisions as a sign that the monetary tightening cycle was nearing an end and propelled the markets into the green and rates fell sharply. Following its reactions, the International Monetary Fund intervened to remind investors that interest rates will remain high for a long time in order to permanently bring inflation below the central banks’ target.