Intel Corporation did not delay with the publication of the annual report on form 10-K, the study of this document made it possible to understand in hot pursuit what problems she has in the financial sector due to the need to increase capital expenditures with falling revenue and income. It is becoming more and more difficult for it to finance activities at the expense of its own reserves, and at least two years remain before the cherished goal of restoring technological leadership.

Image Source: Intel

The first chart in the annual report shows how free cash has declined as a result of Intel’s operations over the past five years. To be more precise, they began to decline in 2020, but by the past they had decreased from $35.9 billion to $15.4 billion. Free cash flow at the end of last year generally became negative, reaching $4.1 billion modulo.

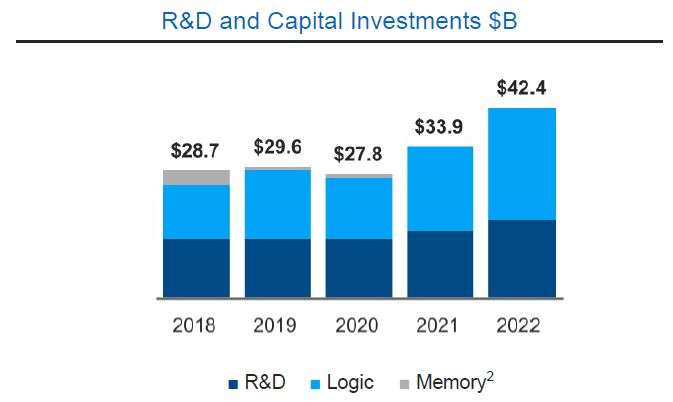

As you know, under Patrick Gelsinger, who took over as CEO regarding two years ago, the company’s capital expenditures began to rise. In parallel, spending on research and development increased. If in 2021 they amounted to $15.2 billion, then in the past they increased to $17.53 billion. fall.

Image Source: Intel

If we consider capital expenditures separately, then in 2021 they amounted to $18.7 billion, and in the past rose to $25 billion. Together with R&D expenses, this amount reached an impressive $42.4 billion at the end of 2022, with revenue of no more than $63 billion In a year-on-year comparison, total expenses rose by a quarter, while revenue fell by 20%. In the coming year, according to some estimates, Intel will allocate regarding $ 20 billion for capital expenditures. In fact, this amount will be 20% lower than last year, although it will exceed the corresponding figure for 2021.

Image Source: Intel

The year before last, Intel returned $8 billion to shareholders through share buybacks and dividends, but in 2022 it was no longer spending on share buybacks, although dividends amounted to a decent $6 billion, up slightly from 2021 ($5.6 billion). At the quarterly reporting conference at the end of this week, Intel management made it clear that it is going to maintain the level of dividends at a competitive level this year as well. From the outside, this spending of funds does not look entirely rational, but the company’s management may hope to attract investors to its shares through such a policy.

If you notice an error, select it with the mouse and press CTRL + ENTER.