An analysis has been raised that the electric vehicle tax reduction clause in the US Inflation Reduction Act (IRA) will eventually be amended. The reason is that excluding the batteries of the three domestic companies that have partnered with major US automakers might put a brake on the US electric vehicle market.

Currently, the three domestic battery companies, LG Energy Solution, SK On, and Samsung SDI, have established joint ventures with General Motors (GM), Stellantis, and Ford to establish or are in the process of constructing a battery plant in the United States. In particular, Ford is a leading company in the US electric vehicle market. The Ford Mustang Mach E model also took fourth place in the US electric vehicle sales rankings in the first half of this year.

According to the U.S. Department of Energy, the proportion of domestic battery makers in the total U.S. battery production facilities will increase to 70% by 2025. In fact, it means that batteries from the three Korean companies are supplied to most electric vehicles in the United States.

If you look at the top 10 companies in the annual cumulative electric vehicle battery usage (excluding the Chinese market) announced by SNE Research, three Japanese battery companies remain, excluding Chinese and Korean companies. Lithium Energy Japan (LEJ) and Prime Earth EV Energy (PEVE) are still evaluated as infancy level battery technology, so Panasonic is the only one in terms of actual technology.

Panasonic is supplying batteries to Tesla, accounting for 87% of the total supply. Panasonic is also highly dependent on China for the supply of raw materials for batteries. There is no big difference between the three domestic battery companies. Moreover, while Hyundai Motor and Tesla are bisecting the electric vehicle market in the US, if tax credits become impossible for the three domestic batteries and Panasonic batteries, the conversion to eco-friendly cars in the US is no different.

Some experts have suggested that the US authorities are aware of this and adopt a kind of ‘political wait-and-see’.

Sung-Hoon Yoon, a professor at Chung-Ang University’s Department of Convergence Engineering, said, “It is impossible to supply batteries that replace Chinese-made raw materials within two years. There is no way to know this. It is highly likely to act strongly as a kind of political investigation and then gradually revise the bill.” analyzed.

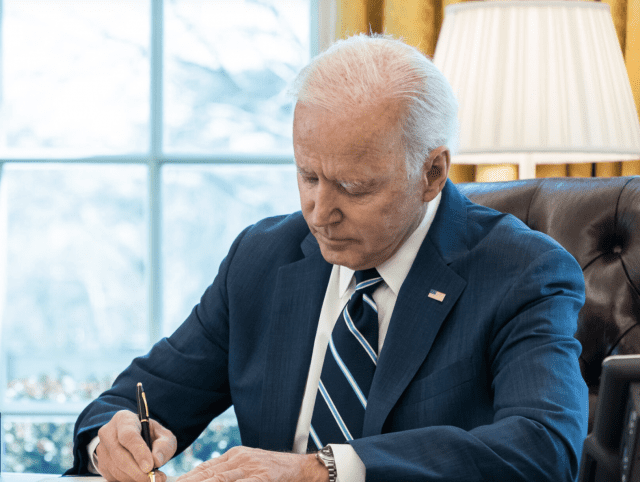

In fact, the U.S. government pushed for the signing of the ‘IRA’ bill despite concerns from countries such as Korea and the European Union (EU), but recently decided to form an emergency channel for electric vehicle tax credit with the government.

Related articles

Earlier on the 7th (local time), the Ministry of Trade, Industry and Energy announced that it had agreed to establish a separate bilateral consultation channel with the United States regarding electric vehicle tax credit.

An official from the Ministry of Trade, Industry and Energy said, “It is difficult to say that the bill will be amended, but it can be viewed as a positive current.”