Relations between Taiwan and Japan, dubbed the ‘semiconductor honeymoon’, are getting tighter. TSMC, a Taiwanese foundry (semiconductor consignment production) company, is building a production line in Kumamoto Prefecture, Japan, at a total cost of 1.2 trillion yen (approximately 11.6 trillion won). The Japanese government subsidizes 40% of the construction cost. Construction began in April and will be completed in September next year, with mass production scheduled for the end of 2024.

Sony, Japan’s leading information technology (IT) company, plans to build an ‘image sensor’ (semiconductor that serves as the human eye) production line next to the TSMC plant. The purpose is to receive chips produced by TSMC and complete the sensor right away at the factory next door.

Recently, a senior TSMC official hinted at the possibility of building a second plant in Japan. “We are not ruling out the possibility of building a new plant in Japan,” said Hou Yongqing, TSMC’s senior vice president of sales in Asia and Europe, in an interview with the Japanese media on the 8th. Japan’s Minister of Economy, Trade and Industry Yasutoshi Nishimura said on the 9th, “We welcome the fact that TSMC is considering building additional factories in Japan.”

In fact, Japan is evaluated as not the best location to build a cutting-edge semiconductor factory. Because of frequent earthquakes. Production lines at Japanese semiconductor companies such as Kiosia are likely to stop due to earthquakes. A recent example is the contamination of Kiosia’s state-of-the-art NAND flash production line due to a magnitude 7.6 earthquake in March. As a result, 10% of Kiosia’s NAND flash production is reported to have decreased. Kiosia’s market share fell from second place in the first quarter to third place in the second quarter.

TSMC’s construction of a factory in Japan is behind Apple

Still, why is TSMC so active in building a plant in Japan? On the surface, it is analyzed that the huge amount of subsidies distributed by the Japanese government and collaboration with Sony, a long-time customer, have had an impact. There is also an opinion that we should look at the other side. A high-ranking official in the semiconductor industry I recently met said, “The real reason TSMC is building a Japanese factory seems to be because of ‘Apple’.”

Apple, which accounts for the largest portion of TSMC’s sales, is ‘No. 1’ is a customer. As of last year, TSMC accounted for regarding 25% of TSMC’s sales. From TSMC’s point of view, Apple is a ‘big hand’ customer that should not be missed. TSMC cannot be free from Apple’s influence.

Apple is ordering ‘Leave China’ from its partners such as Foxconn these days. This is because Apple has suffered several production setbacks in recent years due to the CCP’s unpredictable policies. A typical example is the disruption to the operation of Foxconn’s factory, which produces iPhones, due to the Chinese government’s blockade of Zhengzhou. Apple demanded that Foxconn “move its core production lines from China to India and elsewhere.”

“I don’t believe in China”… Pressure to ‘De-China’

It is analyzed that Apple’s pressure is also acting on TSMC. Apple is known to be concerned regarding the fact that TSMC’s factories, which make core semiconductors for iPhones and MacBooks, are concentrated in Taiwan. In any case, if TSMC’s state-of-the-art factory collapses due to a Chinese invasion, it might cause ‘catastrophic’ damage to Apple.

So Apple is asking TSMC to ‘leave Taiwan and diversify production locations’. TSMC’s building a factory in Japan is analyzed as an extension of Apple’s policy of inducing ‘de-China’ for its partners. To understand this, we first need to look at the love triangle that leads to TSMC-Sony-Apple.

Sony’s flagship product is an image sensor that acts as a human eye in electronic devices. Sony’s image sensor is supplied to Apple.

Sony produces the core chip of its image sensor from TSMC. From Apple’s point of view, if there is a problem at TSMC’s factory, it will not be able to smoothly supply Sony’s image sensors. In the end, it’s very likely that iPhone sales will take a hit.

That’s why Apple pressured TSMC to build a factory in Japan. In 2024, when the TSMC Kumamoto factory is completed, Apple will put away worries regarding Sony’s ‘image sensor’.

Apple says it will use American-made chips

Not all problems have been solved. The AP (application processor) for the iPhone and Macbook, which Apple develops directly, is also produced at the TSMC plant in Taiwan. Apple’s AP is incomparably more important than the image sensor supplied by Sony.

