And if you deposited your savings elsewhere than on a booklet A? Thanks to its expertise, fintech Yomoni helps you find the ideal investment, even if you don’t know anything regarding it.

Because it constitutes liquid, risk-free and cost-free savings, the Livret A account has won over nearly 85% of households according to INSEE. But its interest rate limited to 2% and inflation, which is now over 6% encourage more and more people to diversify their savings. Still need to find it.

Yomoni precisely helps neophytes (but also the most seasoned) to find the financial investment that suits them best. A 100% online solution, made up of experts, who has all the cards in hand to manage your savings.

At the start of the year, Yomoni reimburses part of your management fees (offer subject to conditions). Until April 7, with promo code Ymoni22you can save up to 350 euros discount on these fees.

*Any financial investment may involve the risk of capital loss.

Who is evil?

Launched in 2015, the leader in online savings management already has more than 50,000 contracts to its credit, or nearly one billion euros under management mandate. While it is generally necessary to choose between the personalized advice of a management company or a bank and the flexibility of an online solution, Yomoni has sought to bring together the best of both worlds.

Like a traditional establishment, this company has a team of experts responsible for advising you on financial products, and above all for managing your investment portfolio. It is therefore not necessary to have advanced knowledge in the field to get started.

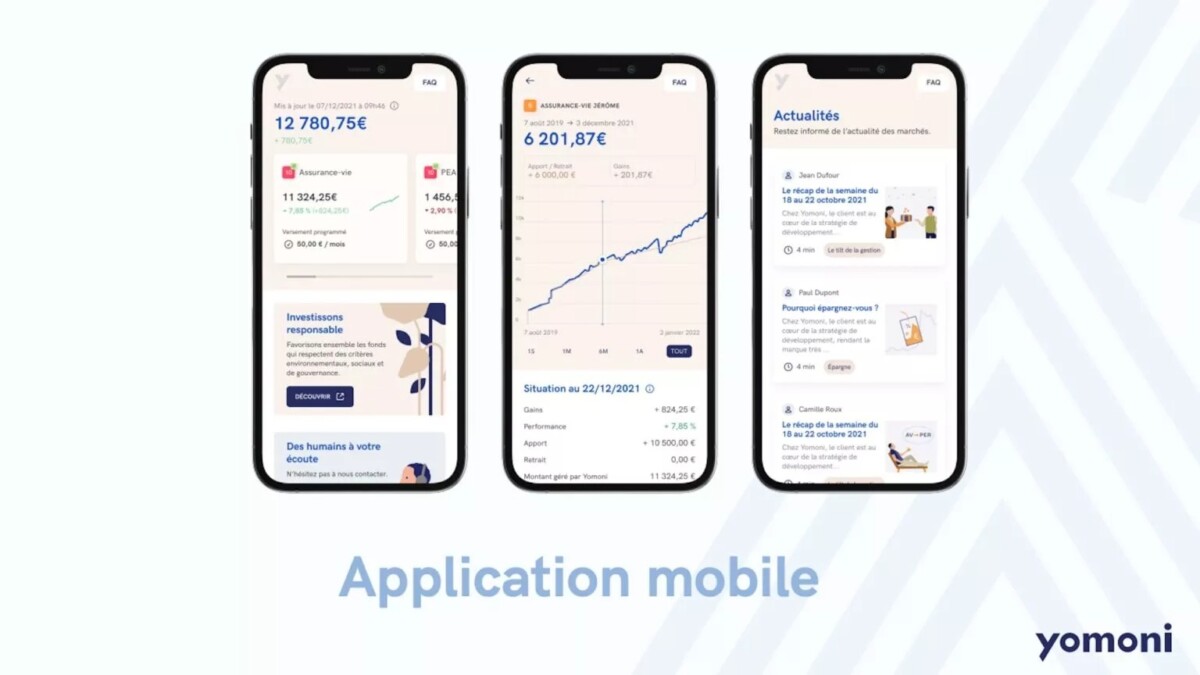

Practicality and simplicity being the watchwords of Yomoni, the fintech offers as a bonus a complete eponymous application, available on iOS and Android. This is useful at all stages of the investment:

- upstream of any subscription, this application offers you to answer a quick questionnaire in order to determine your investor profile and to offer you products adapted to your needs and the desired level of risk;

- once the investments are made, you can follow their performance in real time using interactive graphs. You can also view all the operations carried out by the managers;

- at any time, you can program via the application additional payments (one-off or recurring) on existing contracts (PER, life insurance) or even request the withdrawal of part of the funds.

Another major advantage of Yomoni: its pricing. It is currently one of the most competitive on the market. The fintech does not apply any entry fees, imposes no commitment period and limits management fees to 1.6% of the amount invested. Knowing that the less risky the products subscribed to, the more these costs are reduced.

Savings products for everyone

Short or long-term investments, with or without risk, responsible investments: Yomoni has a varied offer, adapted to all profiles. These products can take the form of a Retirement Savings Plan (PER), an Equity Savings Plan (PEA), a securities account, or even life insurance. About 40% of French people already have one, in particular for the advantageous taxation it brings.

Yomoni allows in this capacity to open a life insurance contract with a starting capital of 1,000 euros and does not require any payment therefollowing. This type of investment can take different forms. The more cautious choose a cautious version of life insurance, while the more informed choose more offensive products. Yomoni even offers indexation on the major stock market indices (ETF) to those who wish.

To take out life insurance, you don’t need to be an expert. Yomoni selects for you the investments that correspond to your objectives. You can add funds or withdraw them at any time at no additional cost.

Since the creation of Yomoni in 2015, its most offensive life insurance contracts have been able to achieve annualized returns of 6.5%, far from the 2% of the Livret A. Nevertheless, it is important to keep in mind that past performance is not indicative of future performance and that any investment medium represents a risk of capital loss. This is why Yomoni’s experts support each client in the selection of their investments.

A simple and totally online subscription

Yomoni makes every effort to facilitate access to complex savings products for the most novices. This simplicity is visible from the subscription, which takes place entirely online.

After completing the form determining your risk profile on the Yomoni site or application, you are put in contact with experts to choose the products that are right for you. Then just send in digital format your proof of identity, address, mobile line, as well as your bank details and you’re done.

And to reward all new subscriptions, until April 7, Yomoni is launching a great management fee reimbursement offer (subject to conditions), which can reach 350 euros with the promo code Ymoni22.

*Any financial investment may involve the risk of capital loss.