‘High exchange rate = good export’ is a thing of the past

Loss of effectiveness due to sharp rise in raw material prices

Losses from airlines with high foreign currency debt surge

Chemical, steel, and battery industries are also struggling

As the won-dollar exchange rate broke through 1,400 won, domestic companies were caught in a ‘third-hand’ emergency of high exchange rates, high interest rates, and high prices. This is because the long-standing formula that exports increase when the exchange rate rises (depreciation of the won) is now a thing of the past. In particular, this ‘exchange rate shock’ is accompanied by a contraction in demand and an economic downturn, making companies more anxious.

On the 23rd, the won-dollar exchange rate in the domestic foreign exchange market closed at 1,409 won 30, down 40 days from the previous day. Although it declined slightly, it continued its high streak of 1,400 won for the second day. Due to the 1,400 won exchange rate, which came 13 years following the global financial crisis, companies that have to pay for raw materials in dollars are making a ‘evil’ sound.

Battery companies that produce products by importing raw materials from abroad, chemical companies that import naphtha, a basic raw material for petrochemical products, and steel companies that import iron ore and coal are being hit directly by the soaring exchange rate. The price of cathode materials purchased by LG Energy Solutions, the world’s second-largest battery maker, was $42.37 per kg, regarding double that of last year ($21.81). The average price of naphtha imported by Lotte Chemical was $863 per ton, up 41.0% from last year ($612). As of the second quarter, the exchange rate in the third quarter surged by 100 won from the end of the previous quarter.

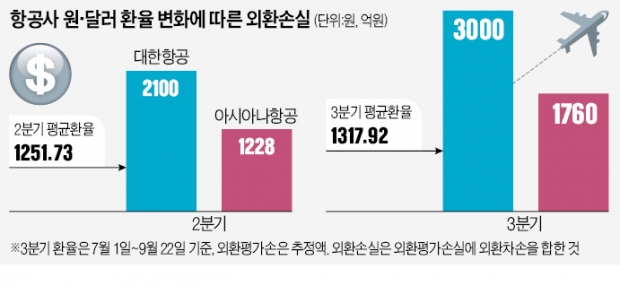

Companies with a lot of foreign currency debt are suffering from a surge in interest rates and a rise in the exchange rate. An example is airlines. It is estimated that Korean Air and Asiana Airlines will lose regarding 350 billion won and 288 billion won in foreign currency valuation losses, respectively, if the exchange rate rises by 100 won. Asiana Airlines, which had a debt ratio of 6544.6% at the end of June, suffered a loss on foreign currency valuation of 416.3 billion won in the first half of this year alone, more than double that of the first half of last year (198.3 billion won). As foreign currency borrowings borrowed to import aircraft reached 4.86 trillion won as of the end of June, interest expenses are snowballing.

An official from a large corporation said, “It is not easy to pass on the increase in raw material prices to product prices as global demand has also decreased due to the economic slowdown.”

Korean Air and Asiana, if the exchange rate rises by 100 won, only the valuation loss is 630 billion won a year

Soaring raw material and logistics costs due to high exchange rates… Food, chemical, steel, etc. hit directly

The U.S. central bank’s (Fed) hike in the benchmark interest rate and the resulting strong dollar are pouring into domestic companies. As the cost of raw materials and logistics soared this year and the exchange rate soared, each company is startled and convening an emergency response meeting to respond to the high exchange rate. The high exchange rate has been a factor in enhancing the competitiveness of export products, but the current high exchange rate is a sign of economic downturn. There is growing concern that corporate profitability may deteriorate significantly due to the sudden high interest rate and high exchange rate as soon as it leaves the low interest rate zone for a long period of time.

○ Busy in preparing countermeasures once morest sharp fluctuations in the exchange rate

According to the business world on the 23rd, major companies are busy analyzing scenarios and preparing countermeasures according to the high exchange rate one following another. In particular, with the forecast that the exchange rate might rise to 1,500 won per dollar early next year, companies are struggling, saying that they have to discard all existing business plans and make new ones.

An electronics industry official said, “The market is moving far beyond the initially expected exchange rate and interest rate figures. He sighed, saying, “Let alone next year’s business plan, we are in a position to re-examine the plan for the fourth quarter, which starts a week later, from the beginning.” An LG Energy Solution official said, “The dollar volatility is a bigger problem than the exchange rate rises. It is very difficult to come up with a stable business plan.”

In particular, there are many difficulties for companies that have to pay the price of raw materials in dollars. One of them is the food manufacturing industry, which imports raw materials such as wheat, oils and fats, and coffee beans from overseas and processes and sells them. There are many companies that delay purchasing raw materials and regret it because the exchange rate has been rising all the time. An official from the food industry said, “In the first half of the year, international grain prices jumped due to the war between Russia and Ukraine, and the purchase of ingredients was delayed.

The airline industry, which owes a lot of dollar debt for the import of aircraft, is also a representative industry that suffers from high exchange rates. If the exchange rate rises by 100 won, only Korean Air and Asiana Airlines will lose more than 600 billion won in foreign currency valuation. Asiana Airlines and low-cost carriers (LCC), which operate mainly in Asian countries, are in a situation where interest rates rise and high exchange rates are ‘tangled up’ while traffic with China and other countries is not sufficiently resolved.

The steel industry, which buys iron ore and coal from overseas, and the oil refinery, which imports and refines crude oil, have also been hit hard. The price of iron ore imported by POSCO stood at $126 per ton in the second quarter, up 31.2% from the fourth quarter of last year ($96). As raw material prices fluctuated and the exchange rate soared, the cost of purchasing raw materials is highly likely to rise further in 3Q.

○“The topic for next year is cost reduction”

Businesses agree that the strong dollar will not change easily. This is because the Fed has a strong will to control inflation, and there are many reasons why the dollar has no choice but to strengthen, such as the Russia-Ukraine war and the US-China conflict. Kim Hyung-joo, senior research fellow at LG Business Research Institute, said, “The current high exchange rate is not due to a liquidity crisis as it was during the foreign exchange crisis or the financial crisis.

Companies that benefit from the sharp rise in the exchange rate are also not as bright. Automobile, shipbuilding, and semiconductor-related industries with a high proportion of exports. In the second quarter, Hyundai Motor recorded 2.154 trillion won in sales and 641 billion won in operating profit as a result of the exchange rate appreciation. However, a Hyundai Motor official said, “The bigger problem is that the car does not sell no matter how much money is paid in dollars. There is,” he feared. Sung-tae Jeong, a researcher at Samsung Securities, said, “In a situation where demand is shrinking due to the economic downturn, the sense of crisis caused by the overall recession is greater than the immediate exchange rate gains and losses.”

Companies are defending once morest exchange rate risk in various ways, such as diversifying supply chains, diversifying payment currencies, and subscribing to derivatives. SPC Group announced that it is considering a plan to pay for raw materials imported from outside the US, such as French butter and Australian wheat, in local currency instead of dollars.

Lee Sang-eun / Kang Kyung-min / Park Han-shin / Hankyung reporter selee@hankyung.com