The dollar would not have a significant drop in the remainder of 2022At least that is the first impression of the experts when they look at the macroeconomic situation in the United States.

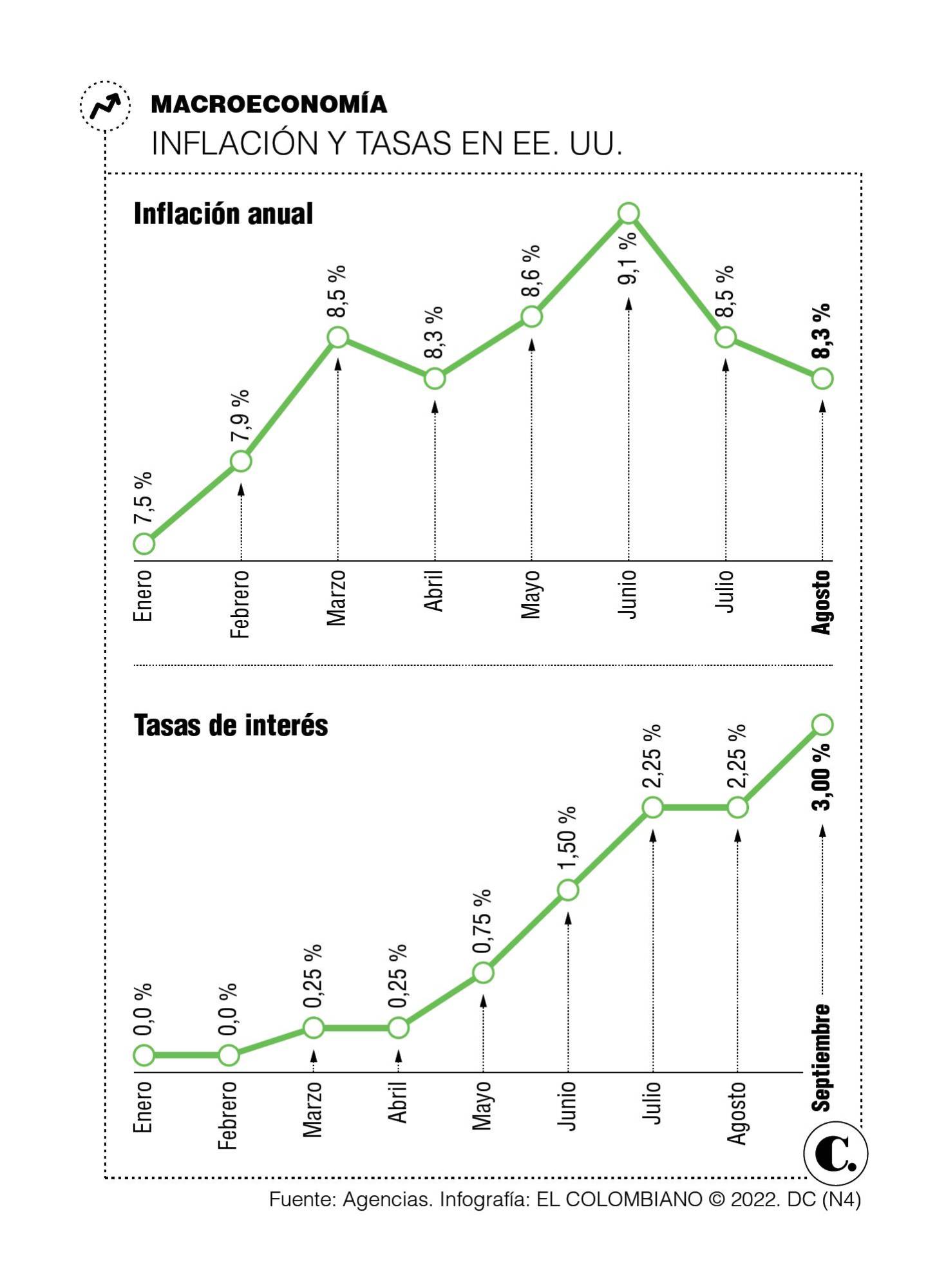

We must put the matter in context: in the North American country they are facing the highest cost of living in the last 40 years. Consequently, the Federal Reserve (Fed), counterpart of the Banco de la República, it is raising interest rates with the aim of slowing down the rise in prices.

Jerome Powell, Chairman of the Monetary Authority, yesterday announced the third consecutive increase of 75 basis points to leave rates in a range of 3% and 3.25%, very much in line with what the markets around the world expected. And although there is not a big surprise to shake investors, it is not enough to detract strength from the price of the dollar.

What can happen?

Rate increases by the Fed have an effect on other economies. This is taking into account that investors prefer to take their dollars to the US and that reduces the amount in circulation to negotiate them in other countries, which is why the gringo currency becomes more expensive.

Gregorio Gandini, a financial market analyst, affirmed that this scenario had already been discounted in Colombia and that explains the rally that the currency had between June and July, a period in which it reached the historical price of $4,627, a record that is still valid.

The Federal Reserve still has two more meetings left for 2022 and Jerome Powell has already warned that, if the cost of living does not yield, there will be more increases in rates. With this in mind, from Gandini’s point of view, the first thing that can be expected is that the dollar remains strong in other countries.

To illustrate, take a look at the DXY index, which measures the greenback once morest a basket of seven other currencies, including the euro. When it rises, it reflects the appreciation of the US currency once morest the others.

This year, the DXY started at 96.21 units and with the passing of the months it shot up because the market was already waiting for the Fed to increase its rates. Yesterday, for example, this index jumped from 110.17 to 111.39 units.

In Colombia, according to Gandini, it is very possible that the dollar will continue between $4,000 and $4,400, which is the range that has been observed in recent weeks. In other words, a significant drop is not expected. And from the point of view of the analysts consulted by the Banco de la República, the dollar might end up between $4,200 or $4,290.

Alexánder Ríos, an analyst at Inverxia, explained thatHourly rates in the US are estimated to close 2022 between 4% and 4.25%. “So, a door is opened for the dollar to have more bullish than bearish sentiment. Although analysts maintain the perspective of a dollar at $4,200 in a positive scenario, if inflation in the US does not subside, the possibility opens up for it to end above $4,400 in the worst case scenario”, he pointed out.

For your part. Andrés Pardo, chief strategist for Latin America at XP Investments, noted that, evidently, the increase in the US rate “puts upward pressure on the dollar for this Thursday, since the foreign exchange market closed yesterday at 1: 00 in the followingnoon, before the Fed’s decision.

“Nevertheless, there may be later corrections. Next week the decision of the Bank of the Republic of Colombia will be importantwhich if it manages to raise its interest rate by a magnitude similar to that of its last meeting, might contribute to a downward correction in the dollar, although I do not think it will be very marked, “added the expert.

/img/9238500.jpg?v=0&st=AkYS32jRvmmRqj4IdLOO17_wfDfb8JksVNBef1iYCHk&ts=1600812000&e=0)