image.png

What is truly remarkable is that, even without the data for the fourth quarter, 2022 has been the record year for gold purchases by Central Banks since 1967.

Why has this year been the one with the highest demand for gold in recent decades? It is no coincidence that during 2022 inflation once once more made world news. And the central banks seek refuge.

Gold is usually a good hedge once morest inflation. But if there was record inflation this year, why didn’t gold perform positively this year? Basically because it has a direct competitor: the nominal interest rate. As bond yields rise, investors have greater incentives to invest there.

However, the real explanation for the movement of gold comes from the real interest rate. Unlike the nominal rate, the real rate contemplates inflation.

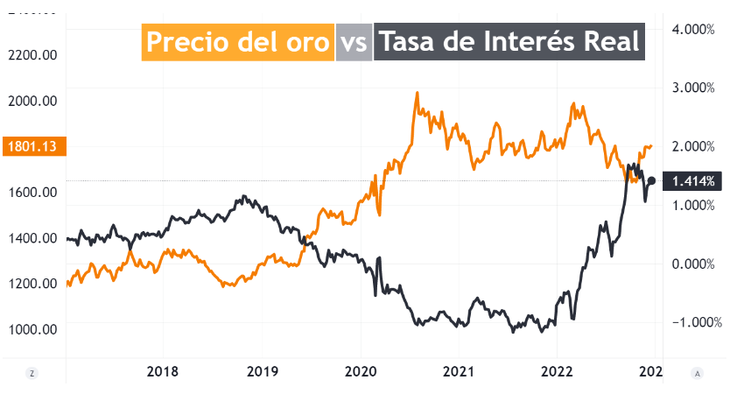

Let’s see the gold evolution (left axis) and the real interest rate (right axis):

image.png

The real interest rate is the inflation-adjusted nominal (black line). If this rate goes up, gold usually falls and vice versa. In recent weeks, the real rate began to fall (since the nominal rate fell and inflation expectations remained uneventful), so gold reacted upward.

Why do they have an inverse relationship? Any investor has greater incentives to turn to treasuries, if they have a positive return, adjusted for inflation. On the other hand, gold does not accrue any interest, so it loses its attractiveness.

The market continues to discount that inflation will not last long. In fact, the 10-year inflation expectations They are around 2.3%. What happens if inflation does not come down as the market expects? That would drive the real interest rate down, which would be great fuel for gold.

Another determining factor for gold to rise is the level of debt. For example, in the United States, total debt represents 420% of GDP, a higher ratio than during the Great Depression y post WWII.

With a government that is unwilling to raise taxes or cut spending, the monetization (issuance of money) of the deficit by the Central Banks will once once more be seen as the path of least resistance. What would happen before such monetization? Inflation would remain high, so gold would benefit.

There are reasons to be positive regarding the future of metal. In addition, the Central Banks are increasing their reserves at record levels. They are the ones who run the world economy, and if they are betting on gold they must have their reasons.

As always, prices rule. And now they indicate that gold is waking up following a long sleep. To follow him closely.

To finish, I invite you to read a report with the factors that you have to take into account to invest in commodities. In addition, I am going to tell you 3 simple investment ideas. you can download here.