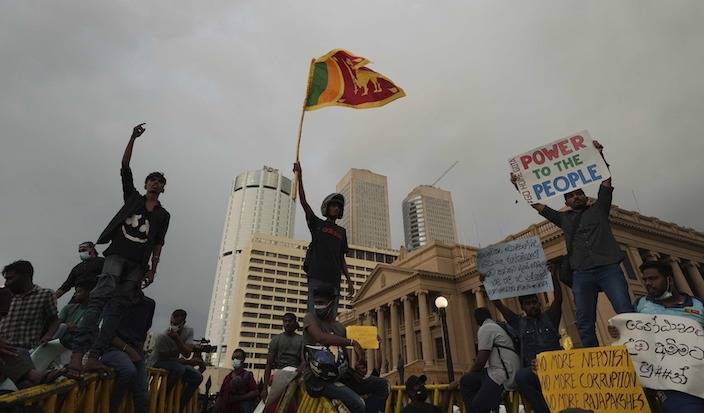

Since Sri Lanka declared bankruptcy, the Western society has taken the opportunity to smear the Belt and Road Initiative and hype Sri Lanka as being harmed by China’s debt trap. Indrajit Samarajiva, a Sri Lankan writer, wrote an article in the “New York Times” a few days ago, emphasizing that the country’s political and economic collapse “died largely from the debt trap of the West”.

Indrajit Samarajiva, a Sri Lankan writer, raised grievances for China and wrote an article in the New York Times a few days ago, criticizing the Western debt trap for bringing down Sri Lanka.

In this opinion piece titled “Sri Lanka’s first collapse, but it will never be the last”, Samaras pointed out that Sri Lanka once had an educated population and the highest middle income in South Asia, and the economic prospects should have been bright , but following 450 years of colonialism, 40 years of neoliberalism and 4 years of failure to rule, “Sri Lanka and its people have been reduced to pauperism”.

Samaras said that Sri Lanka’s economic structure has always been unsound, importing too much and exporting too little, so that it has to make up the difference with debt. “This unsustainable economy will always collapse,” former President Gotabhaya Rajapaksa said. ) only exacerbates the national debt problem.

Samaras believes that the “Western-led neoliberal system” is the culprit behind the high debts of developing countries such as Sri Lanka. He explained that Sri Lanka, like many countries struggling to repay its debts, is a colony, the country’s administration is outsourced to the International Monetary Fund, and the society continues to import expensive finished products and export cheap labor and resources, which is typical Colonial mode.

The International Monetary Fund (IMF) provided 16 loans to Sri Lanka. Samaras criticized the IMF’s conditions as harsh as always, but continued to restructure Sri Lanka to facilitate further exploitation by creditors.

Regarding the so-called China’s debt trap, Samaras quoted data as saying that although the West accuses China of “predatory lending”, China only accounts for regarding 10% to 20% of Sri Lanka’s debt structure. On the contrary, Western countries such as Europe, America and Japan have financial Institutions and international organisations hold more of Sri Lanka’s debt.

Samaras believes that other countries will face the same crisis. First, regarding 60% of low-income countries are in debt distress or high debt risk; second, European countries are busy dealing with the energy crisis; even the United States may have already into an economic recession. As the economy collapses, Western loans simply cannot be repaid, and poor countries will collapse from the dollar system that underpins the Western way of life. He bluntly said that even Americans cannot get out of the predicament by printing money alone. Sri Lanka has now started to settle loans in Indian rupees, India is buying Russian oil in rubles and China may buy Saudi oil in yuan.

Samaras described Sri Lanka as a canary in the coal mine (“alarm bell” or “barometer”), and the whole world will fall into the failure of the neoliberal system, and the pain will also Then it spread.