In its July periodic risk report, the UK regulator FRC (Financial Reporting Council) the auditor BDO for the unacceptable quality of the audit of an unspecified financial service provider.

Like right now die Financial Times has learned from reliable sources, the audited company is the mother of all mobile banks – Revolut.

The complaint comes at the worst possible time. Revolut has to grow faster, the competition from the digital neobanks never sleeps.

The company urgently needs a full banking license in all markets and the corresponding capital. If the financial figures for the 2021 financial year are not accepted in September, both are in question.

Managers are already leaving the ship.

The development stands in stark contrast to the previous success story. Revolut is very popular – also in Switzerland.

According to its own information, the fintech has 18 million users worldwide, around 450,000 of them in Germany. That’s more customers than all other Swiss neobanks combined.

The attractive conditions in currency exchange have made Revolut’s debit cards the preferred means of payment during the holidays.

However, not everything seems to be so free.

In December 2018, Revolut received a “specialized banking license” from the Lithuanian banking regulator, allowing the company to accept deposits and make loans.

However, Revolut is not allowed to offer its own investment products with this license. This year 10 more countries have been added.

In England, of all places, where Revolut has its headquarters, the bank remains “only” an e-money institute – basically a service provider that simplifies money transactions without being able to influence the management of the money.

So far, however, this fintech model has been the decisive advantage over traditional banks. One participated in the transaction turnover without costs for compliance and complex regulation.

The traditional banks might take care of that.

The costs of the service were therefore not substantially lower at the core, they were just borne by a different one – a well-known pattern of digital disruptors, as the example of Uber shows.

Taking a taxi is basically still the same price. You need a car, gas and a driver to get you from A to B.

Although the technology brings supply and demand together more efficiently, the effective customer benefit ultimately consists in the lower price, which is achieved on the hump of the “self-employed taxi drivers” who, with low social benefits and cheap conditions, chaff people around with their private cars.

The “taxi drivers of the financial industry” didn’t put up with this any longer. In the fight once morest the new competition, they upgraded with alternative products.

Your greatest weapon: the banking license. The banks didn’t necessarily need Revolut, but Revolut needed them.

In other words: Revolut had to go with the banks where Zalando went with the shoe stores.

In order to reduce dependence on banks and to be able to offer its own additional services, Revolut is striving for full banking licenses.

In England, the company applied for a banking license with the British Financial Market Authority FCA in January 2021. To this day, however, she is waiting for an answer.

Alternatives to licenses? Revolut hardly has them.

For better or for worse, the neobank must grow as quickly as possible. Only a dominant market position forces the banks to continue working with the fintech.

The competition is big. “The acquisition of new customers has become more difficult and expensive,” attested Thomas Hilgendorff, head of the hipster neobank Yapeal, at the beginning of the year.

New players like Yuh! from Swissquote and Postfinance are entering the market, while Neon or Zak have almost been forgotten.

UBS also caused astonishment, which now does not want to buy the US fintech Wealthfront.

Technology can be copied. The barriers to entry are low. User numbers are everything.

According to the research house WhiteSight, 16 neobanks ceased their activities this year alone. The winner takes it all – or to put it another way: the one with the deepest pockets.

Revolut has no choice but to do everything possible to drive growth. Eat or be eaten.

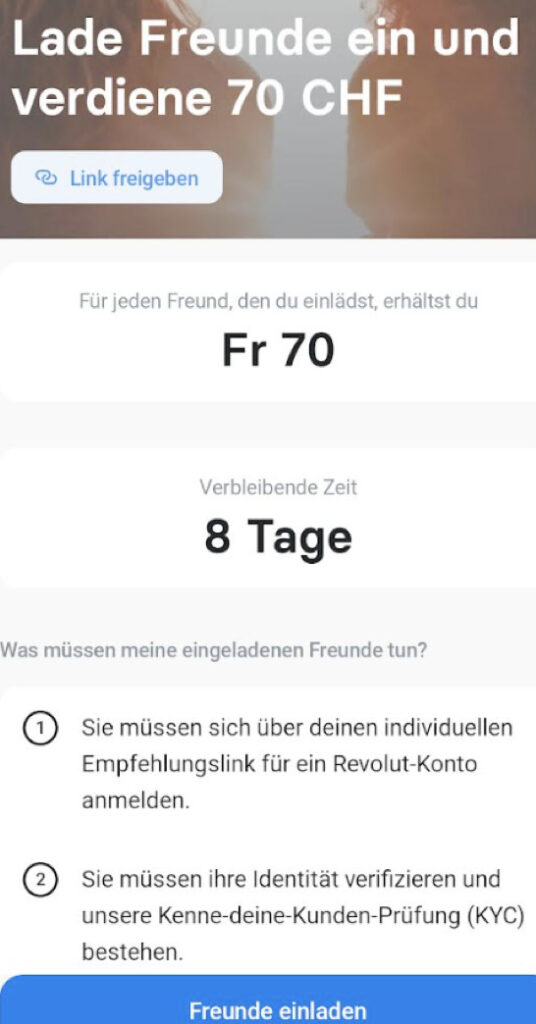

Customers who recommend Revolut are currently being issued a hefty reward. The current promotional offer is CHF 70 per new customer.

In the previous months it was 90.

Anyone who saw their cash register ringing when they looked at their rebellious Facebook friends was happy too soon. The friends must make 3 individual purchases of at least 5 francs within 8 days with the physical Revolut card.

What appears to be no problem at first glance turns out to be problematic at the latest when you receive the card following 8 days.

Sorry, missed the deadline, it says in the app – accompanied by a torn heart. Apparently the fake friends are to blame for the missed gilet money.

