4% before Apple’s opening ↓, Taiwan Semiconductor, Foxconn, and STM also fell

“Withdrawal of production increase of 6 million units due to slowing demand in China,” Bloomberg reports

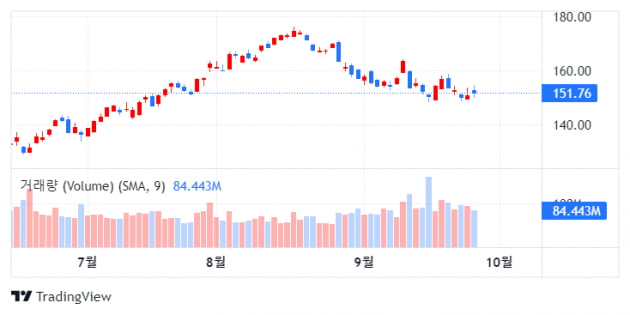

Shares of Apple and its suppliers worldwide fell following a Bloomberg report that Apple would withdraw its plans to increase production of 6 million iPhones due to lower-than-expected demand.

According to Bloomberg and MarketWatch on the 28th (local time), Apple (AAPL) plunged nearly 4% in pre-open trading on reports that it will withdraw its plans to increase iPhone production on the same day.

Taiwan Semiconductor, which was expected to supply additional semiconductors if Apple increased production, fell 2.2% in the Asian market on the same day, and the share price of iPhone assembly maker Foxconn fell 3%. Dutch-Swiss semiconductor maker STMicro fell more than 5% in the morning in European trading. The company’s dependence on Apple accounts for regarding 20% of its sales.

Earlier, Bloomberg reported that Apple had informed its suppliers that it was withdrawing its plan to increase production by 6 million units as demand for the iPhone 14 lineup did not grow as expected due to slowing demand in the Chinese market. Apple said it plans to produce 90 million units as originally planned, which is in line with Apple’s forecast this summer.

According to Jefferies’ analysis, purchases of the new iPhone 14 series fell 11% year-over-year in the first three days of launch.

According to market researcher IDC data, the global smartphone market is expected to decline by 6.5% from last year to 1.27 billion units this year. “High inventory levels in the distribution channels and low demand with no signs of recovery have led to a reduction in orders,” said Nabila Popal, research director at IDC.

By Kim Jung-ah, staff reporter [email protected]