The US CPI announced on Tuesday (13th) increased by 8.3% year-on-year, higher than the expected 8.1%, but lower than the previous value of 8.5%. Although the growth rate fell, it still triggered a violent reaction on Wall Street, and blood flowed into the US stock market. Experts interpret that the main crux is that “there is no good news” in the entire report.

Markets were upbeat ahead of the release of the Fed data, and stocks even strengthened ahead of schedule. The mainstream view is that energy prices represented by gasoline have dropped significantly in August, and the Federal Reserve has raised interest rates strongly, which is expected to be reflected in various data.

However, what the CPI data shows is the supply shock initially caused by the epidemic, which has now turned into a full-blown inflation. Housing, food and medical care have become the main drivers of price increases in the month, and prices in some areas have even appeared. a record increase.

Energy prices do nothing to stabilize inflation

Gasoline prices fell 10.5%, while food prices rose 0.8%, the report showed. Both numbers were in line with expectations, but other parts were surprising.

Stronger-than-expected data on both core goods and services: Core CPI rose 0.6% m/m vs. consensus expectations for a 0.3% gain, taking the annual pace to 6.3% from 5.9% previously, as consumers appear to be buying from relatively cheap Necessities, shifted to discretionary goods, inflating prices in the process.

Prices of core goods rose 0.5%, including apparel (0.2%), new cars (0.8%), health care goods (0.2%) and alcoholic beverages (0.4%); most on Wall Street had expected a small decline in apparel prices, with new car prices There will be a small increase, but the price of a new car has risen unexpectedly.

Meanwhile, used car prices fell 0.1% month-on-month, a smaller decline than most had expected.

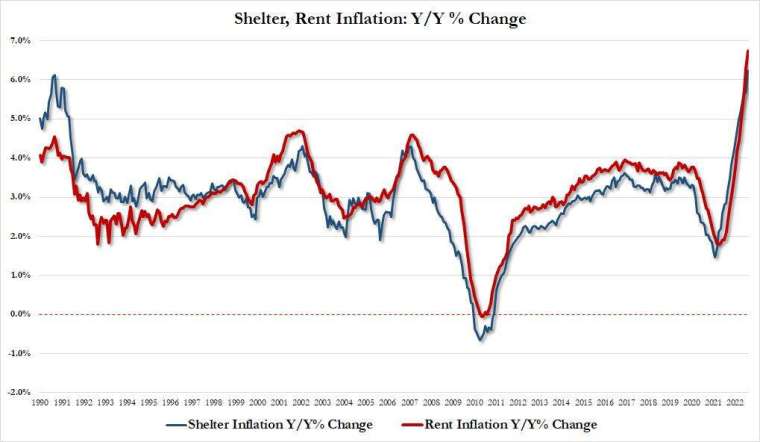

The worst part came when housing prices surged once more by 0.7%, while rents (0.7%) and owner-equivalent rent OERs (0.7%) were broadly in line with expectations, and there were no signs of this trend line slowing anytime soon.

Not what the Fed wants to see at all

Bank of America believes that the unexpected strengthening in core commodity prices this month suggests that further supply chain pressure relief and inventory rebuilding are needed, especially in the auto sector, before good price pressures ease.

Rob Dent, an analyst at Nomura, said there was a strong rally in both goods and services, and the Fed will be very focused on that, “there’s no good news in the entire report.”

James Athey, director of investment at Abrdn, believes that the recent rebound in the stock market looks very misjudged and premature. Relative to the consensus, this CPI reading is very strong, which is not what the Fed wants to see at all. The odds of a slower pace of rate hikes following September have receded as a result of these data.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, noted that U.S. inflation has not eased as investors had hoped, and core inflation accelerated more than expected. Today’s data was interpreted as a guarantee of a 75 basis point rate hike next week, with 50 basis points or more likely next month.