Chances are that every time you went to the supermarket this year you noticed that prices had gone up, it is possible that you might not reach it and had to reduce the size of your purchases, or that you had to increase your budget for food. But the shortage did not stop there, the same thing happened if you were planning to ask for a home on the weekend, pay your energy bill, go on a trip or buy some “estren” this December. “Everything is very expensive” was the most frequently heard phrase throughout 2022.

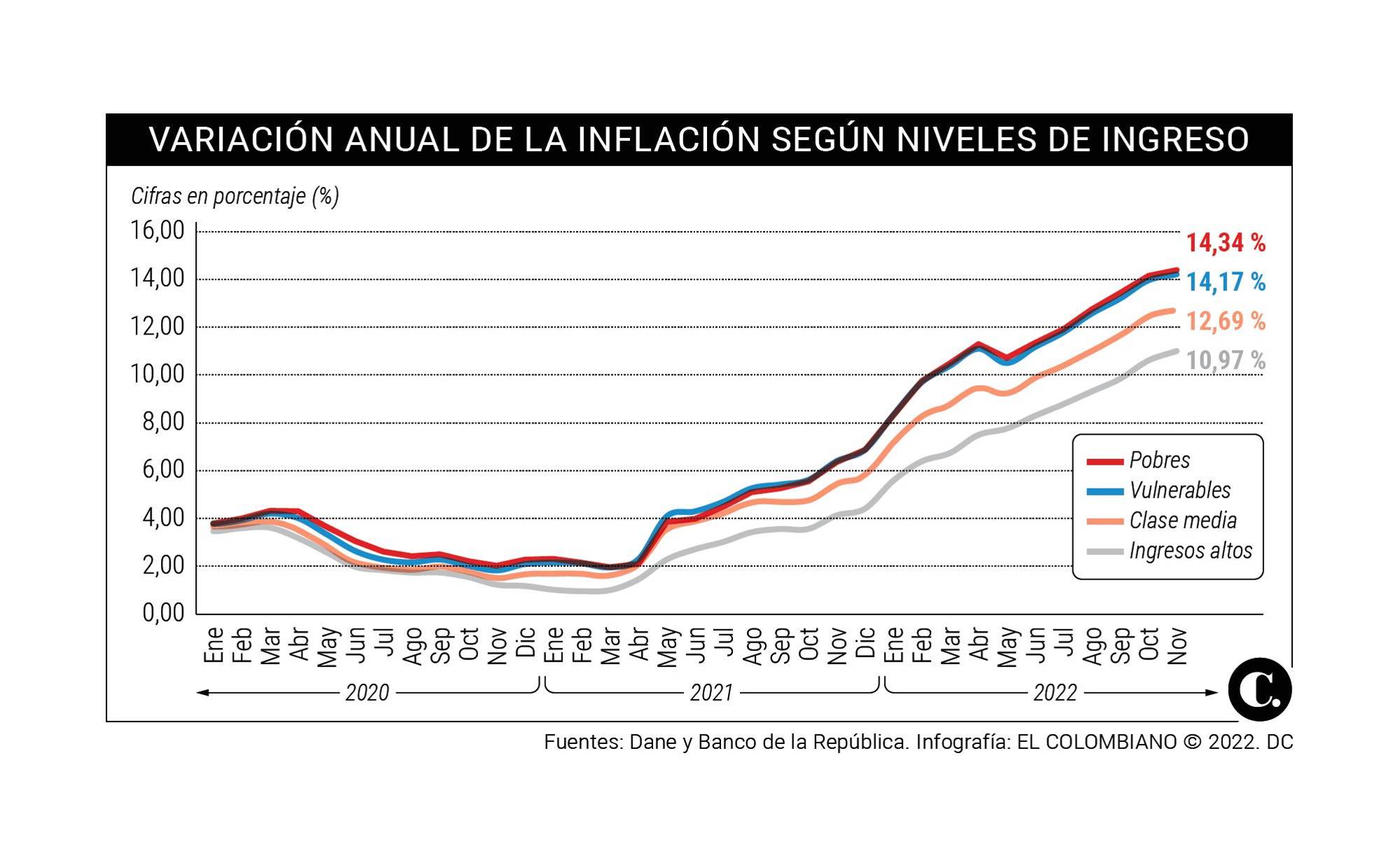

According to the National Administrative Department of Statistics (Dane), the cost of living has risen 12.53% in the last year (from November 2021 to November 2022), and the worst hit to the pocket has been felt by the poorest families for whom inflation has been 14.34%.

Why is there a difference? Because the price of food is what has risen the most (27.08%) and the poorest families spend a greater proportion of their income on food. For example, Dane says that the price of cassava for home consumption increased 107.64% in one year, that of arracacha, yams and other tubers rose 104.09% and for onion Colombians paid 89.63 % plus.

Why did the prices increase?

The first thing to say is that inflation is not a phenomenon that is hardly experienced in Colombia, the whole world has been facing a shortage for reasons that are very difficult to control.

The first explanation is that since 2021, with the reactivation of the global economy following the confinements to stop the spread of the pandemic, demand skyrocketed, families around the world went shopping without control, very good news for the commerce that had experienced paralysis, but the supply might not keep up with the demand, the companies might not produce so quickly and it must not be forgotten that there was a crisis of containers that were not enough to move global trade. That started to make the products more expensive.

