- Rafael Abuchaibe (@RafaelAbuchaibe)

- BBC News World

3 hours

image source, EPA

Biden made the announcement accompanied by his secretary of education Miguel Cardona

Wednesday was a day of surprises for Monica Geary, a 27-year-old American. And while she says they were all good, there are a few that she’s most excited regarding.

And it is that the president of the United States, Joe Biden, has just announced that the federal governmenta lossWe buy up to $20,000 in student debt to those who qualify. In addition, he said that the temporary suspension of payments on these debts-standing since the start of the coronavirus pandemic-will be extended until the end of the year.

“When I found out, I was reviewing how much I was going to have to pay monthly to not only pay the interest that I am incurring with my student debt, but also to be able to pay the main debt,” Geary tells BBC Mundo.

The young resident of Washington DC still owes the federal government more than $120,000 in student debt for a postgraduate degree in international development.

Monica says that the $10,000 that will be forgiven her may not make much of a dent in her total debt. But that’s not to say she wasn’t happy regarding Wednesday’s announcement.

“I’m more excited regarding the announcement that the interest and payment break has been extended than I am regarding debt forgiveness. It’s $10,000, it really doesn’t make any difference to my debt, does it?”

Monica is one of the 43 million Americans who they can benefit from Biden’s ad.

Measures have been criticized by Republicans and some moderate Democratswho consider that with them the weight of the debt is being transferred to citizens who have never been in debt and will contribute to increasing inflation.

image source, Getty Images

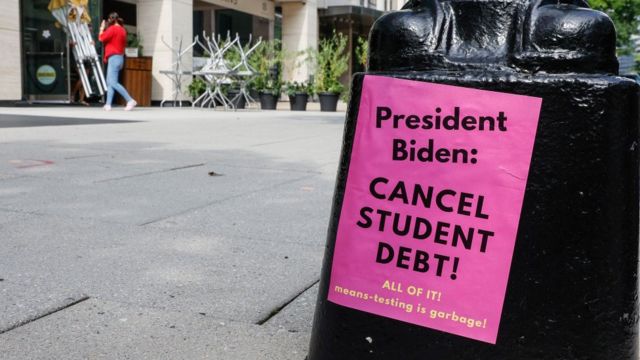

One of Biden’s campaign promises was to eliminate student debt. The young people demanded that the president fulfill his promise.

Who will benefit?

President Biden assured that the measures he was going to announce were designed to counter “unsustainable” increases in higher education prices in the country.

Accompanied by his Secretary of Education, Miguel Cardona, Biden assured: “The weight (of student debt) is so great that even if you graduate, you may not have access to the middle-class life that a university used to provide.”

Thus, the US government will forgive up to $20,000 in student loans to people who have been beneficiariesas of the Pell scholarshipa federal grant that helps the lowest-income students with the best grades to access higher education.

To people who have student debts and have wages inferior at $125,000 a year (family income less than US$250,000), the government will forgive up to US$10,000.

According to White House figures, the Biden administration expects some 43 million people with student debt to benefit, while regarding 20 million will finish paying their debts with this ad.

image source, Getty Images

Students have been protesting for years to have their debts cancelled.

Help for students

Katie Seifert, originally from the state of Virginia and currently a digital strategist in the US capital, is one of the people who, with the White House announcement, will be able to continue her life without student debt.

“I was very lucky because I got a lot of scholarships that covered my tuition while I went to college, so I didn’t have to pay anything while I was there. But I did get almost $20,000 in federal loans so when I graduated I wouldn’t have to take out private loans.” , he told BBC Mundo.

Before the president’s announcement, Katie’s debt was around $3,500. That is, within the parameters of the White House, Katie will no longer have student debt.

“I am very excited to have this $3,500 forgiven. I graduated with regarding $20,000 in debt and it took me 5 years to get it down to $3,500.”

To live while you study

Like Monica, Juan Gómez, a journalist who arrived in the city of Miami more than 10 years ago, told BBC Mundo that he had received a federal loan to be able to study for a postgraduate degree.

But in the first semester, when Juan received his loan funds, he received more money than he expected.

“They lent me money as if I were just going to study,” that is, as if I wasn’t going to work while I finished my postgraduate degree. “The first semester they lent me an amount of money, I didn’t know and I said ‘well, I spend what I need and I keep the rest’. So it was a very big mistake”.

Because of that mistake, Juan still owes almost $21,000 in student debt. But unlike Monica and Katie, Juan is 41 years old and has three children.

Now, with Biden’s announcement, Juan’s debt might be cut in half.

“I haven’t paid student debt for regarding a year and a half,” he says, thanks to the suspension that has just been extended until the end of the year.

“That’s also good to know, because I have monthly payments of regarding $300 that I’m going to have to add to the budget when the suspension is over.”

A risk for inflation?

Republicans and some moderate Democrats have said canceling debt will increase inflation by giving Americans more money to spend.

image source, Getty Images

House Republican Leader Kevin McCarthy criticized Biden on Twitter.

The leader of the Republican minority in the House, Kevin McCarthy, criticized the president through Twitter: “Who will pay for Biden’s debt transfer hoax? American workers who have already paid their dues or who never took them on in the first place.”

However, Democratic voices have responded by saying that by canceling those debts, it will help to eliminate some economic inequalities caused by racial differences.

And it is that black students are more likely to take out federal student loans and in higher amounts than other Americans. Four years following earning a bachelor’s degree, black borrowers owe on average nearly $25,000 more than their white peers, according to a Brookings Institution study.

As President Biden walked away Wednesday from the atrium from which he announced the measures, a journalist asked him regarding the impact this measure might have on the recent increases seen in inflation.

“I will never apologize for helping American workers and the middle class,” the leader said.

“No high-income individual or household will benefit from this action.”

Remember that you can receive notifications from BBC World. Download the new version of our app and activate it so you don’t miss out on our best content.

Remember that you can receive notifications from BBC World. Download the new version of our app and activate it so you don’t miss out on our best content.