“I live for the fun of opening a treasure chest every morning. Am I addicted to Coupang too?” (My song mom)

“If you order before 12:00 at night, the item will arrive the next day. I feel like Cinderella” (Heungdeok Mom)

These types of articles that have been frequently posted on Mom Cafe recently are important clues to understanding the changes in the e-commerce market. This is because it is a signal that Coupang’s ‘lock-in effect’ is in full swing.

The fact that women at the forefront of real life are addicted to ‘rocket delivery’ can be interpreted as meaning that the online competition between Coupang and E-Mart is leaning towards Coupang’s victory.

According to the New York Stock Exchange (NYSE) on the 28th, Coupang stock price closed at $16.71 the day before. It is up more than 80% from the low in May last year. The market capitalization recorded KRW 35.24 trillion. The gap with competitor E-Mart (market cap of 3.301 trillion won) widened to 12 times.

The reason why the stock price, which suffered from the bubble controversy, rose is because Coupang succeeded in turning a profit with an operating profit of $77.42 million (95.6 billion won) in the third quarter of last year, and its market share is rising alone.

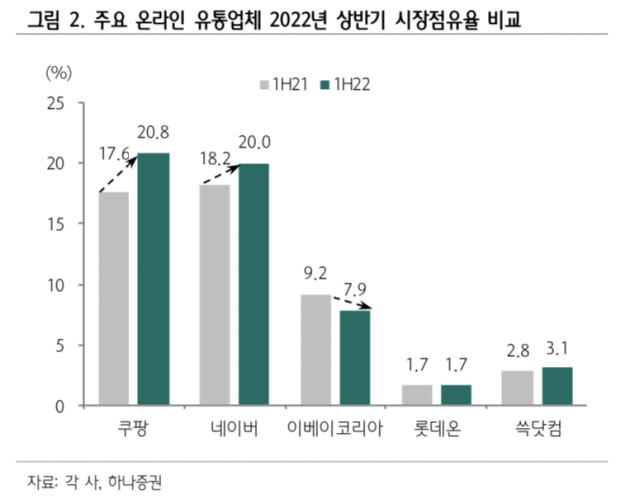

In the first half of last year, Coupang recorded a 20.8% share of online shopping. Compared to the same period last year, it increased by 3.2 percentage points. Suk.com rose only from 2.8% to 3.1%, and G Market Global (formerly eBay Korea) operated by E-Mart fell from 9.2% to 7.9%.

Funding from Japan’s Softbank and the introduction of a one-day delivery system are cited as the background for Coupang’s leadership. However, there is also a view to find the cause in a more fundamental place.

In the history of corporate development, most of the rulers of new industries have come from outside the ‘institutional sphere’. Smartphone leaders did not come from mobile phone makers Samsung or Nokia, and electric car powerhouses were not born in Germany or Japan, which dominate the automobile market.

Traditional powerhouses worked hard on new businesses, but also put considerable effort into maintaining existing businesses. Compared to new companies such as Coupang, which are rushing following hitting the reservoir, there is no choice but to lack momentum. Few executives were able to go ‘all in’ on a new venture with no guarantee of success.

Since its establishment in 2010, Coupang has built a rocket delivery system with losses of 250 to 500 billion won every quarter until last year. The cost invested in the logistics network alone amounts to 6.2 trillion won.

E-Mart took over eBay Korea (Gmarket Global) for 3,440.4 billion won in 2021, but recently changed its strategy to focus on profitability.

Even if the manager has a vision, there are many cases where employees can’t digest new things. A cement manufacturer owner said, “I feel that it is difficult to promote a new business with employees who are accustomed to the cement business.”

The cases of Coupang and E-Mart tell us that there is no permanent No. 1 in the stock market, and opportunities and crises come at the same time when the paradigm of the industry changes.

E-Mart stock price, which once exceeded 300,000 won, has come down to the early 100,000 won. Lotte Shopping lost one-fifth of its peak. Coupang is trading at a higher price than the combined value of all domestic distribution stocks such as department stores, marts, and convenience stores.

Yeouido stock market news and the story of ants <불개미 구조대>is published every Saturday. Subscribe to the reporter page so you don’t miss an article.

Reporter Park Eui-myeong [email protected]