To all this is added that in February the Russian invasion of Ukraine exploded, and beyond the unfortunate results in human lives that the war has meant, it put the world economy on the ropes. A lot of oil and gas comes out of that region —Russia alone produces regarding 11 million barrels of oil per day—, cereals, strategic minerals for the manufacture of technology and automobiles, and fertilizers —42% of the fertilizers that Colombia consumed before the invasion They came from those two countries.

With this war it not only became more expensive to produce in Colombia but in the rest of the world. Europe is so dependent on Russian gas supplies that its energy costs have risen and the price of its production has skyrocketed.

And already at the local level, the prolonged winter that damaged many crops weighed heavily on the increase in prices, in fact, coffee growers reduced their production by close to one million bags this year, even in the midst of the best prices in history.

solution in sight

The hope is that the increase in the interest rate of the Banco de la República begins to reduce consumption and in this way prices begin to be controlled. At least that is where the confidence of Finance Minister José Antonio Ocampo is placed, who told EL COLOMBIANO that the natural thing is that inflation in Colombia takes the same course as that of the United States, which has been falling for three months as a result of the tightening of the monetary politics

The most expensive dollar in history

The Colombian economy faced for the first time what seemed impossible: a dollar at $5,000. During the pandemic, the US currency had reached a record high of $4,153 (on March 23) amid the uncertainty due to the confinements, and from there it slowly fell off.

So, since the beginning of this year, the dollar began to climb, approaching —and exceeding at times— $4,000, but in the second semester, driven mainly by the increase in interest rates in the United States, which promotes capital outflows from investment in that country, and the election of the first left-wing president in Colombia deepened the devaluation of the peso.

On June 2, the dollar surpassed the historical record and reached $4,198.77 and on November 3 it exceeded $5,000 for the first time, since the representative market rate for that day was $5,015.84. The maximum exchange rate was registered in the following week when it was $5,061.21 (November 5).

Against all odds, the dollar began to give way, ending the year slightly above $4,700. All the think tanks assure that this is the new reality of the national economy, since the United States currency will never be below $4,000 once more, and here the necessary adjustments will have to be made so that the expensive dollar is the least traumatic. possible.

everyone loses and some win

With an expensive dollar, imported ones became more expensive, which represent a large part of national consumption, especially in what has to do with technology, vehicles, auto parts and clothing.

On the other hand, the Colombian economy depends on imported fertilizers, almost 80% comes from abroad, so local food production also became more expensive, so the dollar also pushed the already high inflation.

2022 was a particularly difficult year for Venezuelans who sent remittances to their country from Colombia, since the pesos did not yield when converted into dollars, while Colombians abroad celebrated by sending resources to the country.

Exporters also got a good slice, since the prices of the commodities they were high and the dollar gave them even more momentum

The escalation of interest rates

The rise in the cost of living around the world forced central banks to increase their interest rates. The global economy was coming off a period of at least a couple of years with rates close to zero to promote economic growth during and following the pandemic.

The United States led the way throughout the year, the other issuers, including the Banco de la República, watched its movements carefully because they indicated two things: the speed with which the rates were transmitted to the reduction in consumption and therefore the decrease of inflation, and the appetite of investors for that economy with which it is necessary to compete.

It is that the United States Federal Reserve (FED), led by Jerome Powell, had a rate between 0% and 0.25% and now places it at 4.5%, which is considered very high for a power. The European Central Bank placed its rates at a maximum of 2.75% a couple of weeks ago, and all the countries increased it in the course of 2022. Colombia already has the intervention rate at 12%, the highest in recent 23 years.

This has brought a reduction in access to credit, especially the mortgage whose interest rate has gone from 8% to 18%.

Both Leonardo Villar, manager of the Banco de la República, and José Antonio Ocampo, Minister of Finance, are confident that this intervention rate, together with the reduction in rainfall, can lead to a break in inflation in the coming months and that it will begin to converge towards the goal of 3%. The official forecast is that in 2023 inflation will be 7%, but there are so many factors that influence it that you never know.

And on the business side, 2022 also surprised: castling falters with takeover bids

After six Public Offers for Acquisition (OPA), Jaime Gilinski, through his companies Nugil and JGDB Holding, obtained 38% of the shares of Grupo Sura and 31% of those of Grupo Nutresa, consolidating himself as one of the main shareholders of the so-called Grupo Empresarial Antioqueño (GEA), in which it has been classified as a hostile takeover.

The one that was unsuccessful was the takeover bid that it launched for Grupo Argos, which was declared void as it did not reach the minimum required by the tycoon, so it did not achieve any participation in the infrastructure holding company.

Beyond the participation achieved so far by the banker from Cali, what was seen throughout the year is a dispute for the control of the Paisa companies, both in the shareholders’ meetings and in the boards of directors as well as in the judicial instances. Side and side requirements to the superintendencies of Health, Industry and Commerce and Finance and before the judges of the Republic have been the order of the day. It is not surprising that long litigations come to resolve the controversies, remembering the 10 years of litigation that the Paisa businessmen and Gilinski had when he sold them Banco de Colombia.

Nor would it be unusual, according to several market analysts, for new takeover bids to be presented with better prices, either from Gilinski’s account or from his Arab partner IHC, which has greater financial muscle.

It should not be forgotten that the objective that Gilinski is pursuing is Bancolombia, since he wants to merge it with his bank, GNB Sudameris, and it seems that his patience has not yet run out in this obsession.

5.061,21

pesos per dollar was the highest representative market rate.

12,53%

was the annual inflation to November in Colombia, reported by Dane.