Latinos are among those most affected by not having health insurance.

Foto:

Justin Sullivan / Getty Images

Although health insurance in California is mandatory, there are many people who do not have it for various reasons including cost and/or a lack of knowledge of what it takes to have insurance.

Experts indicate that each plan, whether public or private, is different depending on the medical needs of each person.

The UC Berkeley Labor Center reported that since 2013, prices for the four largest categories of health care services—inpatient, outpatient, professional services, and prescription drugs—have risen steadily in California, along with use of those services. It has decreased.

Insurance prices also change by region, as health care services themselves vary widely depending on the level of consolidation of health care markets in each region, according to research from the UC Berkeley Petris Center.

The results agree with research at the national level, since the more consolidated the market is, the less competitive it is and the higher the prices.

Who are the least insured?

In 2020 data from California Health Interview Survey They estimated that Los Angeles County had the largest number of people without health insurance, at 784,000. Statewide Latinos were identified as uninsured at 64%. This number was the highest compared to other breeds.

Additionally, it was reported that approximately 22% of immigrants in California did not have health insurance.

There was an idea that this last number would drop following the approval of Medi-Cal, the government health insurance, for low-income undocumented people over 50 years of age.

However, there are still thousands of people without applying and this is due to “immigration uncertainty,” according to Néstor Valencia, a health care expert and former mayor of the city of Bell.

“Even residents and citizens think they will lose their status if they sign up for Medi-Cal,” said Valencia, who works with several Los Angeles County hospitals.

This prevents people who qualify for the Medi-Cal or Covered California service from turning it down.

Other fears are that the Internal Revenue Service (IRS) is going to charge them high taxes at the end of the year or if they are homeowners that the government is going to take them away to pay for their health services.

And the biggest problem facing Latinos and any other migrant community is the

language and technology barrier, Valencia said.

“I have had to see when they want to apply and they are told that they can only fill out the application online,” he explained. “Not only that, but then they have to scan documents and send them. That’s how they scare people.”

information is the key

Patricia Izquierdo, a spokeswoman for Covered California, said Californians can continue to enjoy low premiums on their health insurance for the next three years thanks to the Reducing Inflation Act.

However, he stressed that it is important that each person who is going to sign up for health insurance review their plan so that they do not have surprises when they make their medical appointment.

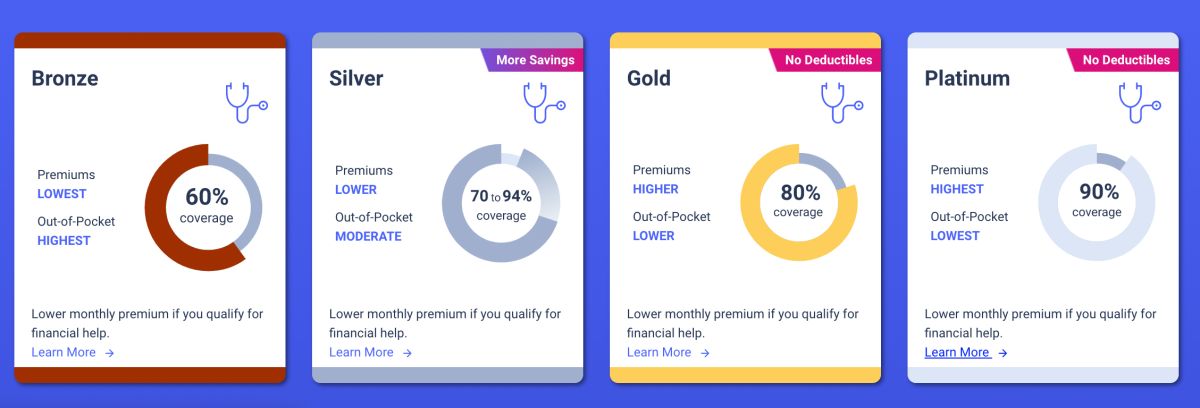

“It is important that they say what their needs are because if they are going to sign up for very cheap health insurance, their copayments are going to be very high,” said Izquierdo.

This is especially important for those people who go to the doctor more often. In this case it is better to pay a slightly higher plan and it will have the lowest copays.

Izquierdo said the Silver 94 plan is usually recommended.

Examples Covered California gives include a young adult making $27,000 a year can pay $37 on the Silver plan or get the Bronze plan for free.

Another example is that of a family of four where the salary is $83,250. The family can pay $350 with the Silver plan or $67 with the Bronze plan.

Both plans have the Reduction of Inflation Act discount.

Izquierdo indicated that there is still time for people to visit a health insurance agent to advise them on what is the best plan according to their pocket.

The registration deadline is January 31.

To know more you can visit: https://www.coveredca.com/