Irrespective of the tone of voice, telephone inquiries are referred to the Frequently Asked Questions by the roboadvisor without emotion.

It says under “When will I get my card?” Amazing: Depending on the delivery method, it can take up to 10 days for standard and up to 5 days for express deliveries.

So if you can’t count on friends who will do everything they can to get their hands on the Revolut card as quickly as possible, look into the tube.

Revolut also holds a carrot in front of crypto donkeys. Anyone who trades their coins via Revolut in the future will receive 15 francs. Crypto trading fees have been summarily slashed by 20%.

Growth above everything.

The expansion costs. In 2020, Revolut posted a loss of £168 million (CHF 190 million) on £222 million in revenue (CHF 250 million)

That burns a lot of capital.

In July of last year, Softbank and Tiger Global invested $800 million in the fintech in its most recent funding round, taking the neobank to a staggering $33 billion in valuation, 6 times more than at the end of 2020.

Revolut-CEO Nikolay Storonsky exulted: We have enough money for 2 years. At the same time, he sold his own shares on a large scale.

Conversely, even if the $800 million injected should be enough for two years, this means that Revolut will probably burn around half a billion annually and will have to raise capital once more next year at the latest.

We’re talking regarding $1.5 billion. To this end, the board of directors has been strengthened with Martin Gilbert, ex-co-CEO of Standard Life Aberdeen, and Michael Sherwood, ex-co-CEO of Goldman Sachs London.

An IPO was considered. In September 2021, Storonsky said: “To successfully complete an IPO, you need a few billion in sales.”

Although the billion in sales is still a long way off, that didn’t seem to stop the Revolut boss from recruiting an entire investor relations team in May this year.

Stock market experience required. Platforms like Equityzen are already offering pre-IPO shares in Revolut.

But the times for airy ratings are over. Tech stocks have taken a beating over the past 12 months.

Financing has become more difficult with rising interest rates. Anchor shareholder Softbank even announced a record loss of $23 billion a month ago.

The FRC and FCA might become a show stopper. It remains to be seen whether Revolut, under the increasing pressure to show growth, has not been so precise with the numbers.

There is talk of “aggressive revenue recognition” and “undetected material misstatement”. In other words: Revolut allegedly booked sales that had not yet occurred and possibly misled investors.

The ball is now up to the auditor BDO to go over the books at Revolut.

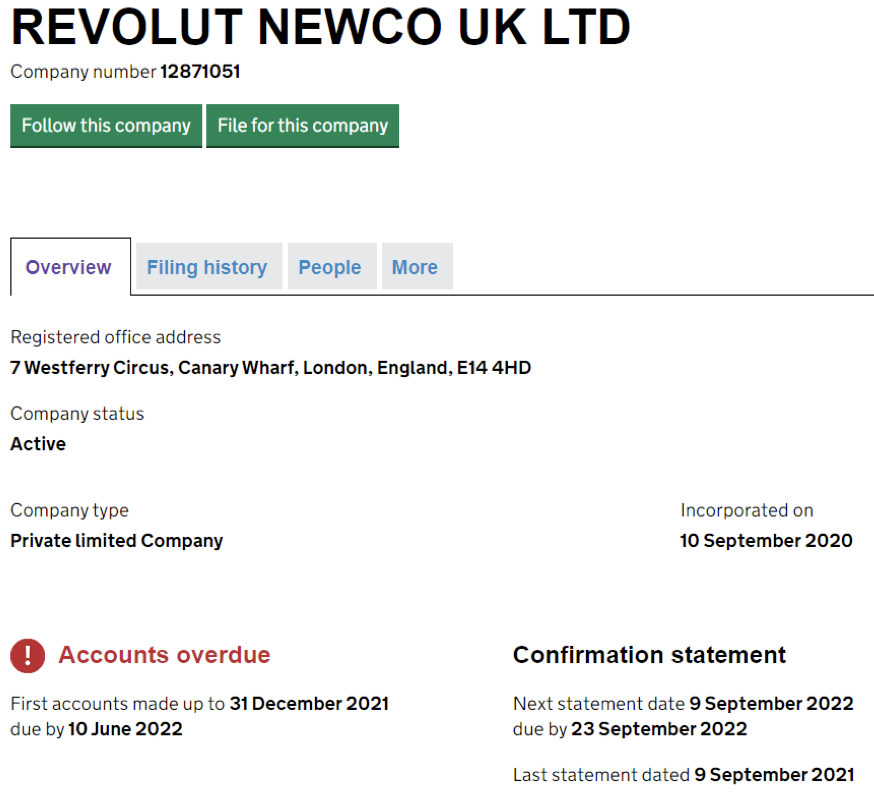

This happens at the wrong time. At the end of September, Revolut Group Holding and its subsidiaries (including Revolut Newco, Revolut FIC, Revolut Travel) would have to submit the audited figures to the regulator.

Actually, this should have happened in June. If September also passes without being used, the financial services provider faces sanctions.

The UK banking license would be a long way off.

Some of the neobank’s top managers obviously didn’t want to wait that long: they jumped overboard.

Against the background of the accounting allegations, it is explosive that the departures mainly took place in Risk & Compliance.

Recent appointments included UK and Global Head of Regulatory Compliance Justine Wootton and UK Anti-Money Laundering Officer Mathew Seneviratne.

Then there was Global Chief Compliance Officer Harry Gill, Head of Global Affairs and Wealth & Trading Deirdre Halligan, and Chief Revenue Officer Alan Chang and Head of Privacy: they all threw in the towel earlier in the year.

Revolution looks different.