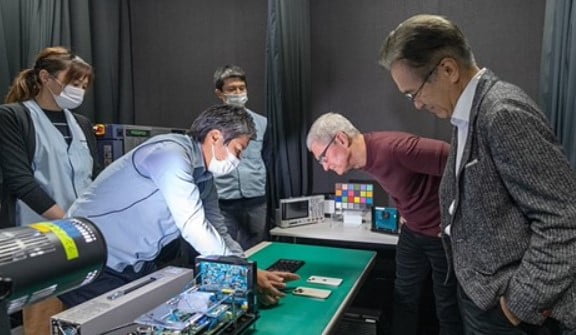

The US government pressured TSMC to build a factory in Phoenix, Arizona. TSMC’s top executives, including TSMC founder Maurice Chang, said flatly, “Production in Taiwan is advantageous. There is no need to build a factory in the United States,” but gave up in front of the United States. TSMC is currently building a 4nm production line in Phoenix by investing tens of trillions of won. Tim Cook, CEO of Apple, welcomed the plant at a recently held equipment introduction ceremony, saying, “We will be the first customer of TSMC’s plant in Arizona.” Once this plant is completed, Apple can escape Taiwan risk.

Even more surprising news is that TSMC has announced that it will build one more plant in the United States. The process is also expected to be the latest 3nm, not 4nm. It is expected that there was an irresistible demand from Apple here as well. An official from the semiconductor industry analyzed, “It is impossible to understand that TSMC, which was burdened with leaving Taiwan, is increasing its investment in Japan and the United States, except for ‘Apple’.” .

Negotiation on an equal footing with ‘superpower’ Apple, only Samsung Electronics

Few companies can stand up to this powerful Apple superpower. In Korea, Samsung Electronics is said to be negotiating supplies on a relatively equal footing with Apple. In the smartphone market, Samsung Electronics and Apple compete fiercely for the world’s No. 1, but it is different in the semiconductor market. Apple receives memory semiconductors such as DRAM and NAND flash from Samsung Electronics. Of course, there are alternatives to Samsung Electronics, such as SK Hynix and US Micron. However, it is known that Samsung Electronics ranks first in terms of ‘quality’.

Competition among countries to attract Samsung Electronics’ semiconductor factories to their countries is also fierce. The United States, the European Union (EU), and Japan are asking Samsung Electronics to “build a factory in Korea” with bundles of money worth trillions of won. A tax deduction of more than 20% is also promised.

However, the situation in Korea is different. Samsung Electronics completed factories 1 to 3 in Pyeongtaek, Gyeonggi Province, and soon began groundwork for factories 4 and 5. Construction of the 6th plant is also planned in earnest. It is a large-scale project that requires a huge amount of over 20 trillion won for each plant.

The whole world has stepped up to foster the semiconductor industry… Korea going backwards

President Yoon Seok-yeol personally pushed ahead with a special semiconductor law that would increase the tax credit rate for facility investment by large corporations from the current 6 percent to 20 percent. It was at this time that a consensus was formed that unconventional support measures were needed to compete with the US, which decided to give 25% tax credits to companies investing in its own country, and China, which was investing 187 trillion won by 2025 to nurture the semiconductor industry.

The result is ‘less than expected’. On the 23rd, the ruling and opposition parties only raised the tax credit rate for large corporations by 2 percentage points from 6% to 8%. It is a shabby result created by the Ministry of Strategy and Finance, which opposed the reduction of corporate tax revenue, the Democratic Party of Korea, which advocated preferential treatment for large companies, and the power of the people who responded lukewarmly.

Rep. Yang issued a separate statement and said, “The global standard for semiconductor investment tax credit is 25%.” It is a policy to drive global semiconductor companies out of Korea.” If they build a factory in the US, they can receive a 25% tax credit, but what kind of company would want to build a factory in Korea? Rep. Yang even expressed that “retreating to 8% tax credit is at the level of breaking the promise of the last presidential election.”

Disappointed reactions poured in from the semiconductor industry as well. Lee Chang-han, vice chairman of the Korea Semiconductor Industry Association, said, “Even though semiconductors have strategic value, they offer less benefits than competing countries.”

Reporter Hwang Jeong-soo [email protected]