The eight minutes long Network by Jerome Powell in Jackson Hole has cost world markets two trillion in market capitalization – the wealthiest Americans have lost $78 billion in wealth in those eight minutes. So it was one of the most “expensive” speeches in history, one might say. If you calculate Powell’s eight-minute speech in Jackson Hole and the subsequent global loss of two trillion dollars down to one second, the Fed chairman has a loss of $4.2 billion per second!

Powell in Jackson Hole – ready to take pain

Fed Chairman Powell had made it clear to the markets that the US central bank would not change course in its interest rate policy quickly, but would instead keep interest rates high for a longer period of time, primarily in order to bring inflation expectations down. Jerome Powell mentioned former Fed Chair Paul Volcker three times in his speech – a clear indication that Powell wanted to signal to the markets his determination to fight inflation.

Even if fighting inflation will cause pain, as Powell made clear: “they will also bring some pain to households and businesses” (…). “Those are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

The pain came quickly – notably the highly rated US tech stocks lost market cap. That’s costing those super-rich Americans who hold significant stakes in these companies — like Tesla’s Elon Musk — dearly. In fact, the US Federal Reserve under Jerome Powell has now become an “enemy of the stock markets”. Because if the stock markets lose market capitalization, the so-called “financial conditions” tighten. This reduces demand, which in turn reduces the inflation-driving imbalance between supply and demand.

The Loss of the Super Rich by Powell’s Speech

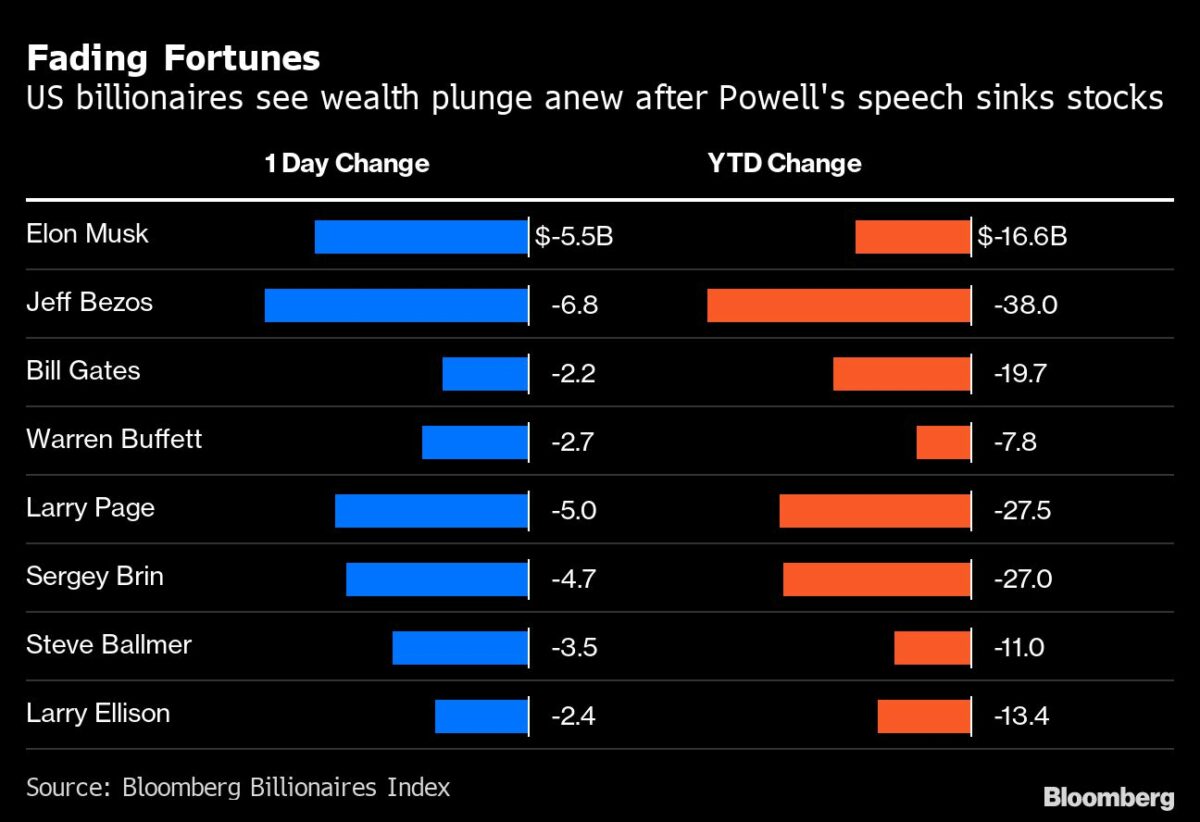

But what do the losses of the super-rich look like in detail? Bloomberg writes:

In just eight minutes, Federal Reserve Chairman Jerome Powell triggered a stock market crash that eroded the wealth of the wealthiest Americans by $78 billion.

Elon Musk lost $5.5 billion of his fortune. Jeff Bezos lost $6.8 billion, more than anyone else on the Bloomberg Billionaires Index. Bill Gates and Warren Buffett’s fortunes fell by $2.2 and $2.7 billion, respectively, while Sergey Brin’s fell below $100 billion.

Powell used his speech at the Kansas City Fed’s annual monetary policy forum in Jackson Hole, Wyoming, to reiterate that the Federal Reserve will continue to raise interest rates to lower inflation and will likely keep them high for a while longer. This was seen as a reaction to the recent rally in US stock markets, which had been fueled by speculation that aggressive monetary tightening might soon be phased out.

The S&P 500 fell 3.4% for its worst day since mid-June. The tech-heavy Nasdaq 100, whose top individual stocks include Microsoft Corp., Amazon.com Inc., Tesla Inc. and Alphabet Inc., fell more than 4%.

Few billionaire fortunes have been spared this year. The world’s 500 richest people lost $1.4 trillion in the first half of 2022, the sharpest six-month decline ever for the world’s richest people. In July, however, US stocks posted their strongest monthly gain since November 2020, leading investors to believe the worst of the market crisis was over.

Instead, Powell’s speech served as a reminder that valuations for large tech companies are still high by historical standards. During the Covid-19 pandemic, when interest rates were near zero, they had increased at an unprecedented rate.

FMW/Bloomberg