Consumption has been one of the responsible for the good moment of the economy in terms of growth of the Gross Domestic Product (GDP).

In fact, household spending in 2021 reached a historic figure of $8.46 billionwhich represented 72% of the national GDP.

Nevertheless, the country is still recovering from the ravages of the pandemicso the question is, where do the resources come from that have allowed Colombian spending to increase?

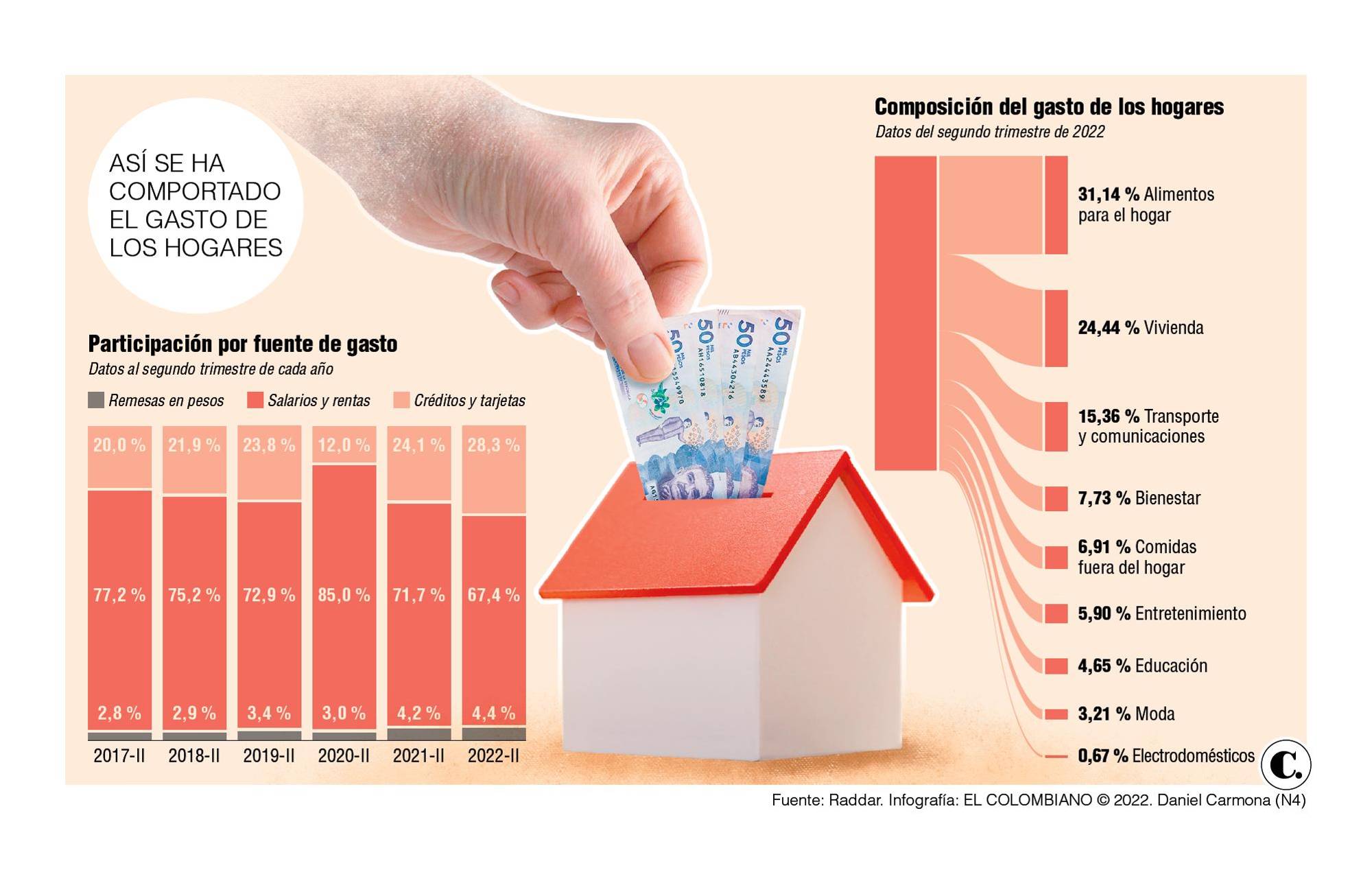

According to the Raddar consultancy, During the second quarter of this year, households spent $219 billionthat is, $29 billion more than that registered in 2021, which meant a growth in quarterly spending of 15.41%.

Likewise, data from June this year showed that spending was $75 billionwhich represented an increase in spending of 14.77% compared to June 2021. This would be due, according to the research firm, to the increase in employment, remittances, the number of credit cards and transactions.

Where does the money come from?

A report by the Bancolombia research group showed that among the most important sources of income that allow households to have consumption capacity are workers’ wages, consumer credit disbursements and remittances.

The first represents resource inflows of employees in companies and it is the most important source, which has improved as the unemployment rate in the country is reduced.

And although there is still a way to go to reach a single-digit unemployment rate, according to Dane, in June of this year there was in the country 2.79 million unemployedwhich meant a decrease of 650,000 people compared to the same period in 2021, when it registered 3.4 million unemployed people.

For its part, the second most important source of income is credit disbursements and consumer loanswhich groups together the different lines and modalities of the financial system, including purchases made with credit cards.

According to Radar, credit placement in households by the financial sector in credit cards, consumption and mortgages it grew by 33.5% in June 2022, compared to the same month last year; while the value of credit card transactions grew 43.8% compared to the same month of 2021.

Finally, remittances constitute another representative income for many families in the country, although to a lesser extent (see graph).

Allowances and savings

Another important source of income for households, and whose main impact is on low-income families, are the subsidy programs of the National Government.

“Only this year a total of $6.6 billion is expected to be transferred to these households through the Solidarity Income program, which will undoubtedly be the one with the greatest boost to consumption”, affirmed Bancolombia analysts.

And they highlighted that although the amounts are lower than the other sources of resources mentioned aboveare values that are becoming increasingly important, especially in the future.

As for savings, this might also be considered as a source of income. According to analysts, so far in 2022 there has been a significant reduction of $7 trillion in the savings accounts of individuals in the financial system. And this would happen because with the pandemic both the number of savers and the savings balances of Colombians increased.