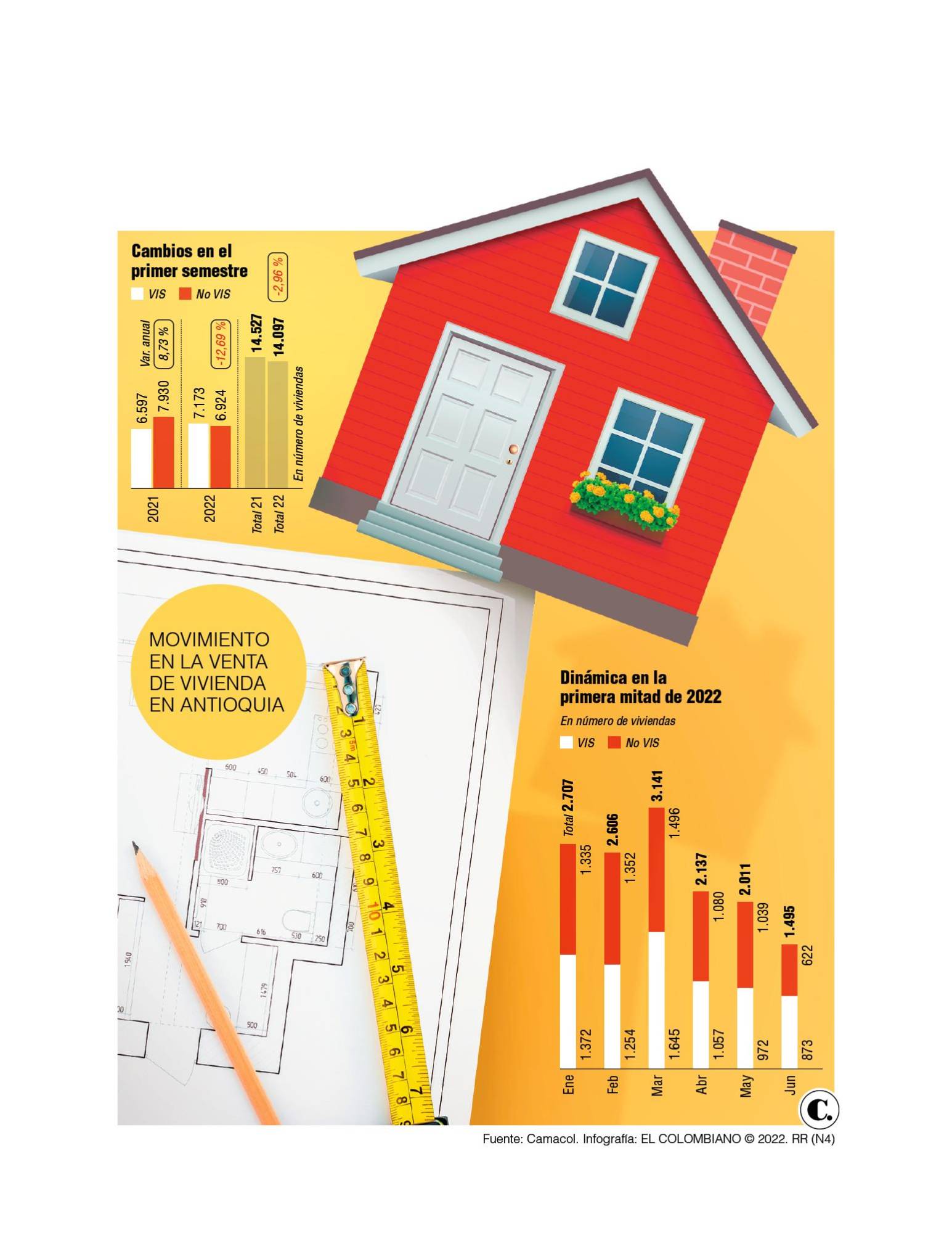

Despite the fact that in Colombia housing sales grew 2.5% in the first semester, reaching 127,218 units sold, in Antioquia the trend was the opposite because 14,097 sales were reported, 2.96% less compared to 14,527 in the same period of the year. 2021, according to Camacol. This contrasts with a positive trend that even left a transfer record the previous year thanks mainly to subsidies.

For those who work in the sector, there have been three determining factors for this: interest rates are rising, the costs of construction materials are skyrocketing and, ultimately, the price of projects is rising and this is transmitted to the consumer. end, who is more cautious looking at the context.

“There is a lot of uncertainty. The projects have decreased and the builder thinks regarding how he is going to sell the square meter due to the increase in materials. What you see in the figures is very consistent with what is happening,” says Juan Diego Merino, owner of Inmobiliaria Merino Hermanos, which offers housing in El Poblado and Laureles.

It’s just that the rise in construction costs is starting to kick in. Anif, a center for economic studies, warns that imported supplies account for 40% of the materials used by the sector and are the most affected.

With figures from Dane, Camacol has said that from June 2021 to June 2022 the price of steel has risen an average of 63% and this, added to “the lack of forcefulness in the required commercial policy measures”, puts at risk 250,000 housing projects in the country, especially of social interest.

It hits the vulnerable

For Anif, it is clear that the problem is having implications especially for low-income people, although it might be extended to those with medium and high income, since the conditions for buying a home “have become unfavorable.”

The situation is causing even those who bought their home not to have “the guarantee of receiving the property within the established period or, in the most complex cases, of even receiving the home,” Anif mentions.

All this is added to the fact that the interest rate of the Banco de la República goes up and up: today it is at 7.5% and although its transmission is usually slower for the construction sector, sooner or later it will impact mortgage loans. Only in the last year the average interest for home loans rose from 10.53% to 12.30%.

In addition, the expert lawyer in commercial law Rafael Felipe Gómez mentions that today the costs for the alienation and deed of a property –including withholding at the source– are rising every day and that complicates things more.

Little trust

With all this, the leader of the Merino Hermanos Real Estate says that clients are cautious, taking into account that a change of government is also approaching. Indeed, Fedesarrollo’s statistics show that the willingness of the country to buy a home is falling.

While in June of last year that indicator stood at -18.8%, for the same period this year it was at -20.4%, with which Antioquians reflect that they are less interested in buying a house.

It is worth mentioning that of the homes sold this year in Antioquia, 7,173 correspond to social interest (VIS), while 6,924 are No VIS