HoonSmart.com>>EIC Siam Commercial Bank will keep an eye on the corporate sector to accelerate the issuance of debentures during the rising interest rate. The short term can still cope. A tendency to be wary of the risk of yield snapbacks, affecting borrowing costs and financial position, revealing that the year ’66-67 has a lot of renewal. Target groups with low credibility especially the service sector – real estate and construction sectors. Risk of defaulting on debt – rising costs From the business has not recovered as before the covids have to wait for the year 67

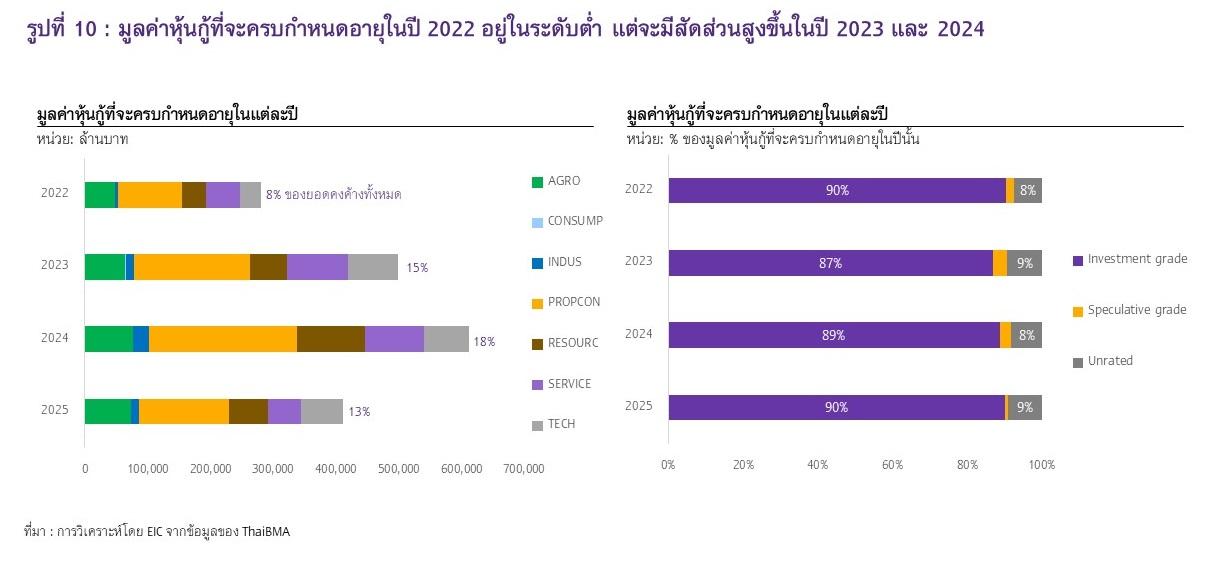

EIC Siam Commercial Bank Debenture risk analysis that Thai business sector (excluding the financial sector) has continuously accelerated fundraising. During the 8 months of 2022, debenture issuance accelerated by 21%, with a total value of regarding 95 hundred billion baht, making the outstanding value high. 3.4 trillion baht, which is a group of debentures rated A- up to 2.3 trillion baht (68% of the total outstanding debentures), while those debentures rated below BBB- (Speculative) and group Unrated has a total value of only 600 billion baht (18%).

Accelerating the issuance of corporate bonds This is in line with the recovery trend of the Thai economy. And as a result of the need to lock the cost of finance before interest rates tend to increase further in the next period. while the business sector may have restrictions on obtaining credit. according to the standards of financial institutions that are still strict Both large businesses and SMEs found that some financial institutions increased margin for high-risk customers. as well as increase the strictness of the terms of the contract Consequently, the limited business sector turned to raise funds through the bond market more. Although costs are likely to continue rising in 2022-2023 in line with market interest rates

In addition, Thai bond yields are also influenced by an uptrend in global interest rates. The US Federal Reserve (Fed) has raised its policy rate by 3% at the end of September to 3-3.25%, resulting in US Treasury yields. Both short-term and long-term increased accordingly. And it will continue to affect government bond yields of other countries, including Thailand.

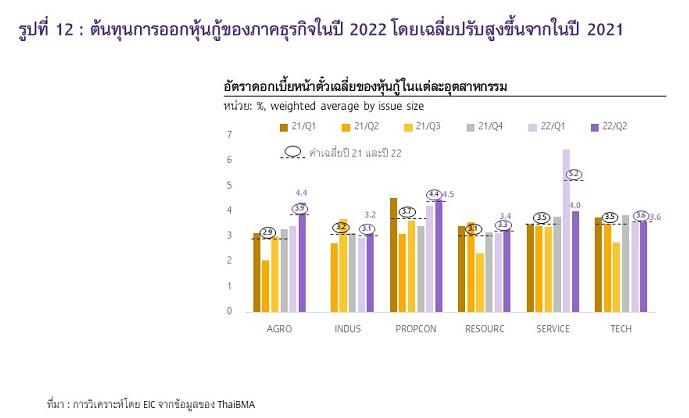

Since the beginning of the year until Sept. 26, 2022, yields on one-year and 10-year Thai government bonds have risen by 0.65% and 1.18%, respectively, causing financial costs for both Thai businesses and households to rise. quite fast Coupon rate, which has increased from 2.3% in 2021 to around 2.6% this year, has risen in almost all segments. Especially the bonds of the group that are very risky. Speculative was 6.8% and Unrated was 5.6%, respectively, still above pre-COVID-19 levels. While the cost of the investment grade group did not change much. where regarding 2.3%

However, the interest rate cycle is up. Consequently, businesses that raise funds through bonds face the risk of yield snapbacks which affect borrowing costs. as well as the financial position of the business sector But more than 90% of bonds currently pay interest in a fixed coupon (Fixed Coupon). Therefore, in the short term, although the interest rate in the money market is likely to continue to rise. But the cost will not immediately increase accordingly. As a result, the risk from the yield snapback of Thai businesses in the “short term” is still not a concern.

The risk tendency increases as the bond matures in the future. in the renewal of bonds (Roll-over risk), especially those in the low credit group. Speculative, most of which have an average remaining maturity of only 1.5 years, with maturity in 2023 and 2024, representing up to 39% and 35% of the total outstanding speculative grade debentures, especially in the service sector. and real estate and construction sectors It has the highest percentage of maturity bonds compared to other sectors. especially debentures in the Speculative grade group

EIC estimates that service business revenues will recover to the same level as the pre-Covid-19 period in 2024, while the real estate and construction sectors will be able to recover equivalent to the pre-Covid-19 period in 2024-. 2025. Therefore, there will be a high risk of default if the earnings still do not recover. The sharp rise in financial costs will only exacerbate the fragile financial position.

EIC views that Thailand’s tightening monetary policy is gradual. This will help the income of the high-risk businesses to recover and cope with tighter financial conditions. In this regard, Thai monetary policy may not need to accelerate interest rate hikes like developed economies. due to the slower economic recovery And there are deeper economic scars and roll-over risks in corporate bonds in slow income recovery sectors. catch up and reduce the risk of default during the rising interest rate